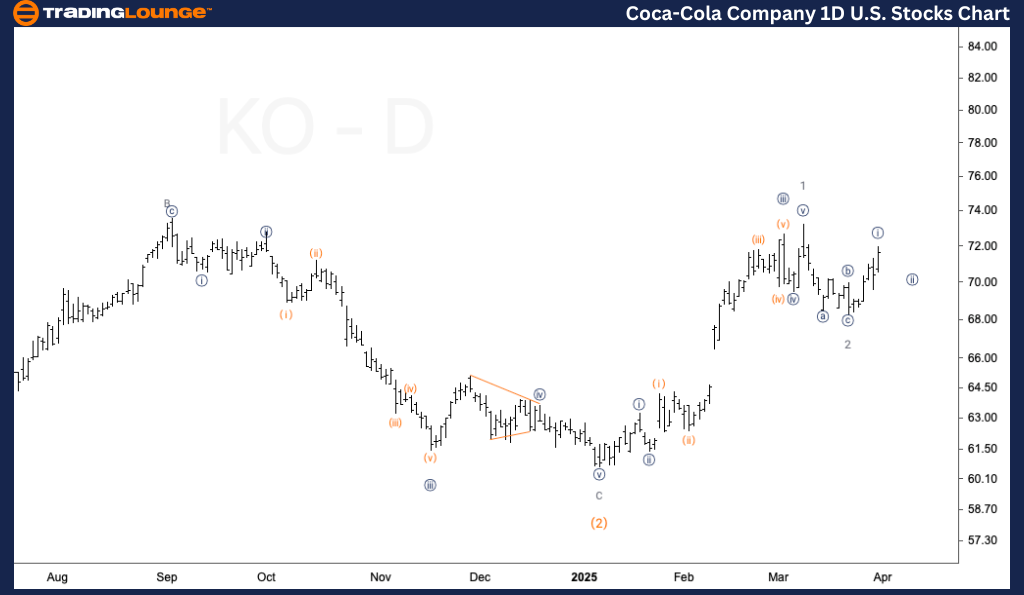

KO – The Coca-Cola Company Elliott Wave Analysis Daily Chart Overview

KO Elliott Wave Forecast

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 3

Direction: Acceleration in wave 3

Details:

The Elliott Wave setup for Coca-Cola (KO) on the daily chart remains highly bullish. The current price movement supports a rise into Intermediate Wave (3), with a projected target near the $100 mark. A confirmed breakout to new all-time highs (ATH) would indicate sustained bullish momentum and validate the upward trend forecast.

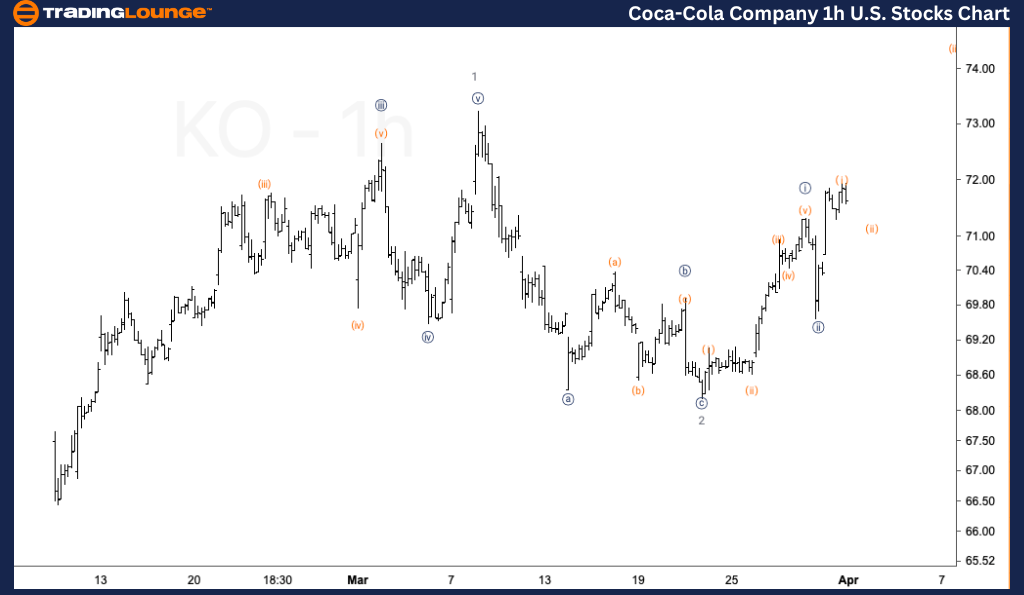

KO – The Coca-Cola Company Elliott Wave Analysis 1-Hour Chart Overview

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iii} of 3

Direction: Upside in wave {iii}

Details:

Short-term Elliott Wave analysis suggests that Wave {ii} has completed, positioning KO for a strong advance in Wave {iii}. However, an alternate scenario may be unfolding, where the move marks the completion of Wave {b} of 2. This would imply a potential short-term pullback. A confirmed breakout will be necessary to validate the preferred bullish wave count.

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: JNJ Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support