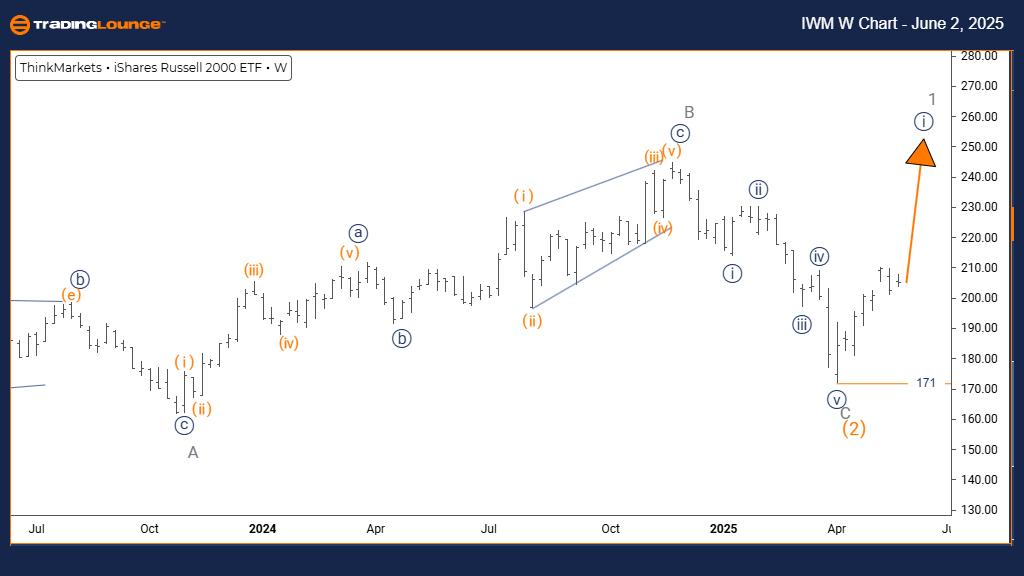

Russell 2000 Elliott Wave Analysis – Trading Lounge Day Chart

Russell 2000 Index Day Chart Analysis

Russell 2000 Elliott Wave Technical Overview

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 1

Position: Navy Blue Wave 1

Next Lower Degree Direction: Orange Wave 2

Details: Orange Wave 1 is progressing within Navy Blue Wave 1, indicating early momentum in a broader uptrend. Invalidation level: 171

Current Chart Outlook

The Russell 2000 Index is displaying a clear bullish setup on the daily chart, as Orange Wave 1 forms the initial leg of Navy Blue Wave 1. This wave pattern points to the early phase of a larger bullish cycle. Price action suggests strong buyer interest, reinforcing the upward structure.

Market Dynamics and Risk Factors

The impulsive wave behavior highlights sustained buying activity. The critical support sits at 171; staying above this level keeps the bullish count valid. A break below would question the ongoing wave structure and possibly signal either a more complex correction or a count revision.

Forecast and Strategic Insights

As the Orange Wave 1 continues, further gains are expected. Once completed, a pullback in Orange Wave 2 is anticipated. Short-term strategies should focus on capturing upside momentum while preparing for a corrective move. Risk management remains essential during this formative stage of the trend.

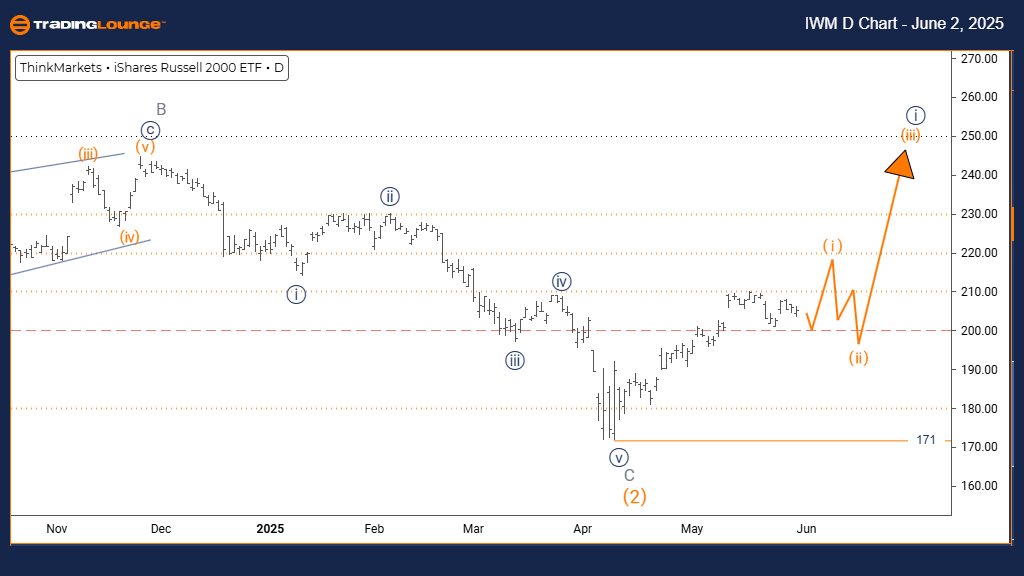

Russell 2000 Elliott Wave Analysis – Trading Lounge Weekly Chart

Russell 2000 Elliott Wave Technical Overview

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 1

Position: Gray Wave 1

Next Lower Degree Direction: Navy Blue Wave 2

Details: Completion of Orange Wave 2 has led into Navy Blue Wave 1. Invalidation level: 171

Long-Term Market View

The weekly chart of the Russell 2000 Index reveals a breakout structure. Navy Blue Wave 1 is progressing within the broader Gray Wave 1. With Orange Wave 2 confirmed as complete, the chart indicates the start of a sustained bullish phase.

Investor Implications

The impulsive structure signals strong bullish conviction. As long as the index holds above the 171 support level, the bullish wave structure remains intact. A break below this would require reassessment of the wave count and underlying trend.

Strategic Takeaways for Investors

This evolving pattern suggests that the Russell 2000 is in the initial stages of a multi-leg uptrend. As Navy Blue Wave 1 continues to develop, the next likely phase is a retracement via Navy Blue Wave 2. Long-term investors should monitor key levels and trend confirmation signals for optimal entry and risk management.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: S&P/TSX 60 index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support