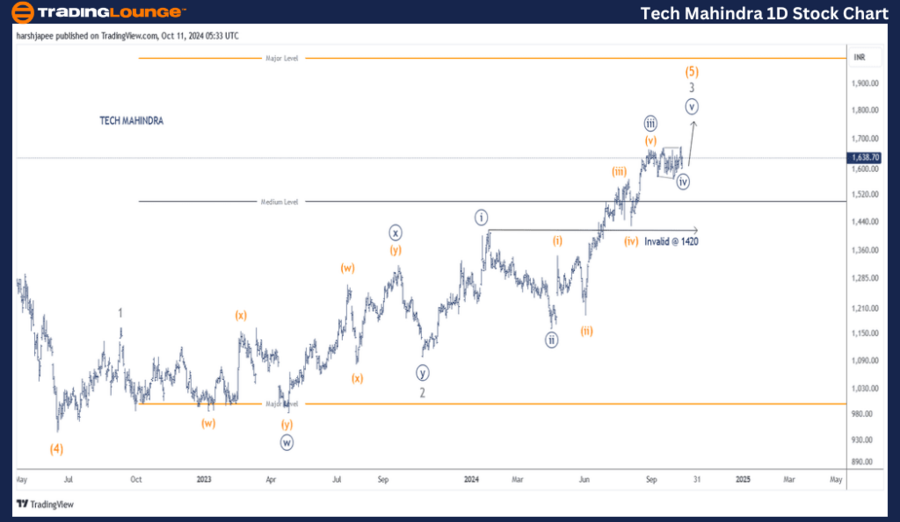

Tech Mahindra – TECHM Elliott Wave Analysis (1D Chart)

TECHM Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((iv)) Navy

Details: Minute Wave ((iv)) may have completed as a triangle formation near the 1600 mark. If accurate, Minute Wave ((v)) is likely to resume the upward trend soon.

Invalidation Point: 1420

Tech Mahindra Daily Chart Analysis and Elliott Wave Counts:

The daily chart of Tech Mahindra suggests a continuing uptrend, potentially reaching the 1800 levels as Minor Wave 3 Grey progresses. The stock seems poised to resume Minute Wave ((v)) of Minor Wave 3, with prices expected to remain above the 1575 mark.

In June 2022, Tech Mahindra completed Intermediate Wave (4) Orange around the 940 level. Since then, Minor Waves 1 and 2 ended near 1160 and 1105, respectively. Minute Waves ((i)) through ((iv)) of Minor Wave 3 also appear to be completed.

Assuming the wave counts are correct, the stock should rise further towards the 1700-1800 zone as the Minute Wave ((iv)) triangle concludes. Moving forward, prices should stay above the 1420 level, which marked the end of Minute Wave ((i)).

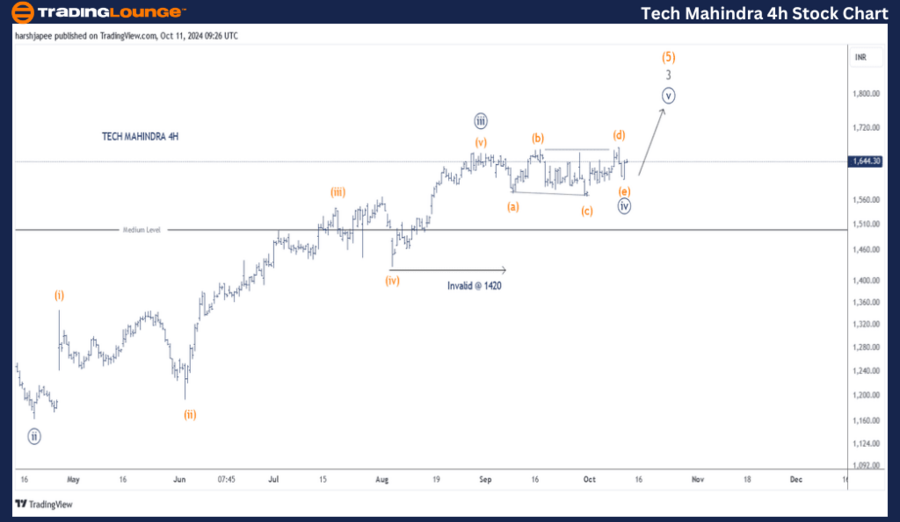

Tech Mahindra – TECHM (4H Chart) Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((iv)) Navy

Details: Minute Wave ((iv)) might be completed as a triangle near the 1600 mark. If correct, Minute Wave ((v)) of Minor Wave 3 Grey, within Intermediate Wave (5) Orange, is expected to move higher soon.

Invalidation Point: 1420

Tech Mahindra 4H Chart Analysis and Elliott Wave Counts:

The 4H chart of Tech Mahindra reveals the sub-waves forming after Minute Wave ((ii)) of Minor Wave 3. Minute Wave ((iii)) displayed impulsive movement, followed by a potential triangle pattern as Minute Wave ((iv)), likely finishing near 1600. If this is accurate, Minute Wave ((v)) should resume the upward trend shortly.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Sun Pharmaceuticals Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Tech Mahindra is expected to continue rising within Minute Wave ((v)) of Minor Wave 3 Grey, which falls within Intermediate Wave (5) Orange. The key invalidation level remains at 1420.