GX URA Elliott Wave Analysis

The Global X Uranium ETF (URA) is a popular exchange-traded fund providing exposure to uranium mining, exploration, production, and nuclear energy companies. Managed by Global X ETFs, URA tracks the Solactive Global Uranium & Nuclear Components Total Return Index, making it a key investment vehicle for those looking to capitalize on the uranium sector.

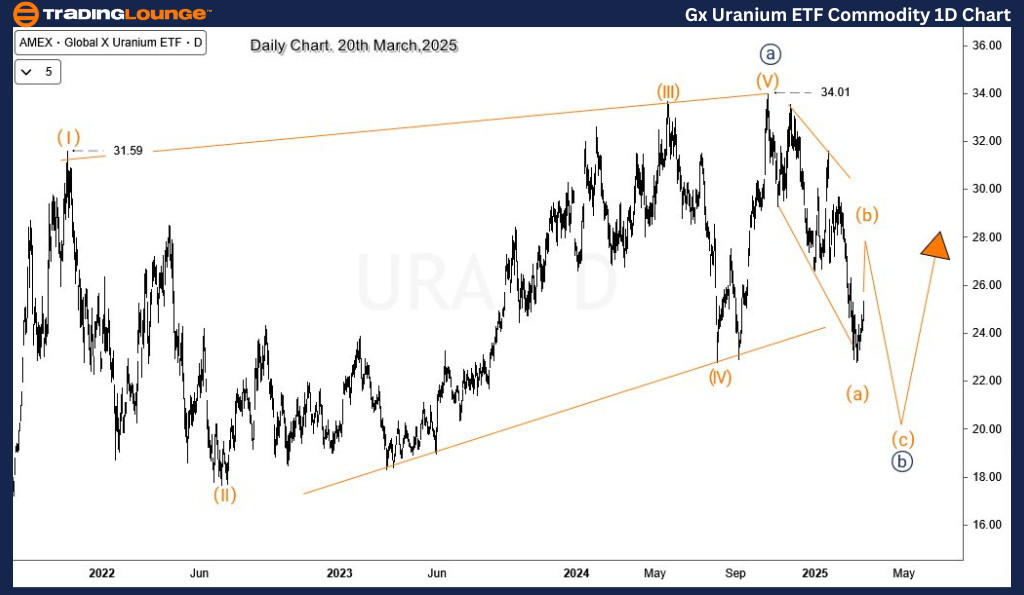

URA’s Corrective Phase: Elliott Wave Perspective

URA has seemingly completed the first leg of its corrective phase, following a long-term 5-wave diagonal structure that peaked at $34 in October 2024. This decline represents the initial part of a three-wave correction. The ongoing retracement, labelled as wave (b), remains within an upward corrective structure but is expected to stay capped below $34 before turning lower in wave (c) to complete the correction.

URA Daily Chart – 5-Wave Rally & Correction in Motion

The daily chart highlights a strong 5-wave diagonal structure that began in March 2022, propelling URA from below $7 to $34 by October 2024. According to Elliott Wave Theory, a completed 5-wave advance is usually followed by a 3-wave corrective move.

- The pullback from $34 appears to have completed an expanding diagonal as wave (a) of ((b)), marking the initial phase of the correction.

- Currently, the wave (b) retracement is unfolding, forming a corrective pattern that is expected to stay below $34.

- Once wave (b) completes, another leg lower in wave (c) of ((b)) is anticipated, leading to a deeper retracement before the broader bullish cycle resumes from the March 2020 low.

URA H4 Chart – Wave (b) Developing, Limited Upside

On the 4-hour chart, the subdivisions of wave (a) confirm the corrective nature of the decline. The ongoing wave (b) retracement is progressing and could push higher into the $28-$30 range before facing resistance.

- Despite the wave (b) bounce, the overall correction remains valid as long as the price stays below $34.

- A decline in wave (c) of ((b)) is expected once wave (b) completes, providing an opportunity for deeper retracement before the next bullish cycle begins.

Upon completion of wave ((b)), the broader uptrend is likely to resume, potentially presenting new long-term buying opportunities for investors.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

See Previous: Corn Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support