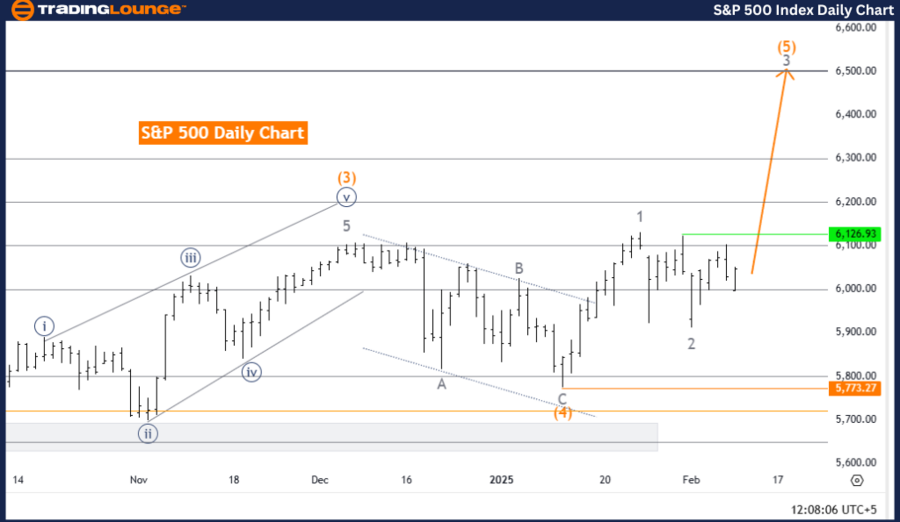

S&P 500 Elliott Wave Analysis – TradingLounge Day Chart

S&P 500 Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Gray Wave 3

Position: Orange Wave 5

Direction Next Higher Degrees: Gray Wave 3 (Started)

Details: Gray Wave 2 appears to have completed, and Gray Wave 3 is currently unfolding.

Wave Cancellation Invalidation Level: 5,773.27

S&P 500 Index Analysis Overview

The S&P 500 Elliott Wave Analysis for the daily chart confirms a bullish trend, with the market in impulsive mode, indicating strong upward momentum.

The current wave structure identifies Gray Wave 3, which is developing within the larger Orange Wave 5. This highlights a significant upside phase, with the potential for further gains as Gray Wave 3 progresses.

Wave Progression and Key Levels

A critical price level to monitor is the Wave Cancellation Invalidation Level at 5,773.27. A drop below this threshold would invalidate the current wave count, potentially altering the bullish outlook. Traders should carefully observe price action around this level for trend confirmation.

Summary

The S&P 500 Daily Chart Analysis confirms an impulsive bullish trend, with Gray Wave 3 of Orange Wave 5 leading the market higher. The completion of Gray Wave 2 has set the stage for continued price appreciation.

Key trading considerations include:

- Monitoring the 5,773.27 level as an invalidation point.

- Assessing the strength of Gray Wave 3 to determine further upside potential.

If the bullish Elliott Wave structure remains intact, traders can expect a continuation of the uptrend, reinforcing positive market sentiment.

S&P 500 Elliott Wave Analysis – TradingLounge Weekly Chart

S&P 500 Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 5

Position: Navy Blue Wave 1

Direction Next Higher Degrees: Orange Wave 5 (Started)

Details: Orange Wave 4 appears to have completed, and Orange Wave 5 is currently unfolding.

Wave Cancellation Invalidation Level: 5,773.27

S&P 500 Index Analysis Overview

The S&P 500 Elliott Wave Analysis for the weekly chart reinforces a bullish outlook, with the market advancing in impulsive mode.

The current wave structure highlights Orange Wave 5, which has started following the completion of Orange Wave 4. This suggests further upside potential, marking the final phase of the impulsive wave sequence.

Additionally, the position within Navy Blue Wave 1 signals the beginning of a strong uptrend, typically associated with rising price action and growing investor confidence.

S&P 500 Index Wave Progression and Key Levels

Summary

The S&P 500 Weekly Chart Analysis confirms a bullish Elliott Wave setup, with Orange Wave 5 within Navy Blue Wave 1 leading the market higher. The completion of Orange Wave 4 sets the stage for further price advances.

Key trading considerations include:

- Monitoring price action near the invalidation level (5,773.27) to confirm trend strength.

- Assessing the development of Orange Wave 5 for potential trading opportunities.

If Orange Wave 5 progresses as expected, the bullish trend is likely to continue, reinforcing positive sentiment in the S&P 500 market outlook.

This Elliott Wave analysis offers traders a structured approach to identifying potential price movements and trading strategies based on wave theory principles.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Bovespa Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support