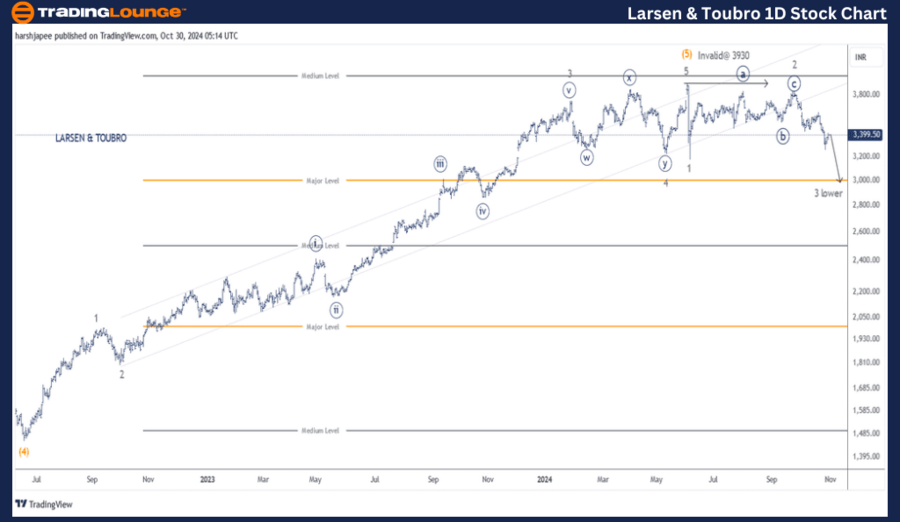

LARSEN & TOUBRO – LT Elliott Wave Analysis (1D Chart)

LT Elliott Wave Technical Analysis

Function: Counter Trend (Intermediate degree, orange)

Mode: Corrective

Structure: Impulse, within larger Wave (A)

Position: Minor Wave 3 Grey

Details: Minor Wave 3 Grey is moving lower, positioned against the 3930 mark.

Invalidation Point: 3930

Larsen & Toubro Daily Chart Technical Analysis and Potential Elliott Wave Counts

The daily chart for Larsen & Toubro suggests a developing counter trend at the Minor degree, notably against the 3930 high. The Intermediate Wave (5) in Orange seems to have culminated near the 3930 mark, potentially signaling the end of a multiyear upward movement.

In June 2022, the stock declined to approximately 1450, marking the beginning of Intermediate Wave (5) Orange. Bullish momentum carried the stock upward, resulting in an impulse that peaked around 3930 on June 03, 2024.

From that point, prices started a downtrend, breaking below 3180—marked as Minor Wave 1 in the larger corrective wave. Minor Wave 2 saw a recovery up to 3840, followed by a renewed downturn. A dip beneath the 3180-3190 range could indicate a deeper correction.

LARSEN & TOUBRO – LT (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Intermediate degree, orange)

Mode: Corrective

Structure: Impulse, within larger Wave (A)

Position: Minor Wave 3 Grey

Details: Minor Wave 3 Grey is trending downward against the 3930 high. Ideally, prices should remain below the 3840 level, where Minor Wave 2 terminated.

Invalidation Point: 3930

Larsen & Toubro 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4-hour chart for Larsen & Toubro provides insight into the progression of sub-waves within Minor Wave 3 Grey, which reached near the 3750 mark before a retracement. Minor Wave 4 Grey completed as a combination pattern, while Minor Wave 5 was relatively shallow, terminating around 3930. From this point, a larger corrective wave has likely begun, with Minor Wave 1 and 2 forming near 3200 and 3840, respectively. Minor Wave 3 continues moving lower.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: HDFC Life Insurance Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Larsen & Toubro is currently in a downward trend within Minor Wave 3 Grey, positioned below the 3930 high.