USDJPY Elliott Wave Analysis Trading Lounge 4 Hour Chart, 29 January 24

U.S.Dollar/Japanese Yen (USDJPY) 4 Hour Chart

USDJPY Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: blue wave A of Y

POSITION: Red wave C

DIRECTION NEXTt LOWER DEGREES: blue wave A of wave Y(started)

DETAILS: blue wave C of black wave X looking completed at 148.810. Now blue wave A of Y is in play . Wave Cancel invalid level: 151.961

The "USDJPY Elliott Wave Analysis Trading Lounge 4 Hour Chart" dated 29 January 24, provides a comprehensive examination of the U.S. Dollar/Japanese Yen (USDJPY) currency pair through the lens of Elliott Wave Technical Analysis.

The "FUNCTION" is identified as "Counter Trend," indicating a focus on potential corrective movements against the primary trend. This suggests an expectation of a temporary reversal within the overarching downtrend in the USDJPY pair.

The "MODE" is specified as "Corrective," implying that the current phase involves price movements counter to the primary trend. Corrective waves are typically characterized by three-wave structures, often labeled as A-B-C.

The "STRUCTURE" is denoted as "blue wave A of Y," suggesting the wave count within the broader Elliott Wave pattern. This indicates the initial phase of a corrective structure labeled as wave A within a larger degree pattern labeled as Y.

The "POSITION" is identified as "Red wave C," pointing to the current subwave within the Elliott Wave count. Red wave C is part of the broader corrective structure.

Regarding the "DIRECTION NEXT LOWER DEGREES," the analysis highlights "blue wave A of wave Y (started)." This indicates that within the broader corrective structure, the subwave of blue wave A has commenced.

The "DETAILS" section notes that "blue wave C of black wave X looking completed at 148.810." This signals the end of a corrective phase within the Elliott Wave count. Additionally, the analysis states that "blue wave A of Y is in play," indicating the initiation of the next corrective phase.

The "Wave Cancel invalid level" is specified as "151.961." This level serves as a critical reference point, suggesting that a breach of this level could invalidate the current wave count, and traders should be attentive to movements around this level.

In summary, the USDJPY Elliott Wave Analysis for the 4 Hour Chart on 29 January 24, suggests a corrective counter-trend movement, with blue wave A of Y in progress. Traders are advised to closely monitor the market, especially focusing on the invalidation level at 151.961.

Technical Analyst: Malik Awais

Source: Tradinglounge.com, Learn From the Experts Join TradingLounge Here

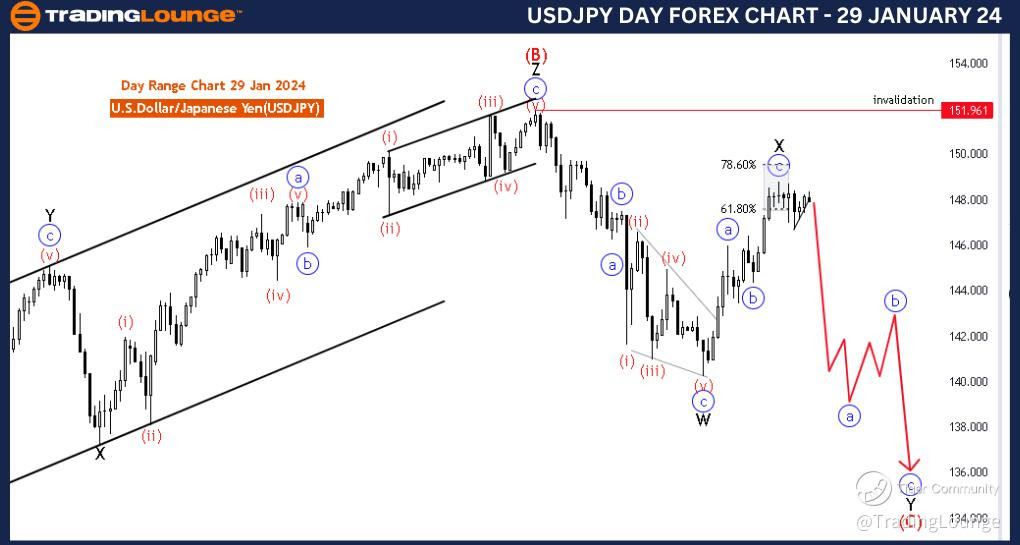

USDJPY Elliott Wave Analysis Trading Lounge Day Chart, 29 January 24

U.S.Dollar/Japanese Yen (USDJPY) Day Chart

USDJPY Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: blue wave A of Y

POSITION: Red wave C

DIRECTION NEXTt LOWER DEGREES: blue wave A of wave Y(started)

DETAILS: blue wave C of black wave X looking completed at 148.810. Now blue wave A of Y is in play . Wave Cancel invalid level: 151.961

The "USDJPY Elliott Wave Analysis Trading Lounge Day Chart" dated 29 January 24, presents a detailed examination of the U.S. Dollar/Japanese Yen (USDJPY) currency pair, focusing on the daily chart and employing Elliott Wave Technical Analysis.

The "FUNCTION" is specified as "Counter Trend," indicating that the analysis is oriented toward identifying potential corrective movements against the primary trend. This suggests an anticipation of a temporary reversal within the broader downtrend in the USDJPY pair.

The "MODE" is identified as "Corrective," which implies that the current phase involves price movements counter to the primary trend. Corrective waves typically consist of three-wave structures denoted as A-B-C.

The "STRUCTURE" is labeled as "blue wave A of Y," indicating the current wave count within the broader Elliott Wave pattern. This suggests that the market is in the initial phase of a corrective structure labeled as wave A within a larger degree pattern labeled as Y.

The "POSITION" is defined as "Red wave C," signaling the current subwave within the broader Elliott Wave count. Red wave C is part of the larger corrective structure.

In terms of "DIRECTION NEXT LOWER DEGREES," the analysis points to "blue wave A of wave Y (started)," indicating that within the broader corrective structure, the subwave of blue wave A has commenced.

The "DETAILS" section highlights that "blue wave C of black wave X looking completed at 148.810." This suggests the termination of a corrective phase within the Elliott Wave count. Furthermore, it notes that "blue wave A of Y is in play," signifying the initiation of the next corrective phase.

The "Wave Cancel invalid level" is specified as "151.961," serving as a critical reference point. A breach of this level could potentially invalidate the current wave count, urging traders to closely monitor price movements around this level.

In summary, the USDJPY Elliott Wave Analysis for the Day Chart on 29 January 24, implies an ongoing corrective counter-trend movement, with blue wave A of Y in progress. Traders are advised to pay close attention to market developments, especially focusing on the invalidation level at 151.961.

Technical Analyst: Malik Awais

Source: Tradinglounge.com, Learn From the Experts Join TradingLounge Here

Previous: USDCAD