Lululemon Athletica Inc. (LULU) Elliott Wave Analysis – Current Trend and Future Outlook

This Elliott Wave analysis for Lululemon Athletica Inc. (LULU) evaluates the present trend structure and offers insights into possible future movements based on wave positioning. We will review both the daily and 1-hour charts to determine the stock's outlook.

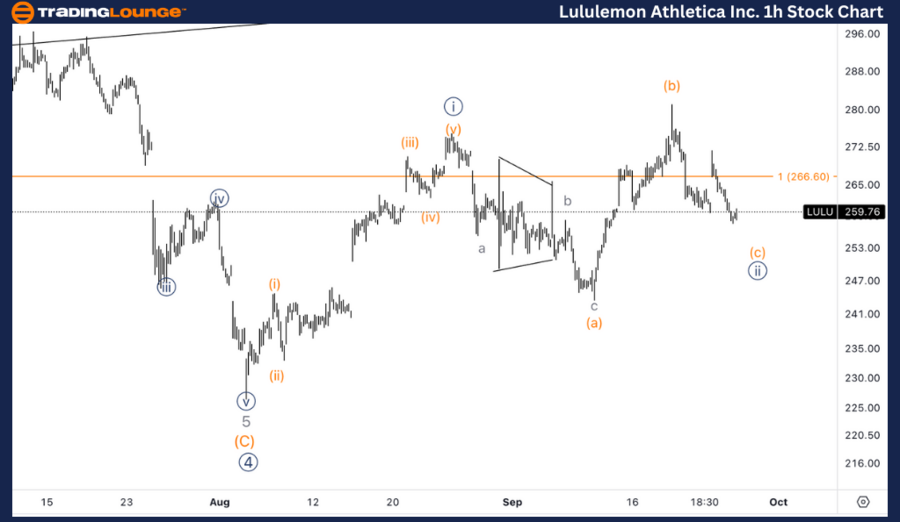

TradingLounge US Stock Lululemon Athletica Inc Analysis – Day Chart

Lululemon Athletica Inc. (LULU) Daily Chart Analysis

LULU Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave (1)

DIRECTION: Upside in (1)

DETAILS: A potential bottom seems to be in place for Primary Wave 4, signaling a resumption of an upward movement. The stock has found support at the $200 level, aligned with Trading Level 2 (TL2).

LULU Technical Analysis – Daily Chart

On the daily chart, Lululemon is progressing within Wave (1) of a new impulsive uptrend, likely following the completion of Primary Wave 4. The stock has found solid support around $200, which is near Trading Level 2 (TL2), indicating a possible bottom formation.

With this support intact, we expect a continuation of the bullish trend as Wave (1) advances. Traders should look for confirmation of this trend by observing price movements above key resistance levels, signaling the next leg higher in this bullish cycle.

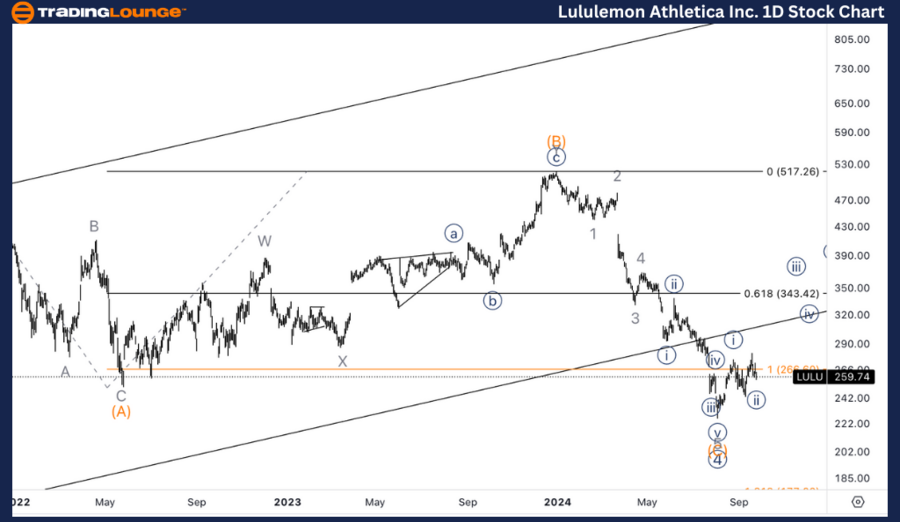

TradingLounge US Stock LULU Analysis 1-Hour Chart

Lululemon Athletica Inc. (LULU) 1-Hour Chart

LULU Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave 1

DIRECTION: Bottom in Wave {ii} of 1

DETAILS: We are currently observing a three-wave move down into Wave {ii}, with an expectation of a bullish resumption. The initial decline from Wave {i} appears to be part of a corrective three-wave structure, suggesting another leg higher is likely.

LULU Stock Technical Analysis – 1H Chart

On the 1-hour chart, Lululemon is within Wave 1 of the larger daily structure. Currently, we are witnessing a correction in Wave {ii}. The decline from the Wave {i} top seems to follow a three-wave corrective pattern, indicating that Wave {ii} is close to completing.

Once this correction concludes, the stock is expected to resume its upward trend, signaling the beginning of Wave {iii}. Given the corrective nature of the recent pullback, the next upward movement could present a strong bullish impulse for Lululemon.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Dell Technologies Inc. (DELL) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support