Johnson & Johnson, Elliott Wave Technical Analysis

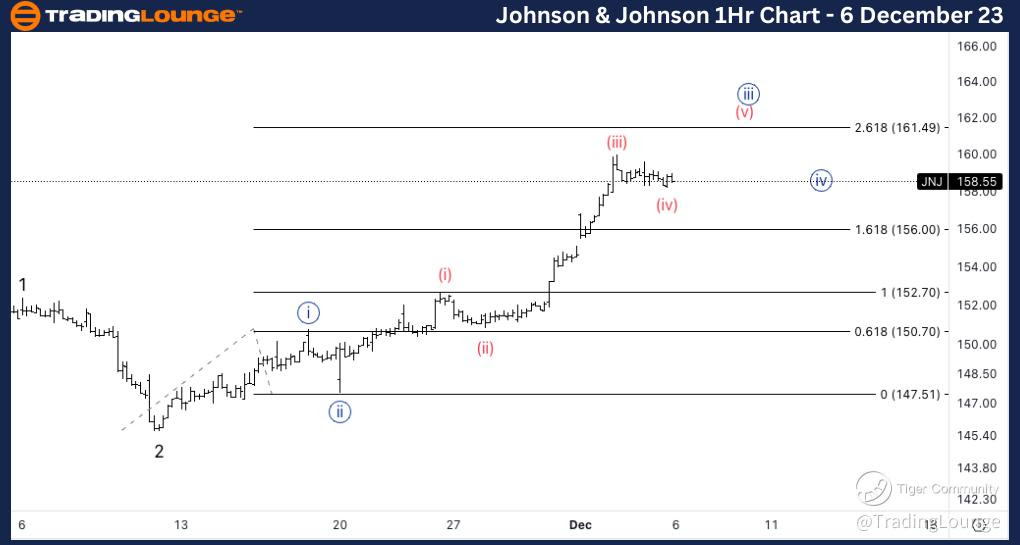

Johnson & Johnson, (JNJ:NYSE): 4h Chart 6 December 23

JNJ Stock Market Analysis: We changed the count to a bullish scenario. At this stage we are looking for upside in either a wave 3 or C that seems to be unfolding as expected. Looking for 5 waves within wave 3/C.

JNJ Elliott Wave Count: Wave (iii) of {iii}.

JNJ Technical Indicators: Above all averages.

JNJ Trading Strategy: Looking for longs into wave 3.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

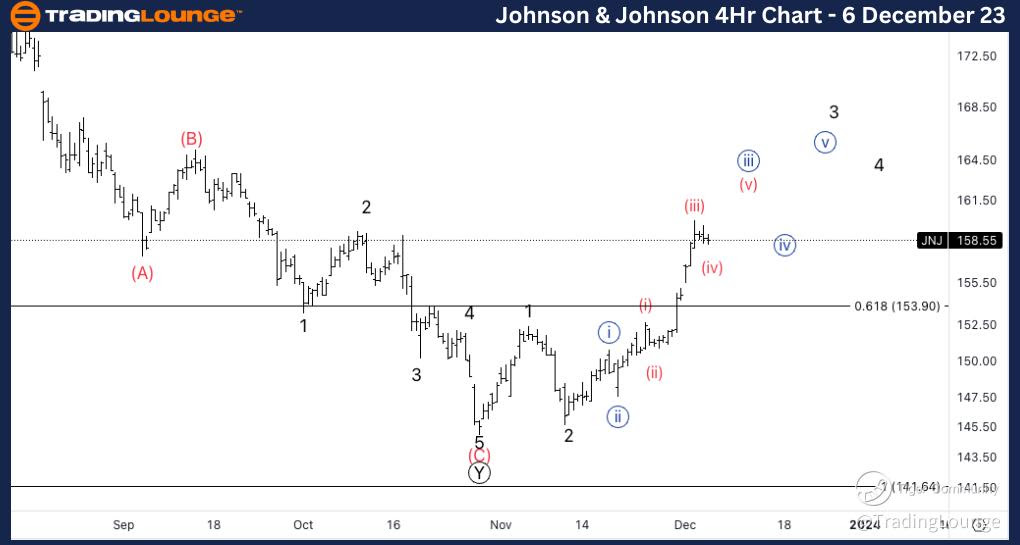

Johnson & Johnson, JNJ: 1-hour Chart 6 December 23

Johnson & Johnson, Elliott Wave Technical Analysis

JNJ Stock Market Analysis: Looking for a sideways consolidation into wave (iv) to then continue higher as we seem to be finding support on 158$. Upside target for wave {iii} stands at 161.5 as we have 2.618 of {iii} vs. {i}.

JNJ Elliott Wave count: Wave (iv) of {iii}

JNJ Technical Indicators: Above all averages.

JNJ Trading Strategy: Looking for longs into wave (v).