FTNT Elliott Wave Analysis Trading Lounge Daily Chart, 4 March 24

Welcome to our FTNT Elliott Wave Analysis Trading Lounge, your go-to resource for comprehensive insights into Fortinet Inc. (FTNT) using Elliott Wave Technical Analysis. Let's delve into the market dynamics as of the Daily Chart on 4th March 2024.

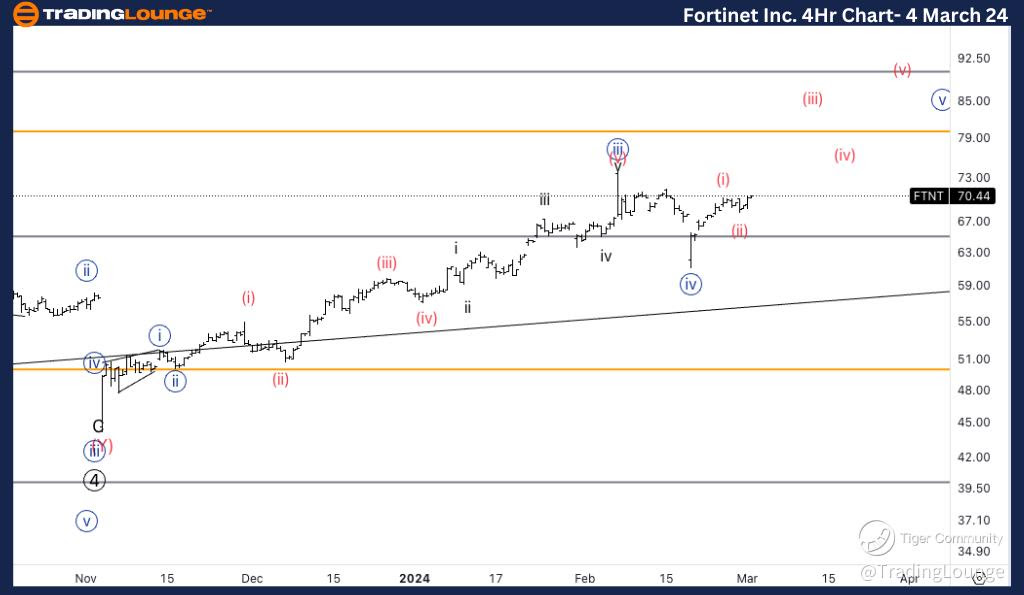

Fortinet Inc., (FTNT) Daily Chart Analysis

FTNT Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulse

STRUCTURE: Motive

POSITION: Minor wave 1 of Intermediate (1).

DIRECTION: Completion of wave {v} of 1.

DETAILS: We seem to have completed a flat correction in Primary wave 4, and now we see to be on the way to breaking the previous wave (X) high at around TL8 80$. We could either be in wave {v} of 1 or else wave {iv} could be a higher degree wave 2.

Our analysis reveals a trend function with an impulse structure, characterized by a motive pattern. Currently positioned in Minor wave 1 of Intermediate (1), we observe the potential completion of wave {v} of 1. Following a flat correction in Primary wave 4, we anticipate a breakout above the previous wave (X) high, approximately around TL8 $80. The ongoing wave could either be wave {v} of 1 or a higher-degree wave 2 represented by wave {iv}.

FTNT Elliott Wave Analysis Trading Lounge 4Hr Chart, 4 March 24

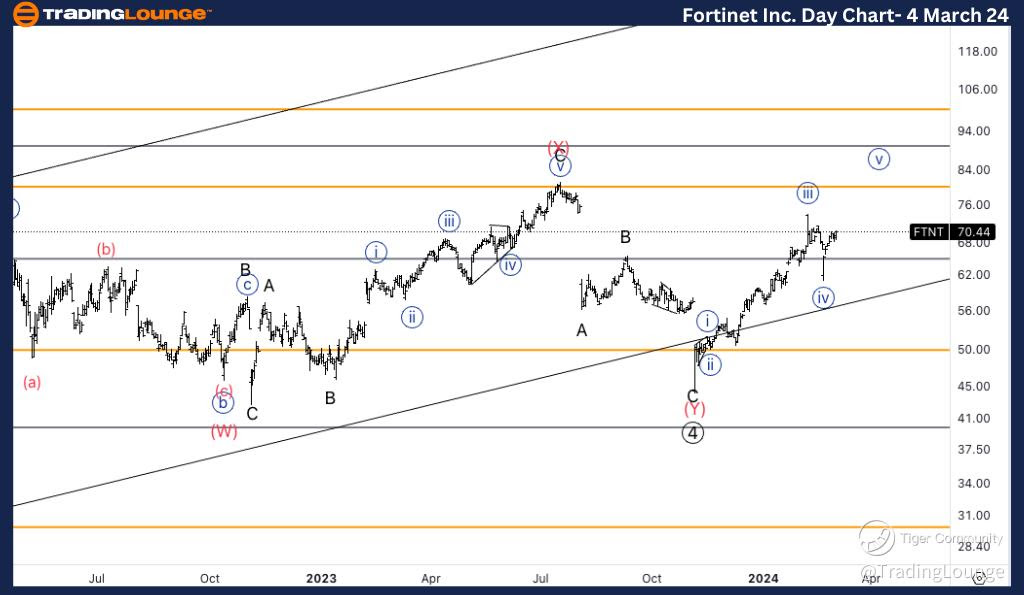

Fortinet Inc., (FTNT) 4Hr Chart Analysis

FTNT Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulse

STRUCTURE: Motive

POSITION: Wave (iii) of {v}.

DIRECTION: Acceleration higher into wave (iii).

DETAILS: Looking for acceleration higher into wave (iii) as we seem to be breaking previous s wave (b) top after finding support on Medium Level 65$.

Here, we identify a trend mode with an impulse structure, indicating a motive pattern. Positioned in Wave (iii) of {v}, we anticipate an acceleration higher into Wave (iii). This expectation comes as we observe a breakthrough above the previous wave (b) top, following support found at the Medium Level of $65.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: The Procter & Gamble Company, (PG)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.