ITC Ltd – ITC Elliott Wave Analysis TradingLounge (1D Chart)

ITC Elliott Wave Technical Analysis

Function: Counter Trend (Minor degree, Grey)

Mode: Corrective

Structure: Impulse within a larger corrective wave

Position: Lower degree impulse may have been completed but remains unlabeled.

Details: Last week, ITC confirmed a potential trend shift with a break below the 480 level. This suggests that a lower (Minute) degree impulse wave might be complete, although it is not labelled yet. Alternate counts will be considered if price action supports it.

Invalidation Point: 530

ITC Daily Chart Technical Analysis and Potential Elliott Wave Counts:

The daily chart for ITC signals a possible end of Intermediate Wave (5) Orange at the 530 high. If this scenario is accurate, a corrective wave may have started, with recent price action dropping below the 400 level in recent trading sessions. Another possibility is that Minor Wave 4 of (5) has completed near the 470 mark.

Since the stock reached lows around 135 in March 2020, it has experienced a significant rally that peaked at 530, completing an Intermediate-level impulse wave. Notably, Minor Wave 3 within Intermediate Wave (3) was extended.

Following Intermediate Wave (4)’s termination around the 400 mark, the stock rallied to 530, potentially marking the end of Intermediate Wave (5). If this analysis holds, ITC could be entering a larger corrective phase with a downward trend.

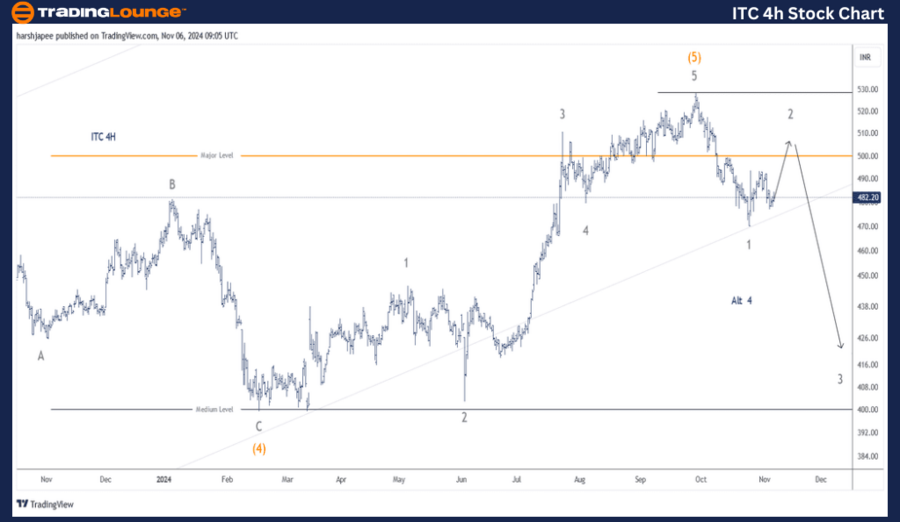

ITC Ltd – ITC (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Minor degree, Grey)

Mode: Corrective

Structure: Impulse within a larger corrective wave

Position: Lower degree impulse might be complete.

Details: A break below the 480 level last week supports a potential trend shift. This suggests that a lower (Minute) degree impulse wave might be complete, though it remains unlabeled. Alternatively, the recent 530 high could represent Minor Wave 3, followed by Wave 4 around 470. Should this alternate scenario play out, ITC may see a rally that surpasses 530.

Invalidation Point: 530

ITC 4H Chart Technical Analysis and Potential Elliott Wave Counts:

The 4-hour chart of ITC shows the development of sub-waves since the termination of Intermediate Wave (4) Orange around the 400-405 mark. Intermediate Wave (5) may be further subdivided into Minor Waves 1 through 5, culminating around the 530 level. Alternatively, Minor Wave 4 could have ended around 470, potentially paving the way for another rally above 530.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: COAL INDIA Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

ITC might have completed Intermediate Wave (5) Orange around the 530 level, signalling the beginning of a larger corrective wave.