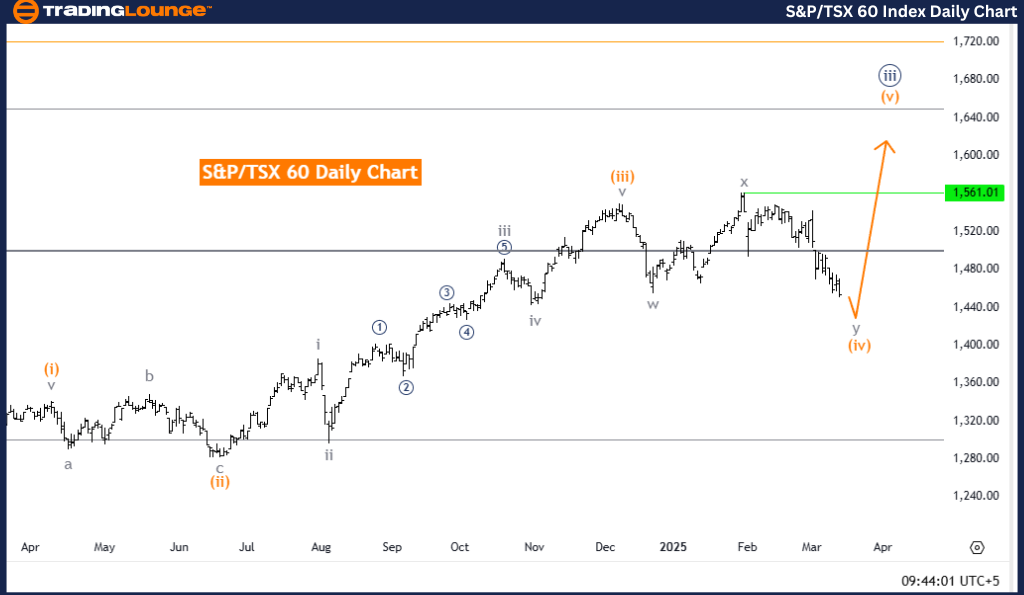

S&P/TSX 60 Elliott Wave Analysis – Trading Lounge Day Chart

S&P/TSX 60 Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave 4

Position: Navy Blue Wave 3

Next Higher Degree Direction: Orange Wave 5

Details:

- Orange Wave 3 appears completed.

- Orange Wave 4 is currently unfolding.

Analysis Overview

The S&P/TSX 60 Elliott Wave Analysis for the daily chart provides an in-depth look at the current market trend and possible future movements.

- The market is presently in a counter-trend phase, indicating corrective price action rather than a strong directional move.

- The primary wave under observation is Orange Wave 4, which is part of the larger Navy Blue Wave 3 structure.

- Orange Wave 3 has likely concluded, and the market has transitioned into Orange Wave 4.

- Since Orange Wave 4 is corrective, traders should expect sideways consolidation or retracement movements before the next major trend develops.

Key Considerations for Traders

- The next higher-degree wave to monitor is Orange Wave 5, which will follow after Orange Wave 4 completes.

- Traders should closely observe the development of Orange Wave 4 and prepare for potential trend shifts.

- Understanding the current wave structure enhances forecasting accuracy for future price movements.

- The daily chart analysis offers a broad perspective, enabling traders to align strategies with larger market trends and upcoming turning points.

Trading Insights

This Elliott Wave analysis of the S&P/TSX 60 daily chart offers valuable guidance for traders navigating the current corrective phase.

- Elliott Wave patterns are essential in making informed trading decisions.

- Identifying the completion of one wave and the emergence of another helps traders anticipate market direction and adjust their strategies accordingly.

- Corrective waves often precede major market trends, making it crucial to remain patient and vigilant during these phases.

- By leveraging Elliott Wave principles, traders can gain insights into market behavior, refining their decision-making and risk management approaches.

S&P/TSX 60 Elliott Wave Analysis – Trading Lounge Weekly Chart

S&P/TSX 60 Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave 4

Position: Navy Blue Wave 3

Next Higher Degree Direction: Orange Wave 5

Details:

- Orange Wave 3 appears completed.

- Orange Wave 4 is currently unfolding.

Analysis Overview

The S&P/TSX 60 Elliott Wave Analysis for the weekly chart provides a broader evaluation of the market’s current trend and future outlook.

- The index is in a counter-trend phase, marked by corrective rather than impulsive movements.

- The key structure under examination is Orange Wave 4, which forms part of the larger corrective sequence within Navy Blue Wave 3.

- Orange Wave 3 has likely ended, signaling the beginning of Orange Wave 4.

- As a corrective wave, Orange Wave 4 may lead to sideways or retracement price action before the next impulse wave takes shape.

Key Considerations for Traders

- The next major wave to track is Orange Wave 5, which will emerge once Orange Wave 4 completes.

- Traders should closely monitor the price behavior within Orange Wave 4 to anticipate the next major movement.

- Understanding the Elliott Wave structure helps traders position themselves ahead of significant market shifts.

- The weekly chart analysis provides long-term insights, helping traders adjust their strategies according to larger market cycles and pivot points.

Trading Insights

This in-depth Elliott Wave analysis of the S&P/TSX 60 weekly chart provides traders with a structured framework for navigating corrective phases and positioning for future trends.

- Wave patterns guide traders in making precise market decisions.

- Recognizing the end of one wave and the start of another aids in forecasting potential price movements.

- Corrective phases often set the stage for major trend developments, highlighting the importance of staying patient and observant.

- Weekly chart analysis offers clarity on broader market movements, allowing traders to plan strategies aligned with long-term Elliott Wave trends.

- Applying Elliott Wave principles enhances market insight, risk management, and decision-making.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: DAX (Germany) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support