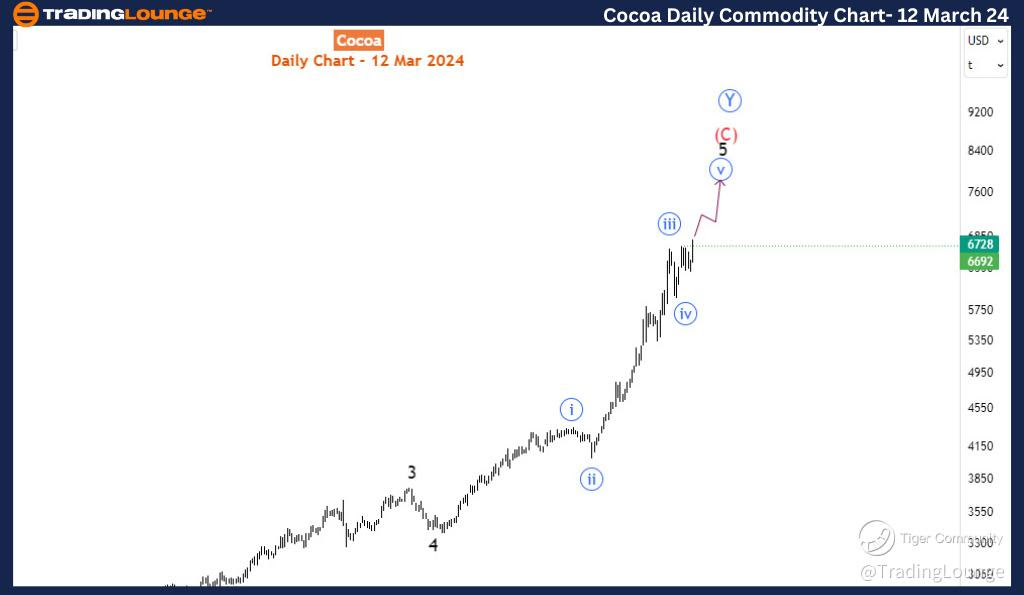

Cocoa Elliott Wave Analysis - breaks into a new all-time high

Cocoa, in its recent movements, has broken above its previous all-time high at 6696, surging to a new peak at 6789. This upward trajectory suggests a continuation of its bullish momentum. The question that arises is: how much further can this upward trend extend?

Cocoa Elliott Wave Technical Analysis

Cocoa Day Chart Analysis

Examining the daily time frame reveals a robust bullish trend that has recently undergone a shallow pullback, likely representing the completion of blue wave iv of 5 of (C) of Y. This indicates that the bullish trend may be approaching its final stages before a notable bearish correction ensues. However, it's important to note that the final stage, wave v (blue) of 5, is still in its early phases. Utilizing Fibonacci projection techniques, it's plausible to anticipate an extension of prices to around 8000 in the upcoming weeks.

Cocoa Elliott Wave Analysis Trading Lounge 4 Hour Chart, 12 March 24

Cocoa 4-hour Chart Analysis

Zooming into the 4-hour time frame, it becomes evident that wave (i) concluded at 6692. With the subsequent breach of this high, wave (ii) is anticipated to have completed as well. Currently, wave (iii) is unfolding and could potentially reach 7654, representing a 161.8% Fibonacci extension of wave (i). Given the remarkable strength of the bullish trend, setting a target of 8000 doesn't seem unreasonable. This scenario appears to be the most apparent and plausible. Even in the presence of alternative wave counts, the overarching direction remains skewed towards the upside.

In essence, Cocoa's price action indicates a compelling bullish sentiment, supported by both daily and 4-hour time frame analyses. While a significant bearish correction may loom on the horizon, the current trajectory suggests further upside potential, with a possible extension towards the 8000 mark in the near term. However, traders should remain vigilant and adaptable to potential alternative scenarios as the market evolves.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Soybean

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.