ASX: BRAMBLES LIMITED – BXB Elliott Wave Technical Analysis (1D Chart)

Greetings, today's Elliott Wave analysis focuses on the Australian Stock Exchange (ASX) and BRAMBLES LIMITED - BXB. Our analysis suggests that BXB may continue its upward movement, supported by the v-grey wave.

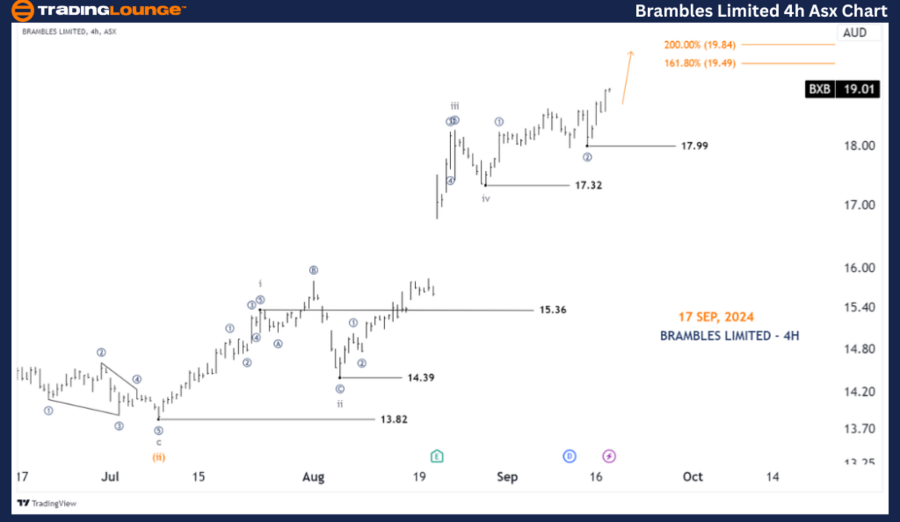

ASX: BRAMBLES LIMITED - BXB 1D Chart (Semilog Scale) Analysis

BXB Elliott Wave Technical Analysis

Function: Major trend (Minuette degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave v-grey of Wave (iii)-orange

Details: Wave iv has recently concluded, and wave v-grey appears to be unfolding with a potential extension higher. The target is set at 20.58, provided the price stays above 17.99. If the price falls below this point, our view will be invalidated.

Invalidation point: 17.99

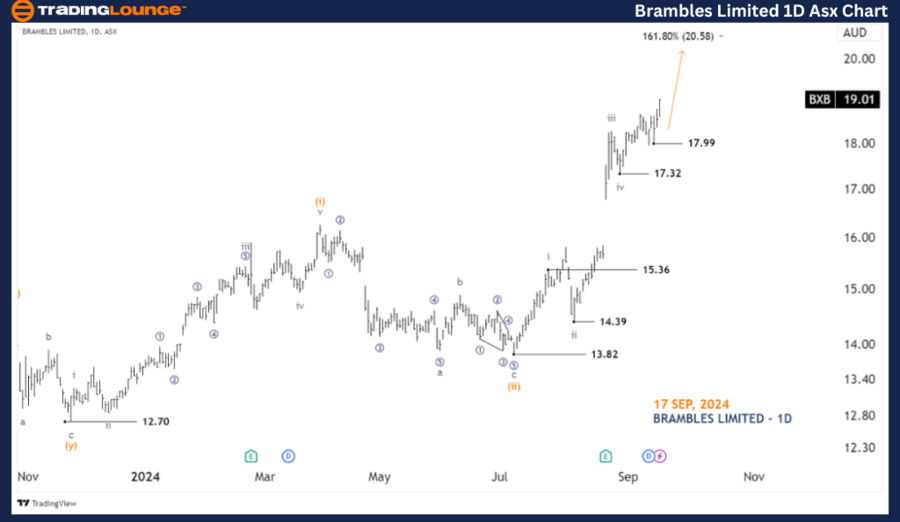

ASX: BRAMBLES LIMITED - BXB 4-Hour Chart Analysis

BXB Elliott Wave Technical Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave ((3))-navy of Wave v-grey

Details: The v-grey wave is extending, with the first two waves ((1))-navy and ((2))-navy already complete. The current wave, ((3))-navy, seems to be unfolding, aiming for the highs of 19.49 - 19.84. A break above these levels would confirm further upward movement, potentially targeting 20.58. The price must hold above 17.99 for this analysis to remain valid.

Invalidation point: 17.99

Conclusion:

This analysis of ASX: BRAMBLES LIMITED - BXB highlights potential trends and key price levels for traders. We provide specific validation and invalidation points to support our wave count, helping enhance confidence in this forecast. By merging these factors, we aim to offer readers a professional and objective view of the current market trends.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Woolworths Group Limited Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support