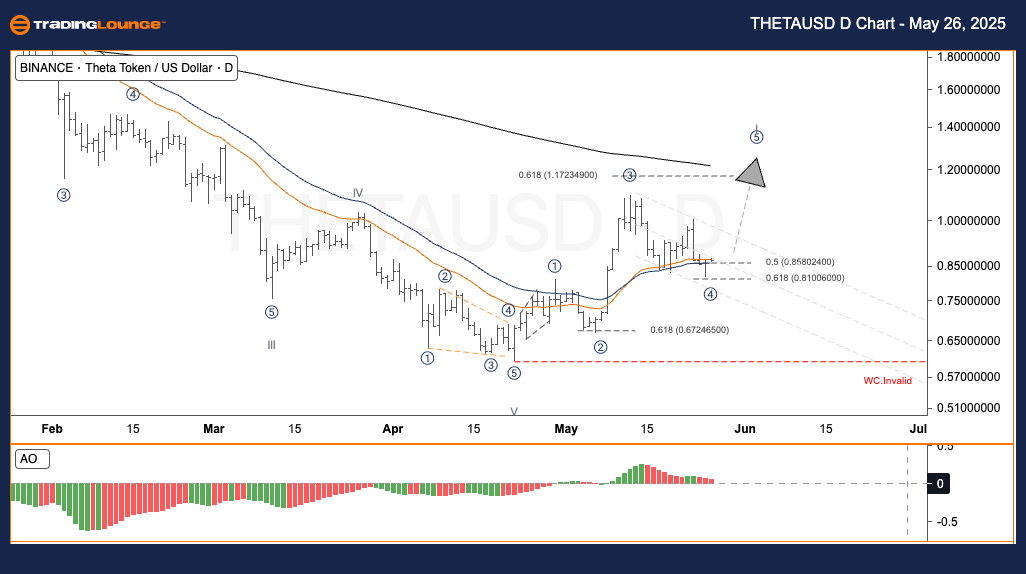

Theta Token / U.S. Dollar (THETAUSD) Elliott Wave Analysis TradingLounge Daily Chart

THETAUSD Elliott Wave Technical Analysis

Function: Follow trend

Mode: Motive

Structure: Impulse

Position: Wave 4

Direction Next Higher Degrees: –

Wave Cancel Invalid Level: –

Theta Token / U.S. Dollar (THETAUSD) Forecast and Strategy:

Theta Token (THETAUSD) is consolidating in wave 4 within a broader bullish Elliott Wave formation. This retracement phase is developing inside the expected correction zone, favoring the start of wave 5 — the next impulsive move upward. Following the completion of waves III and V earlier, the market has transitioned into a new structural phase. Waves 1 through 3 have already been established, and wave 4 is currently progressing. This wave is projected to find support in the Fibonacci retracement levels between 0.5 ($0.8580) and 0.618 ($0.8100). A confirmed bullish reversal in this range can lead to wave 5 extending toward the $1.17 to $1.30 resistance zone.

Trading Strategies

Strategy

- Short-Term Outlook (Swing Trading):

Monitor for bullish candlestick patterns such as an engulfing setup or breakout from current consolidation.

Place Stop Loss slightly below $0.80.

Take Profit within the anticipated wave 5 resistance range of $1.17–$1.30.

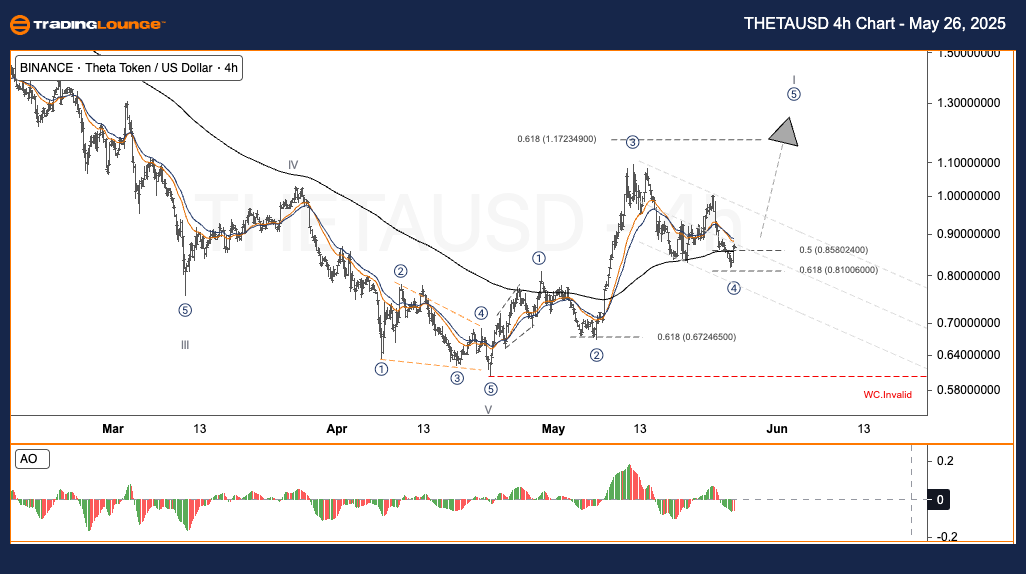

Theta Token / U.S. Dollar (THETAUSD) Elliott Wave Analysis TradingLounge H4 Chart

THETAUSD Elliott Wave Technical Analysis

Function: Follow trend

Mode: Motive

Structure: Impulse

Position: Wave 4

Direction Next Higher Degrees: –

Wave Cancel Invalid Level: –

Theta Token / U.S. Dollar (THETAUSD) Forecast and Strategy:

Theta Token (THETAUSD) continues to consolidate in wave 4, fitting within the overall bullish Elliott Wave outlook. This corrective wave is moving through the ideal retracement zone often referred to as the "golden pocket," setting up conditions for the potential initiation of wave 5. The completion of prior waves III and V has laid the groundwork for a new price structure. With waves 1, 2, and 3 already confirmed, wave 4 is expected to bottom between the 0.5 Fibonacci level ($0.8580) and 0.618 ($0.8100). A rebound from this zone would support a bullish continuation into wave 5, aiming for the $1.17–$1.30 area.

Trading Strategies

Strategy

- Short-Term Approach (Swing Trade):

Watch for confirmation of a bullish move — examples include breakout candles or engulfing formations.

Set Stop Loss below $0.80.

Target the upper range of wave 5, between $1.17 and $1.30.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: EURUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support