Alphabet Inc., Elliott Wave Technical Analysis

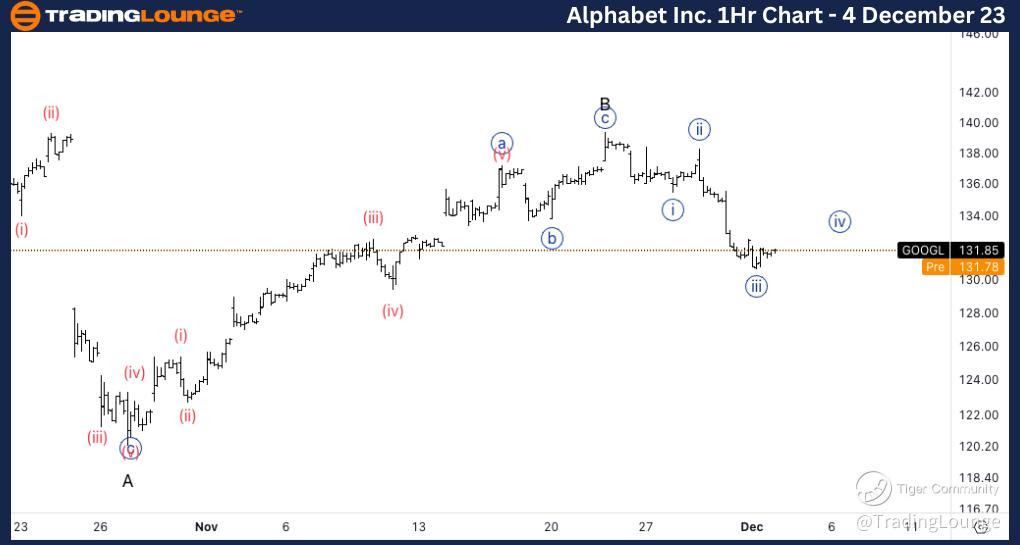

Alphabet Inc., (GOOGL:NASDAQ): 4h Chart 4 December 23

GOOGL Stock Market Analysis: We are monitoring the downside move into potential wave C as we seem to have an incomplete correction into potential wave (2).

GOOGL Elliott Wave Count: Wave C of (2).

GOOGL Technical Indicators: Below all averages.

GOOGL Trading Strategy: Looking for quick shorts if 130$ becomes tested resistance.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

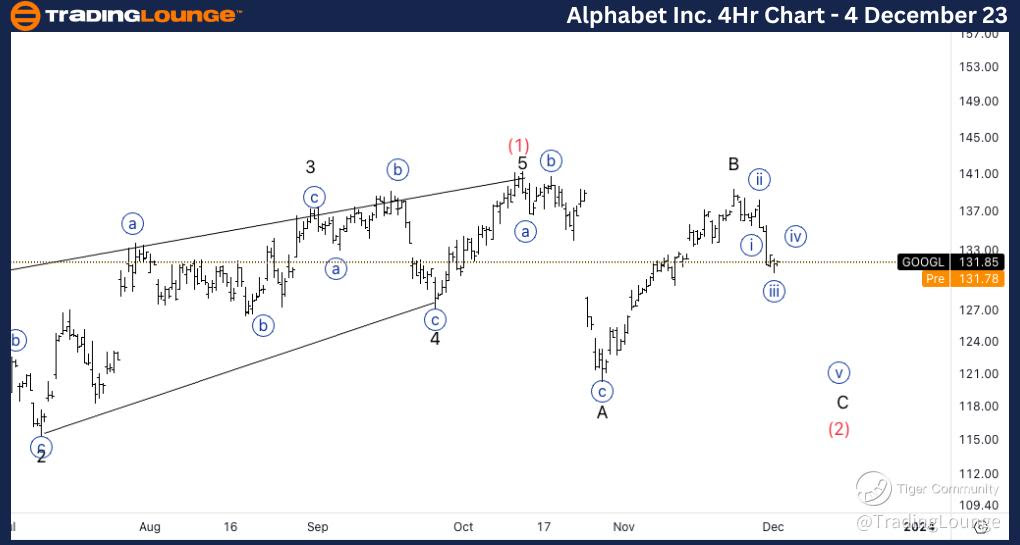

Alphabet Inc., GOOGL: 1-hour Chart 4 December 23

Alphabet Inc., Elliott Wave Technical Analysis

GOOGL Stock Market Analysis: We seem to have had a three wave move to the downside as we are looking for a complete impulsive wave into either a short wave C or else wave {i} of C.

GOOGL Elliott Wave count: Wave {iii} of C.

GOOGL Technical Indicators: Between all averages.

GOOGL Trading Strategy: Looking for quick shorts if 130$ becomes tested resistance.