TXN Elliott Wave Analysis | Texas Instruments Stock Forecast

In this Elliott Wave analysis for Texas Instruments Inc. (TXN), both daily and hourly chart setups provide detailed insights into the ongoing technical structure and potential future price movement of TXN stock.

Texas Instruments Inc. (TXN) Elliott Wave Analysis – Trading Lounge Daily Chart

TXN Stock Elliott Wave Forecast – Daily Timeframe

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Flat Correction

POSITION: Wave (C) of B

DIRECTION: Uptrend in Wave (C)

DETAILS: This analysis indicates a bearish corrective structure. A completed three-wave decline formed Primary wave A, followed by an upward correction developing as Primary wave B.

Texas Instruments Elliott Wave Analysis – Daily Chart Insights

The daily chart of TXN stock reveals a corrective Elliott Wave pattern. After a downward three-leg sequence forming Primary wave A, Texas Instruments stock is now entering Primary wave B. This corrective phase progresses upward through Intermediate wave (C), consistent with a flat wave structure in Elliott terms.

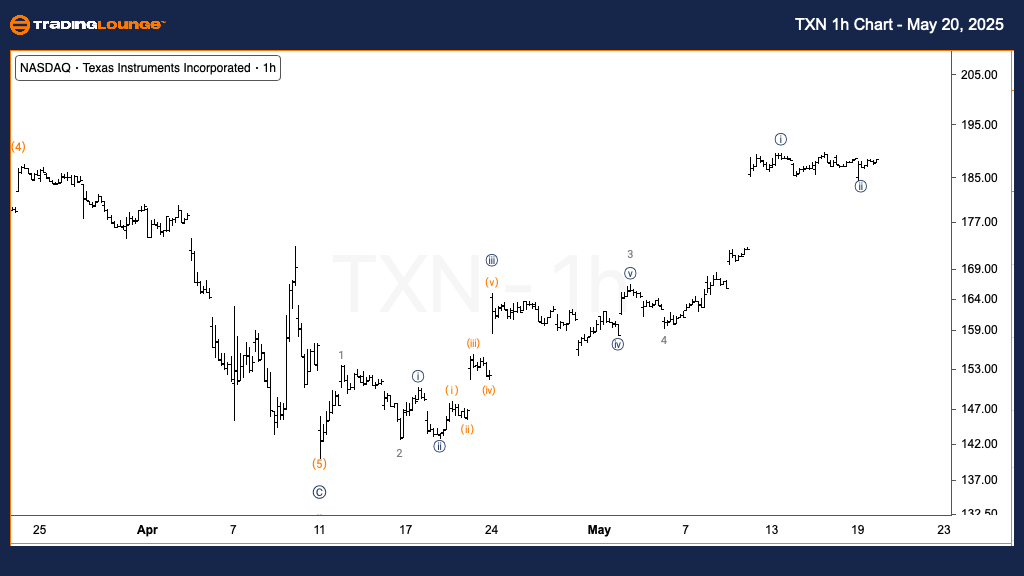

Texas Instruments Inc. (TXN) Elliott Wave Analysis – Trading Lounge 1-Hour Chart

TXN Stock Elliott Wave Forecast – 1H Timeframe

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive Wave

POSITION: Wave {iii} of 5

DIRECTION: Uptrend in Wave {iii}

DETAILS: The bullish structure identifies an active Minor wave 5. Currently, price action is within wave {iii}, pushing toward a key resistance near $200 (Trading Level 2).

Texas Instruments Elliott Wave Analysis – 1-Hour Chart Highlights

The 1-hour chart suggests a bullish outlook for TXN. Minor wave 5 continues to evolve, with wave {iii} propelling the price upward. Traders and investors should closely monitor the $200 level, marked as TradingLevel2, as it may present a potential resistance zone in the short term.

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Mastercard Inc. (MA) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Exclusive TradingLounge Offer: $1 Two-Week Trial, then $29 Per Month - 58% Discount NOW

Access 8 analysts, 250+ markets, real-time chat rooms, AI-powered Elliott Wave charting, and portfolio tools.

Claim This Deal Now