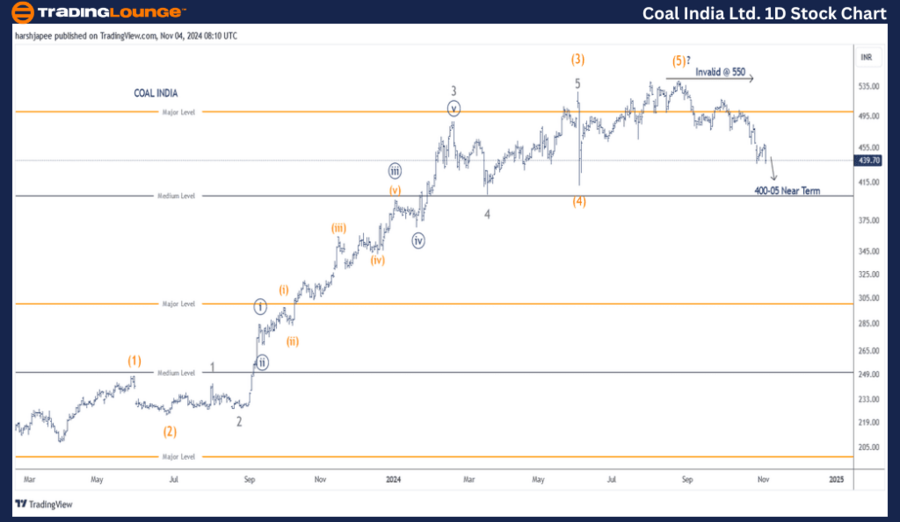

COAL INDIA LTD – COALINDIA (1D Chart) Elliott Wave Technical Analysis

COALINDIA Elliott Wave Technical Analysis

Function: Counter Trend Lower (Minor Degree, Grey)

Mode: Corrective

Structure: Potential Impulse within Larger Degree Correction

Position: Lower Degree Waves are Unfolding, Not Yet Marked

Details: Based on recent analysis, the alternative count has now become the preferred scenario, suggesting a potential top around 550, marking the termination of Intermediate Wave (5) in Orange. The stock is trending downward, unfolding as a potential impulse toward the 400-405 range. A detailed update on the wave count will follow in the coming week.

Invalidation Point: 550

COAL INDIA Daily Chart Technical Analysis and Potential Elliott Wave Counts:

The daily chart of COAL INDIA suggests that a larger degree uptrend concluded near the 550 mark, aligning with Intermediate Wave (5) recorded on August 26, 2024. If this analysis holds, the stock may undergo a significant correction from the 550 high. The initial impulse wave could find support near the 400 level in the short term.

The stock has completed a five-wave rally following a drop near the 210 lows in March 2023. Note that Intermediate Wave (3) experienced an extension, as did Minor Wave 3 within it. Intermediate Wave (4) in Orange represented a sharp correction to 412, recorded on June 4, 2024.

Assuming the above structure is accurate, COAL INDIA has now shifted lower into a larger corrective wave, with price action expected to remain below the 550 level.

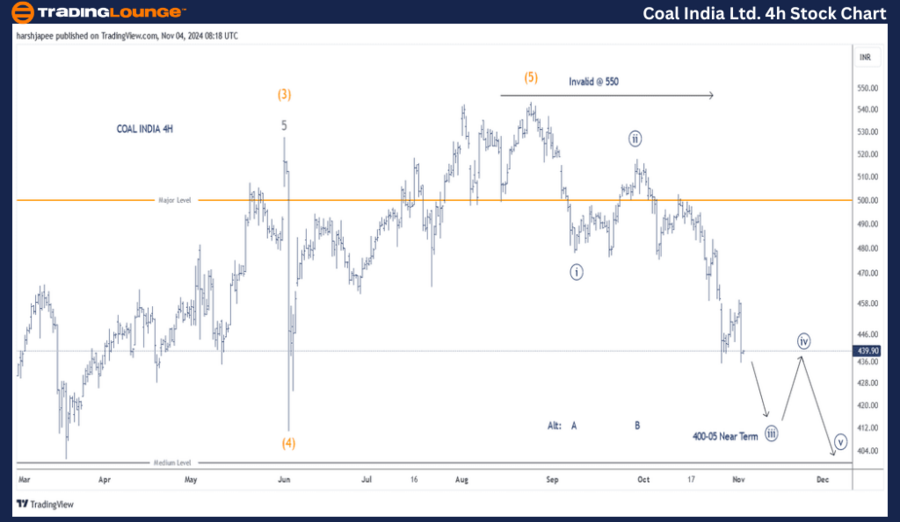

COAL INDIA LTD – COALINDIA (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend Lower (Minor Degree, Grey)

Mode: Corrective

Structure: Potential Impulse within Larger Degree Correction

Position: Lower Degree Waves are Unfolding, Not Yet Marked

Details: As per the alternative count, now the preferred view, a potential top has formed around 550, marking the end of Intermediate Wave (5) in Orange. The stock's downtrend appears to be unfolding as a potential impulse toward the 400-405 target range. Minute Wave ((iii)) of a possible Minor Wave 1 could be forming, or the price is completing Wave C in an A-B-C corrective pattern.

Invalidation Point: 550

COAL INDIA 4H Chart Technical Analysis and Potential Elliott Wave Counts:

The 4H chart for COAL INDIA showcases the sub-waves following the peak at 550, marking Intermediate Wave (5) in Orange. Currently, Minute Wave ((iii)) of Minor Wave 1 appears to be heading toward the 400-405 range, which aligns with the termination of the previous Wave (4).

Alternatively, the decline from 550 may be taking shape as an A-B-C correction, with the last segment moving lower toward the 400-405 level.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: State Bank of India Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

COAL INDIA appears to be progressing through its first impulse decline since the 550 high, or it could be completing Wave C within an A-B-C corrective structure, with an anticipated target around the 400 mark.