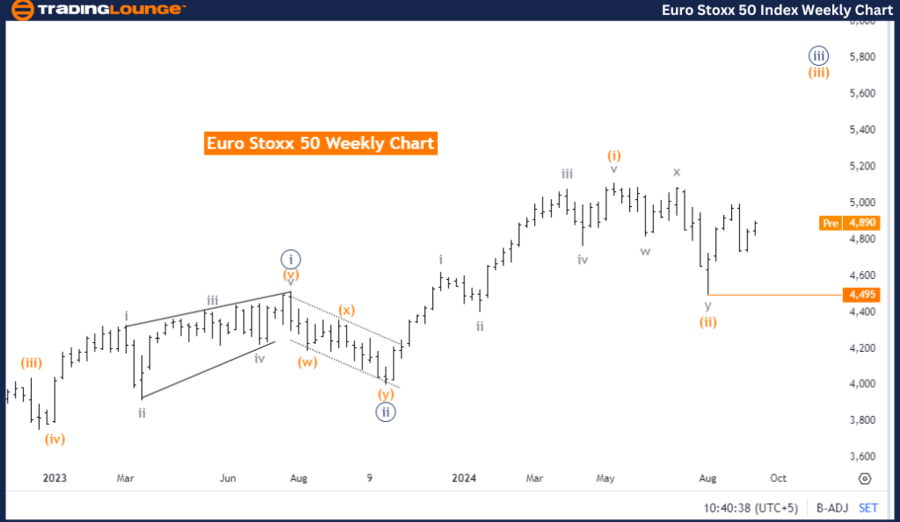

Euro Stoxx 50 Elliott Wave Analysis - Trading Lounge Day Chart

Euro Stoxx 50 Elliott Wave Technical Analysis

The Elliott Wave analysis for the Euro Stoxx 50 index on the daily chart shows a counter-trend movement. This signals a temporary pause or pullback within the broader market direction. The current mode is corrective, indicating that the market is consolidating or pulling back within a larger upward trend.

The focus is on gray wave 2, which is part of the corrective structure in the overall wave sequence. With gray wave 1 already completed, the market is now moving through gray wave 2 of orange wave 3. This suggests a short-term correction within the larger impulsive move.

Once gray wave 2 finishes, the market is expected to resume its upward trajectory in orange wave 3, which is part of the broader bullish pattern. The next higher degree, gray wave 3, will likely push the market higher once the correction concludes.

The invalidation level for this wave count is set at 4495. As long as the Euro Stoxx 50 index remains above this level, the current analysis remains valid, and the market is expected to continue moving upward.

Summary:

The Euro Stoxx 50 is in a corrective phase (gray wave 2) within a larger uptrend. Once the correction ends, the market is expected to rise in orange wave 3. The analysis remains valid as long as the index stays above the 4495 level.

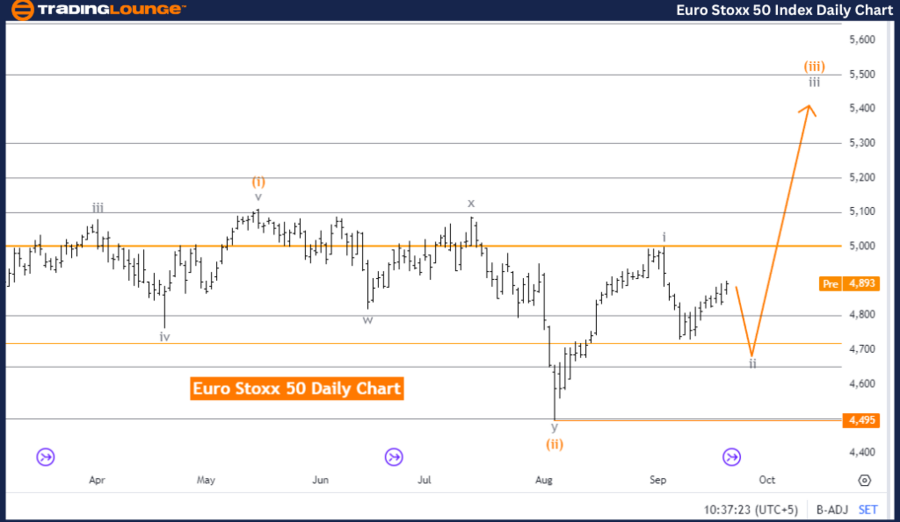

Euro Stoxx 50 Elliott Wave Analysis - Trading Lounge Weekly Chart

Euro Stoxx 50 Elliott Wave Technical Analysis

The weekly Elliott Wave analysis for the Euro Stoxx 50 points to a bullish trend, indicating a strong upward market movement. The current wave mode is impulsive, meaning the market is advancing in line with a broader uptrend.

The key wave under analysis is orange wave 3, a significant upward wave within the impulsive structure. With orange wave 2 now considered complete, the market is advancing through orange wave 3 of 3, which is typically one of the most powerful waves in the Elliott Wave structure.

At this point, the market is positioned in navy blue wave 3, which reinforces the ongoing impulsive move. After wave 3 concludes, a corrective phase (orange wave 4) may begin, but for now, the focus remains on wave 3, which is driving the market upward.

The wave count becomes invalid if the index falls below 4495. As long as the Euro Stoxx 50 index stays above this level, the current analysis remains intact, and the bullish trend is expected to continue.

Summary:

The Euro Stoxx 50 is in an impulsive bullish phase, with orange wave 3 leading the market higher. Orange wave 2 has finished, and orange wave 3 is in progress, suggesting further upside potential. The analysis remains valid as long as the index stays above the 4495 level. A corrective phase (orange wave 4) may follow after wave 3 concludes.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: NIFTY 50 Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support