Gold Elliott Wave Analysis

Gold prices have entered a corrective phase after setting a new all-time high on March 20, 2025. This retracement appears to be temporary, with the broader bullish trend still intact. The upward cycle that began in November 2024 continues to show strength, and further upside is expected before a significant retracement occurs.

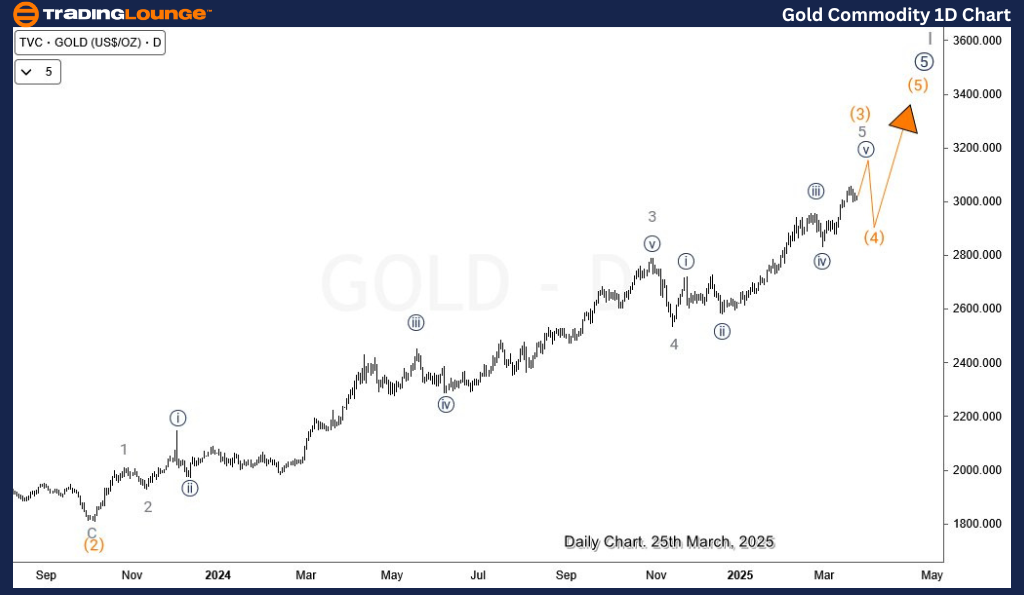

Gold Daily Chart Analysis

The daily chart underscores gold’s persistent bullish momentum. After completing wave (2) in October 2023, the market transitioned into wave (3), which has been advancing in a well-defined impulsive structure. Current Elliott Wave projections suggest that wave (3) still has upward potential.

Detailed subwave analysis within wave (3) shows it is nearing the final stage. The incomplete wave ((v)) of 5 of (3) suggests one more bullish leg is needed to complete this phase. Upon completion of wave (3), a corrective pullback in wave (4) is anticipated, before the market resumes its ascent toward finalizing wave I that originated in December 2015.

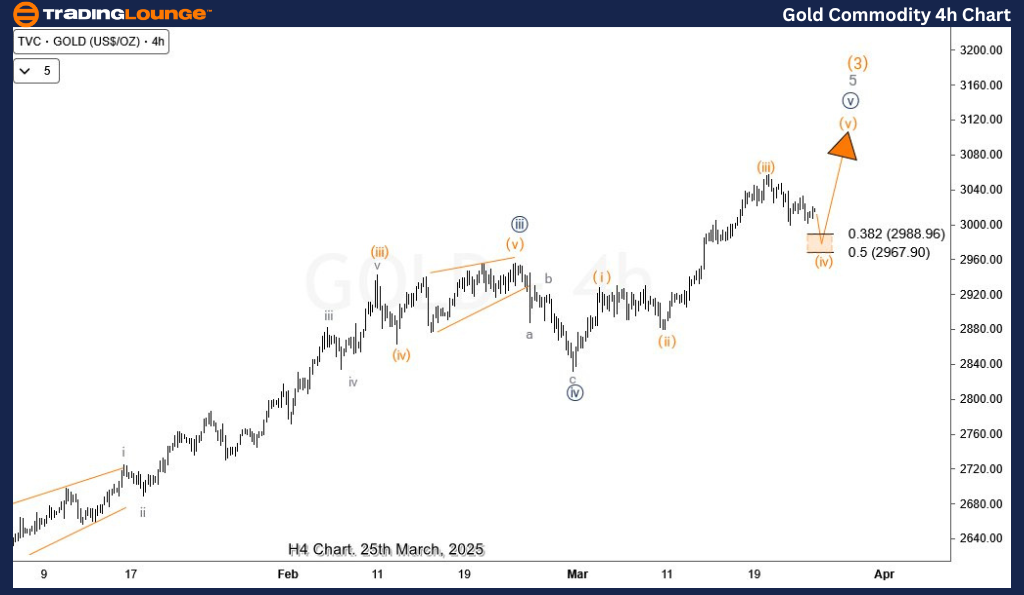

Gold H4 Chart Analysis

The H4 chart reveals the recent decline from the March 20 high as part of wave (iv) of ((v)) of 5 of (3). This structure aligns with typical fourth-wave corrections, which generally find support between the 38.2% and 50% Fibonacci retracement levels. Shallower retracements may bottom between the 23.6% and 38.2% zones.

Initial movement in this pullback followed a three-wave corrective pattern, followed by a minor rebound—indicating a potential double correction. If this count remains valid, gold could complete wave (iv) within the Fibonacci support range of 2988.9–2967.9. This zone may trigger renewed buying pressure, driving a rally in wave (v) that could lead to fresh highs.

Traders should monitor bullish reversal signals near this critical support region. Given the prevailing uptrend, any confirmed bounce from this zone could present a strong risk-reward opportunity for traders targeting trend continuation setups.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

See Previous: GX URA Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support