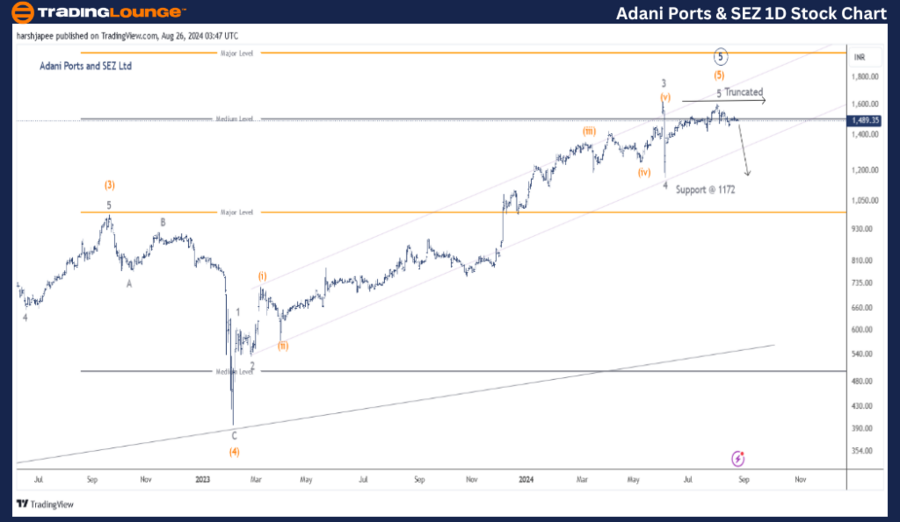

ADANI PORTS and SEZ – ADANIPORTS (1D Chart) Elliott Wave Analysis:

ADANIPORTS Daily Chart Technical Analysis

ADANIPORTS Elliott Wave Technical Analysis

Function: Counter Trend (Intermediate degree, orange)

Mode: Corrective

Structure: Beginning to unfold

Position: Lower against 1620. Wave ((5)) Orange.

Details: The larger degree impulse Wave ((5)) appears to be complete. The stock is likely correcting lower from the 1620 high. The structure is still unfolding and could be developing into an impulse. Additionally, potential lower degree waves ((i)) and ((ii)) may also be complete. No change from last week.

Invalidation point: 1620-30

Adani Ports and SEZ Daily Chart Technical Analysis and Potential Elliott Wave Counts

The daily chart of Adani Ports and SEZ suggests that Intermediate Wave (5) Orange is complete around the 1610-20 zone. The wave seems truncated, peaking just below the orthodox high of Minor Wave 3. If this scenario is accurate, the next larger degree wave is expected to move lower against the 1610-20 range.

Adani Ports and SEZ has been unfolding its Primary Wave ((5)) after bottoming out around the 200-10 lows in March 2020. Additionally, its Intermediate Wave (5) Orange has been unfolding since March 2023, starting from the 400 lows. The all-time high, registered near the 1610-20 range, likely marks the completion of the fifth wave at multiple degrees.

If this analysis holds true, the stock should be setting up for a larger degree corrective wave against the 1610-20 range. A break below 1160-70, corresponding to Minor Wave 4, would confirm this outlook and strengthen the bearish scenario.

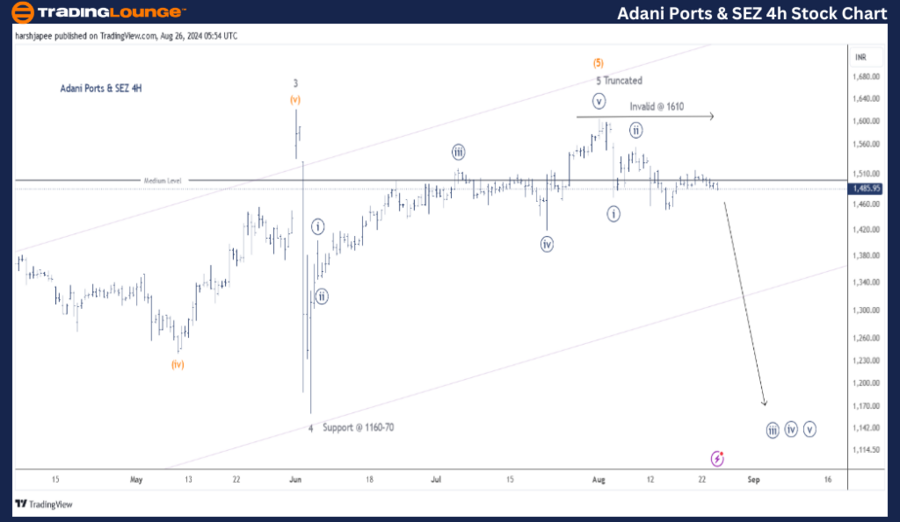

ADANI PORTS and SEZ – ADANIPORTS (4-Hour Chart) Elliott Wave Analysis:

Adani Ports and SEZ 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4H chart of Adani Ports and SEZ highlights potential wave counts between the 1160-70 and 1610-20 levels. Notably, Minor Wave 5 Grey could be subdivided into a potential impulse, which terminated at 1607, marked as Truncated.

Ideally, prices should remain below Minor Wave 5 (1607) and continue moving lower. Additionally, Minute Waves ((i)) and ((ii)) Navy appear complete, and the stock is now potentially progressing within Wave ((iii)) against the 1560 mark.

If this structure holds, the stock could experience a sharp decline as Minuette waves begin to unfold from current levels around 1488. Only a break above 1610 would broadly invalidate the bearish outlook.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Nifty 50 index Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Adani Ports and SEZ could be unfolding an extended Minute Wave ((iii)) Navy against the 1610-20 highs. The medium-term target could be around the 1160-70 range.