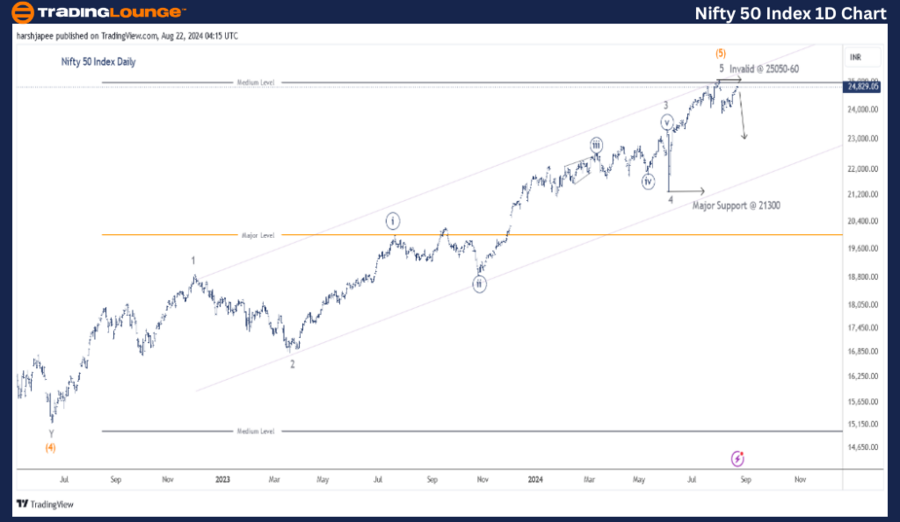

NIFTY 50 INDEX – NIFTY Elliott Wave Analysis 1D Chart

Nifty 50 Index Daily Chart Analysis

Function: Corrective Lower (Intermediate degree, orange)

Mode: Corrective

Structure: Potential Impulse within a larger degree Corrective Wave

Position: Potential Minute Wave ((ii)); unmarked as it's still early

Details: As previously discussed, the potential Minor Wave 5 Grey of Intermediate Wave (5) Orange might have completed near the 25100 level. Additionally, Minute Waves ((i)) and ((ii)) (not labelled on the Daily Chart) may have concluded around the 23900 and 24800-50 zones respectively. If this analysis is accurate, a sharp decline from the current levels against the 25100 mark could be anticipated.

Invalidation Point: 25100-50

Nifty 50 Index Elliott Wave Technical Analysis

The Nifty 50 daily chart suggests a potential top around the 25100 mark on August 01, 2024. If correct, this could mark the termination at multiple degrees, including Minor, Intermediate, Primary, and possibly Cycle Wave III. Alternatively, if Minor Wave 5 is extending, 25100 could represent Minute Wave ((i)).

The Nifty 50 may have potentially completed Cycle Wave III since the lows of 2500 in 2009. If this scenario holds, a significant correction could be imminent, moving against the 25100 high. A drop below 23900 would be an initial indication of bearish control.

Should the above wave structure hold, an intermediate target could potentially be around 21300, aligning with Minute Wave 4 of one lesser degree. Alternatively, a rise above 25100 would confirm that Minor Wave 5 is extending.

NIFTY 50 INDEX – NIFTY (4H Chart) Elliott Wave / Technical Analysis:

Function: Corrective Lower (Minor degree, Grey)

Mode: Corrective

Structure: Potential Impulse within a larger degree Corrective Wave

Position: Potential Minute Wave ((iii))

Details: Minute Wave ((ii)) is unfolding within Minor Wave 1, moving against the 25100 level.

Invalidation Point: 25100-50

Nifty 50 Index 4H Chart Technical Analysis and Potential Elliott Wave Counts:

The Nifty 50 4H chart’s potential wave counts indicate that Minute Waves ((i)) and ((ii)) might have completed around the 23900-30 and 24800-50 zones respectively. If accurate, the index could soon begin moving lower as Wave ((iii)) unfolds. A breach of the 25100 level would invalidate this bearish scenario.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ONGC Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

The Nifty 50 Index appears poised to resume Minute Wave ((iii)) of Minor Wave 1 lower against the 25100 highs. At the time of writing, a potential right shoulder seems to be forming around the 24800-30 zone.