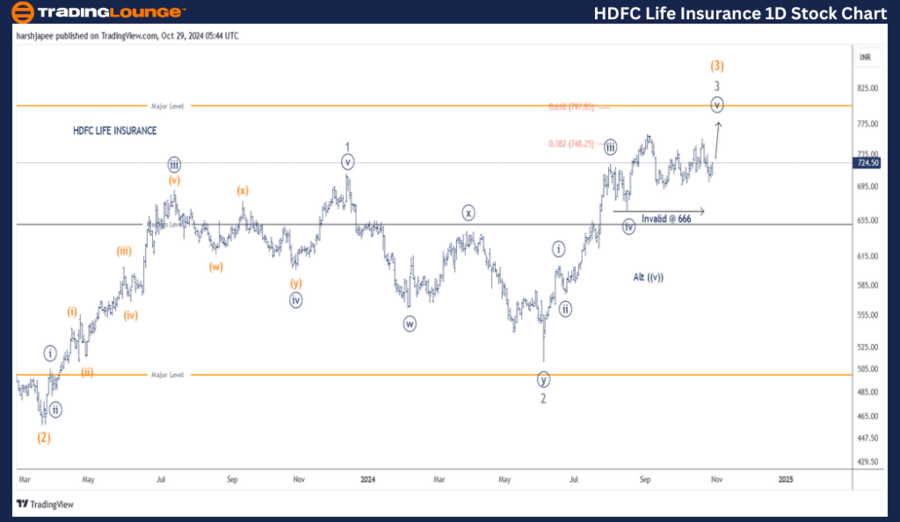

HDFC LIFE INSURANCE – HDFCLIFE (1D Chart) Elliott Wave Analysis

HDFC LIFE INSURANCE – HDFCLIFE Elliott Wave Technical Analysis

Trend: Upward Momentum (Intermediate Wave (3), Orange)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Minute Wave ((v)) Navy

Analysis:

The current Minute Wave ((v)) Navy is advancing within Minor Wave 3 Grey, which forms part of the larger Intermediate Wave (3) Orange. The next potential upside target for this wave is 797. No adjustments to the analysis are required at this stage.

HDFC Life Insurance Daily Chart Analysis with Elliott Wave Counts

HDFC Life Insurance’s daily chart suggests a rally towards the 797 level in the near term, as Minute Wave ((v)) within Minor Wave 3 of Intermediate Wave (3) advances above the 666 support level. A break below this support would validate an alternate wave count, where Minute Wave ((v)) potentially completed around 765.

The stock formed a significant low at approximately 455 in March 2023, marking the end of Intermediate Wave (2) Orange on the daily chart. Following this, Minor Wave 1 Grey peaked near 711, while Minor Wave 2 developed as a complex correction ((w))-((x))-((y)), ending around the 510 level.

Currently, Minor Wave 3 is advancing from the 510 support, with Minute Waves ((i)) through ((iv)) completed. If the count is accurate, Minute Wave ((v)) is moving towards 797 with a key support level at 666.

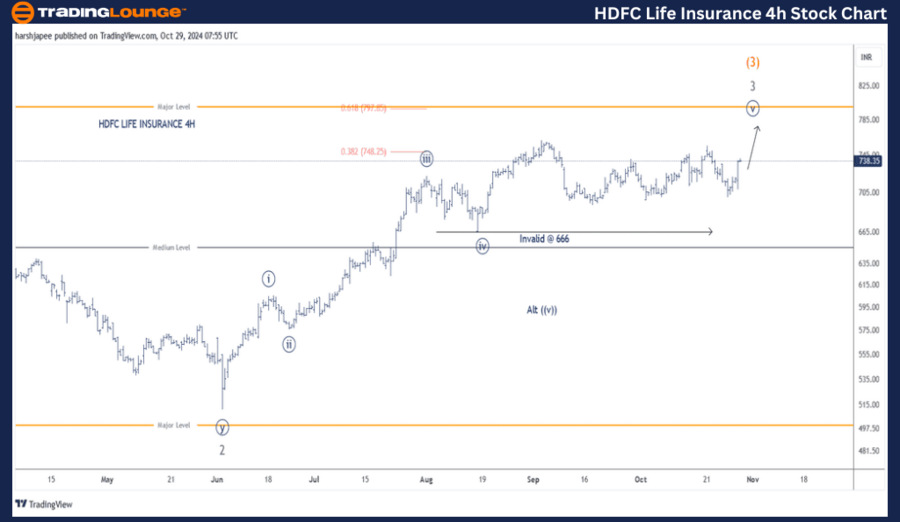

HDFC LIFE INSURANCE – HDFCLIFE Elliott Wave Analysis (4H Chart)

Trend: Continuing Upward Momentum (Intermediate Wave (3), Orange)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Minute Wave ((v)) Navy

Analysis:

The 4-hour chart shows Minute Wave ((v)) Navy rising within Minor Wave 3 Grey of the larger Intermediate Wave (3) Orange. The primary upside target remains 797. A drop below 666, however, could indicate that Minute Wave ((v)) concluded around the 760-765 range.

Invalidation Level: 666, with risk tightened to this level.

HDFC Life Insurance 4H Chart Analysis and Elliott Wave Counts

On the 4-hour chart, HDFC Life Insurance highlights sub-waves following the completion of Minor Wave 2 Grey at approximately 510 on June 4, 2024. Minute Waves ((i)) through ((iv)) appear complete, with Wave ((v)) advancing towards the 797 level, aligning with the Fibonacci 0.618 extension.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: AXIS Bank Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

HDFC Life Insurance is anticipated to rise toward 797 as Minute Wave ((v)) extends within Minor Wave 3 Grey of Intermediate Wave (3) Orange.