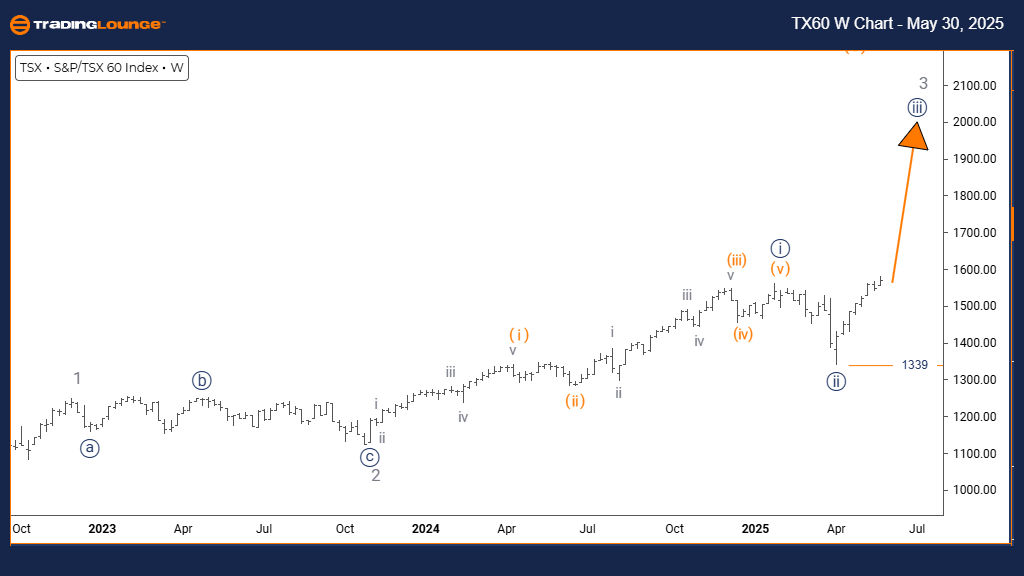

S&P/TSX 60 Elliott Wave Analysis – Trading Lounge Day Chart

S&P/TSX 60 Day Chart Analysis

S&P/TSX 60 Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 1

POSITION: Navy Blue Wave 3

DIRECTION NEXT LOWER DEGREES: Orange Wave 2

DETAILS: Completion of Navy Blue Wave 2 confirmed; development of Orange Wave 1 of 3 is underway.

Wave cancel/invalidation level: 1339

The daily Elliott Wave outlook for the S&P/TSX 60 Index signals a strong bullish momentum emerging. The structure is unfolding as Orange Wave 1, within the broader Navy Blue Wave 3, confirming the end of Navy Blue Wave 2 and initiating a new upward phase.

This bullish setup points to increased upside potential as Orange Wave 1 gains strength. The confirmation of Navy Blue Wave 2's completion strengthens the impulsive outlook. Traders should note the critical invalidation level at 1339—a break below would challenge the current wave count or imply a deeper correction is forming.

This phase marks an ideal entry for those aligned with the trend. As Orange Wave 2 has not yet commenced, the current structure suggests a high-probability rally. Active traders should stay alert to price action while applying risk controls consistent with wave development.'

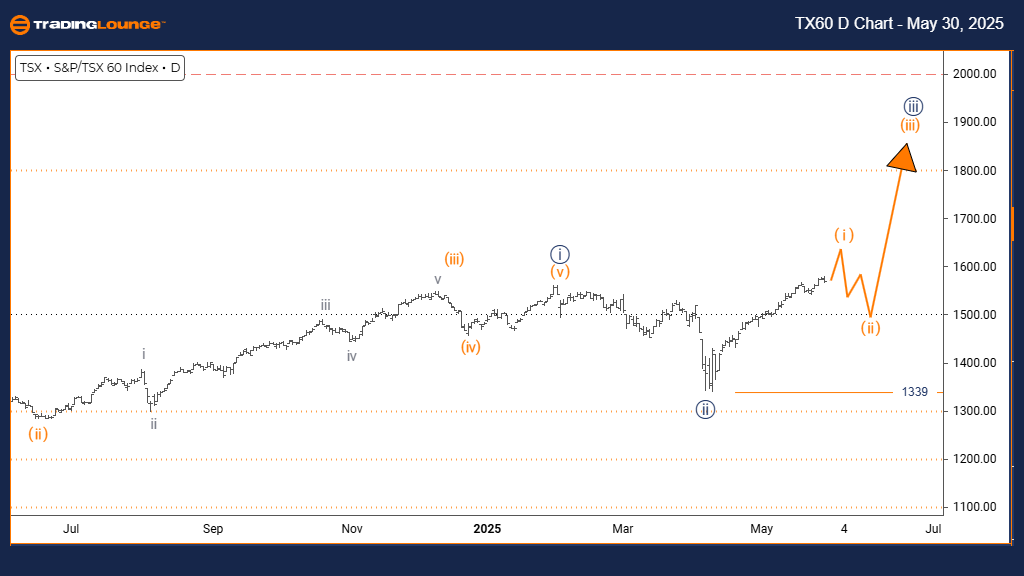

S&P/TSX 60 Elliott Wave Analysis – Trading Lounge Weekly Chart

S&P/TSX 60 Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 3

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 4

DETAILS: Completion of Navy Blue Wave 2 confirmed; progression into Navy Blue Wave 3 of 3 is active.

Wave cancel/invalidation level: 1339

The weekly Elliott Wave chart of the S&P/TSX 60 Index reinforces a strong bullish trend, driven by the impulsive rise of Navy Blue Wave 3 inside the larger Gray Wave 3. The conclusion of Navy Blue Wave 2 confirms entry into the most aggressive phase of this trend cycle.

This current wave signals institutional accumulation and expanding bullish momentum, hallmarks of a powerful third wave move. Maintaining 1339 as the invalidation level helps clarify risk and safeguard the bullish framework.

This stage is typically the most dynamic in Elliott Wave theory, often delivering strong market gains. As traders and investors prepare for Navy Blue Wave 4, they should adjust positions and implement proper risk management strategies, mindful of the potential volatility as the rally progresses.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: DAX index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support