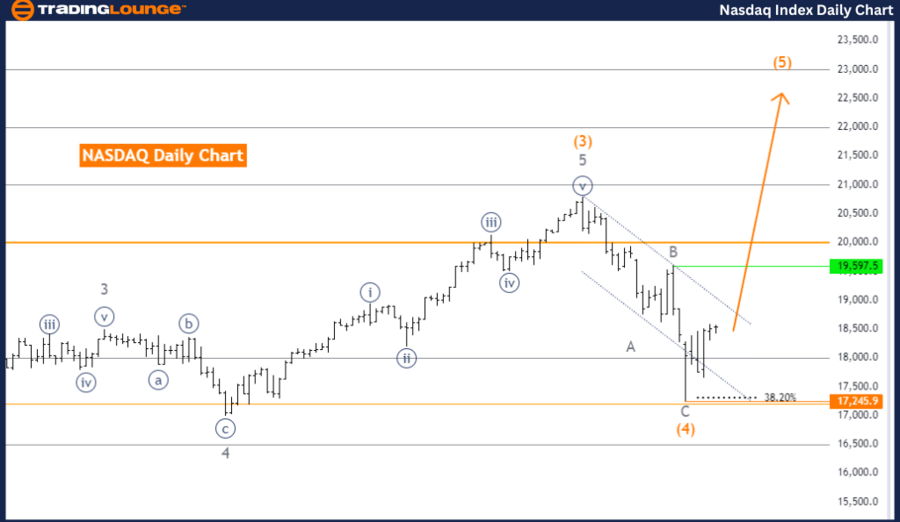

NASDAQ Elliott Wave Analysis Trading Lounge Day Chart

NASDAQ Elliott Wave Analysis - Daily Chart

NASDAQ Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange Wave 5

Direction Next Higher Degrees: Orange Wave 5 (Initiated)

Details: Orange Wave 4 appears complete, transitioning into Orange Wave 5.

Wave Cancel Invalid Level: 17245.9

The NASDAQ Elliott Wave Analysis on the daily chart highlights a strong, ongoing trend in an impulsive mode. The current structure is identified as Orange Wave 5, indicating that the market is in the final phase of a larger upward movement. This suggests the trend is nearing its peak, with Orange Wave 5 as the concluding wave of this impulsive sequence.

The analysis confirms that Orange Wave 4 has concluded, marking the end of the previous corrective phase. With the completion of Orange Wave 4, the market has entered the final upward phase, recognized as Orange Wave 5. Typically, this wave represents the final push within the existing trend before the market potentially transitions into a significant correction or reversal.

The direction for the next higher degrees continues to focus on Orange Wave 5, indicating the upward trend remains active and is expected to persist until this wave fully completes. As Orange Wave 5 progresses, the market is anticipated to continue its upward movement, potentially reaching a peak or experiencing overextension.

The wave cancel invalid level is set at 17245.9. This level is crucial for maintaining the validity of the current Elliott Wave count. If the market drops below this level, the current analysis would be invalidated, suggesting that the expected upward movement within Orange Wave 5 might not unfold as anticipated. In such a case, a reevaluation of the wave structure and overall market outlook would be necessary.

In summary: The NASDAQ Elliott Wave Analysis on the daily chart indicates the market is in the final stages of an upward trend within Orange Wave 5. With Orange Wave 4 complete, the focus remains on the continuation of this trend, with a critical invalidation level at 17245.9.

NASDAQ Elliott Wave Analysis Trading Lounge Weekly Chart

NASDAQ Weekly Chart Analysis

NASDAQ Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange Wave 5

Direction Next Higher Degrees: Orange Wave 5 (Initiated)

Details: Orange Wave 4 appears complete, transitioning into Orange Wave 5.

Wave Cancel Invalid Level: 17245.9

The NASDAQ Elliott Wave Analysis on the weekly chart reveals a robust upward trend in an impulsive mode. The structure under analysis is Orange Wave 5, indicating the market is in the final phase of a broader upward movement. This wave represents the last significant push within the existing trend before a potential reversal or substantial correction.

According to the analysis, Orange Wave 4, the preceding corrective wave, appears to have completed. This completion marks the transition from a corrective phase back into an impulsive phase, where the market resumes its upward trajectory within Orange Wave 5. The current focus remains on the continuation of this upward movement, driven by the ongoing development of Orange Wave 5.

The direction for the next higher degrees remains aligned with the progression of Orange Wave 5, suggesting the upward trend is still active and expected to persist until this wave fully unfolds. As Orange Wave 5 continues to evolve, the market is likely to experience further gains. However, given that this phase typically represents the latter stages of a broader trend, caution may be advisable as the wave approaches potential exhaustion.

The wave cancel invalid level is set at 17245.9, serving as a critical threshold for maintaining the validity of the current Elliott Wave count. If the market falls below this level, it would invalidate the current wave analysis, indicating that the expected continuation of the upward movement within Orange Wave 5 might not materialize as anticipated. In such a scenario, a reassessment of the wave structure and overall market outlook would be necessary.

In summary: The NASDAQ Elliott Wave Analysis on the weekly chart highlights an ongoing upward trend within Orange Wave 5, following the completion of Orange Wave 4. The analysis emphasizes the continuation of this trend, with a key invalidation level set at 17245.9.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See previous: Bovespa Index Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support