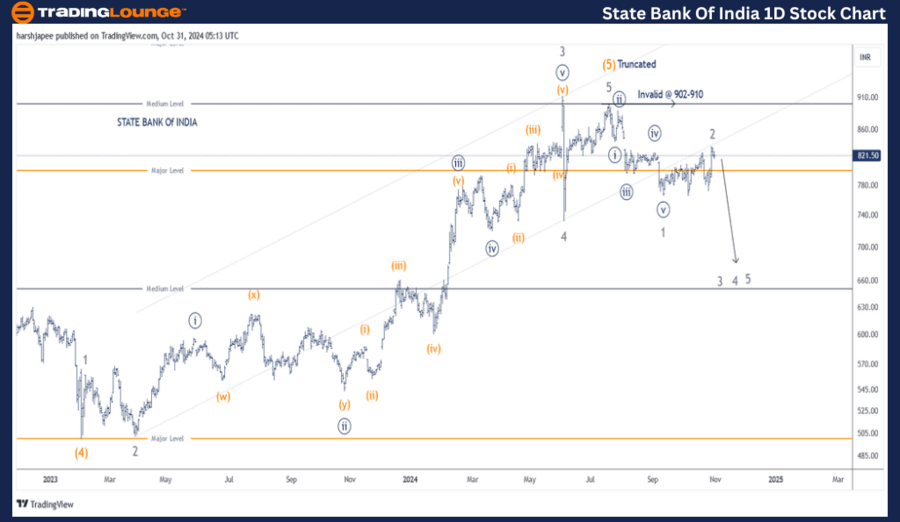

STATE BANK OF INDIA – SBIN Elliott Wave Analysis (1D Chart)

SBIN Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse within Larger Degree Zigzag

Position: Minor Wave 2

Details: Minor Wave 2 (Grey) may now be complete near the 850 level, aligning with the previous Wave ((iv)) of a lower degree. If this analysis holds, Wave 3 could soon commence.

Invalidation Point: 910

State Bank of India Daily Chart Technical Analysis and Potential Elliott Wave Counts

The daily chart of State Bank of India indicates that the stock might have completed its broader uptrend around the 910 mark, with Intermediate Wave (5) (Orange) potentially truncated. Alternatively, Minor Wave 5 within (5) may be extending or subdividing relative to the 730 low.

In February 2023, State Bank of India completed Intermediate Wave (4) (Orange) near 500. Since then, the chart has displayed Minor Waves 1 (Impulse), 2 (Expanded Flat), 3 (Impulse Extension), 4 (Zigzag, Sharp), and 5 (Truncated), culminating near the 910 high.

Assuming this analysis is accurate, the stock has turned downward from 910, beginning a larger corrective phase. Minor Wave 1 (Impulse) and Minor Wave 2 (Flat) appear completed around the 840-850 range. If this trend continues, Minor Wave 3 could now be in motion.

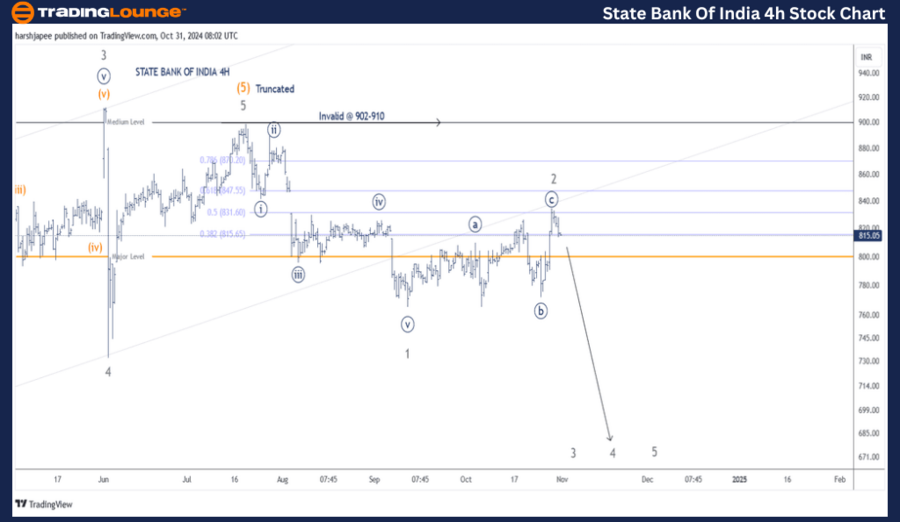

STATE BANK OF INDIA – SBIN (4H Chart) Elliott Wave Analysis

Function: Counter Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse within Larger Degree Zigzag

Position: Minor Wave 2

Details: Minor Wave 2 (Grey) seems to have concluded near 850, aligning with the previous Wave ((iv)) of a lesser degree. If this holds true, Wave 3 may soon emerge. The Fibonacci 0.50 retracement of Wave 1 has been tested, leaving room for a potential 0.618 level test before Wave 3 resumes.

Invalidation Point: 910

State Bank of India 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4H chart of State Bank of India emphasizes the sub-waves following Minor Wave 3’s peak near 910. Minor Wave 4 saw a sharp pullback, ending near 730 on June 4, 2024. Minor Wave 5 potentially displays a truncation around the 900 mark.

If accurate, a larger corrective wave is likely underway, with Minor Waves 1 and 2 now completed near 765 and within the 840-850 range, respectively. Alternatively, Minor Wave 5 may continue to extend, driving prices above the 900 threshold.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Larsen & Toubro Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

State Bank of India is moving lower, with Minor Wave 3 (Grey) expected to continue below the 910 level.