DAX (Germany) Elliott Wave Analysis – Trading Lounge Day Chart

DAX (Germany) Day Chart Analysis

DAX (Germany) Wave Technical Analysis

Function: Bullish Market Trend

Mode: Impulsive Wave

Structure: Developing Orange Wave 1

Position: Advancing Navy Blue Wave 3

Direction (Next Lower Degree): Correction Expected in Orange Wave 2

Details: Completion of Navy Blue Wave 2 confirmed; Orange Wave 1 of Wave 3 is unfolding.

Wave Invalidation Level: 18,530

DAX Technical Overview

Germany's DAX index presents a robust upward trend on the daily chart. Current Elliott Wave analysis identifies Orange Wave 1 progressing within a broader Navy Blue Wave 3, indicating that the correction phase of Navy Blue Wave 2 has ended. This signals the onset of a new bullish impulse wave, with increasing upward pressure and strong buyer sentiment.

Market Behavior

The conclusion of Navy Blue Wave 2 transitions into a strong impulse for Orange Wave 1, supported by consistent upward momentum. This current Elliott Wave structure aligns with a bullish market scenario. However, a price movement below 18,530 would invalidate this wave count and could indicate a potential market correction or trend reversal.

Trading Implications

With Orange Wave 1 gaining traction, the DAX index shows potential for further gains. As this wave precedes a corrective Orange Wave 2, traders should look for bullish continuation signals. Active risk management is essential given the early stage of this impulsive move. The wave count emphasizes upside opportunities under careful technical oversight.

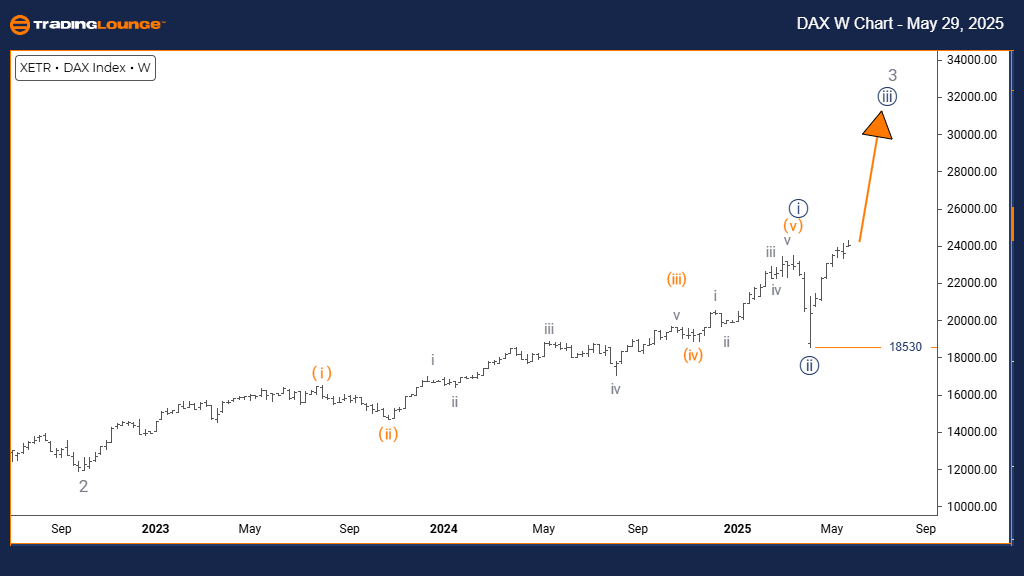

DAX (Germany) Elliott Wave Analysis – Trading Lounge Weekly Chart

DAX (Germany) Elliott Wave Technical Analysis

Function: Long-Term Bullish Trend

Mode: Strong Impulsive Structure

Structure: Advancing Navy Blue Wave 3

Position: Gray Wave 3 in Progress

Direction (Next Lower Degree): Awaiting Navy Blue Wave 4 Correction

Details: Navy Blue Wave 2 has likely ended; Navy Blue Wave 3 is actively progressing.

Wave Invalidation Level: 18,530

Technical Overview

The weekly chart for Germany’s DAX index reflects an ongoing bullish trend within Navy Blue Wave 3, nested inside a larger Gray Wave 3. With the prior correction of Navy Blue Wave 2 complete, the structure points to a high-momentum upward phase, characteristic of third waves in Elliott Wave theory.

Market Behavior

This impulsive wave formation illustrates strong market buying activity. As long as the price remains above the 18,530 invalidation level, the Elliott Wave outlook remains bullish. Buyers continue to dominate this phase of the market cycle, aligning with technical expectations of a continued rally.

Trading Implications

As Navy Blue Wave 3 unfolds, the DAX index appears poised for more upside. Traders should prepare for a potential transition into Navy Blue Wave 4, which could introduce a corrective phase. Effective position management and monitoring of support zones are crucial for navigating this evolving Elliott Wave pattern.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: NIFTY 50 INDEX Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support