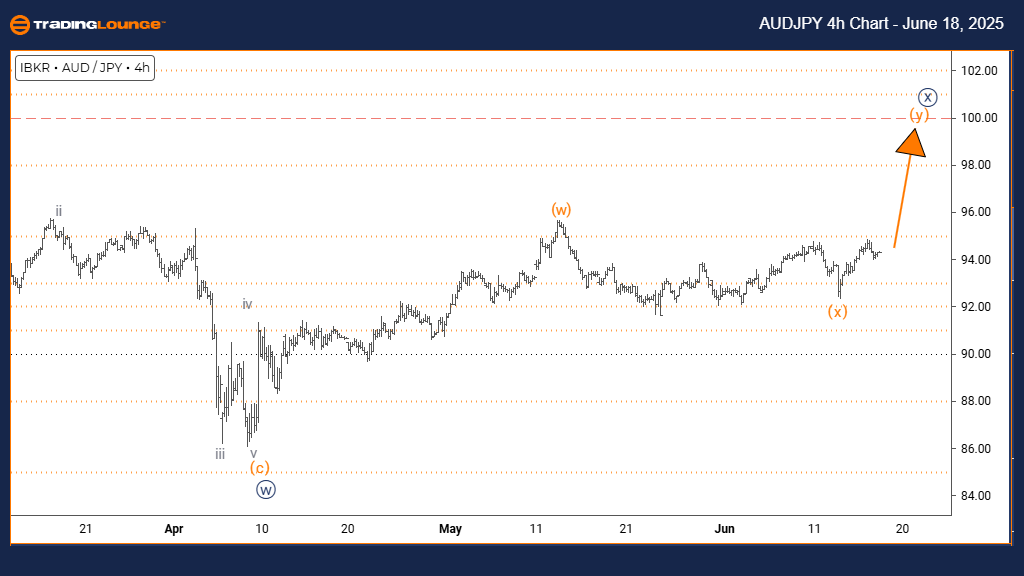

Australian Dollar / Japanese Yen (AUDJPY) Day Chart

AUDJPY Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave X

POSITION: Gray Wave X

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave Y

DETAILS: Navy Blue Wave W is likely complete; Navy Blue Wave X is currently developing.

The daily Elliott Wave forecast for AUDJPY shows a counter-trend move within an impulsive wave structure, suggesting a temporary reversal in the prevailing trend. This move is currently part of Navy Blue Wave X, nested within a broader Gray Wave X correction. Such positioning indicates that the AUDJPY pair is in a complex corrective phase.

Navy Blue Wave W appears to have finalized, giving way to Navy Blue Wave X. This active wave may evolve into a combination or zigzag correction, aligning with a broader corrective outlook. The next significant development is expected to be Navy Blue Wave Y, following the completion of the current wave.

This technical analysis for AUDJPY implies continued counter-trend movement. With Navy Blue Wave X ongoing, short-term momentum remains strong. However, it's important for traders to remember that this setup is part of a larger corrective structure, not a trend reversal.

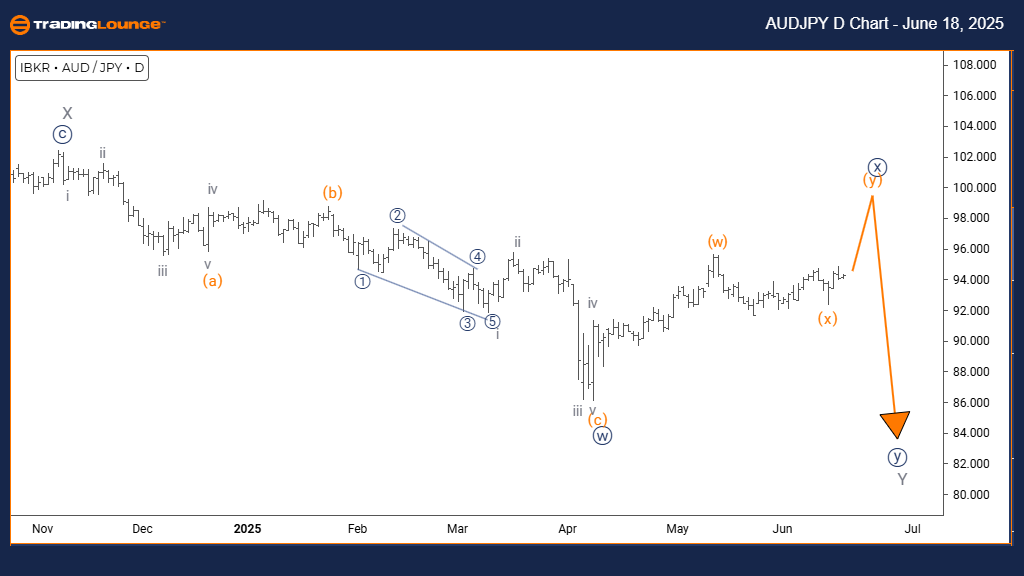

Australian Dollar / Japanese Yen (AUDJPY) 4-Hour Chart

AUDJPY Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Impulsive

STRUCTURE: Orange Wave Y

POSITION: Navy Blue Wave X

DIRECTION NEXT HIGHER DEGREES: Orange Wave Y (Initiated)

DETAILS: Orange Wave X seems complete; now Orange Wave Y under Navy Blue Wave X is underway.

The 4-hour chart Elliott Wave analysis for AUDJPY continues to show a counter-trend structure. The price action is impulsive, indicating robust movement against the higher-degree trend. This is characterized by Orange Wave Y, which forms a component of the ongoing Navy Blue Wave X correction.

Completion of Orange Wave X marks the beginning of Orange Wave Y, which is likely to unfold as a zigzag or corrective pattern. This wave is essential to watch as it shapes the near-term outlook within the broader corrective context.

According to this short-term Elliott Wave outlook for AUDJPY, the pair is expected to sustain counter-trend behavior. Although momentum is currently strong, this move fits into the corrective narrative, not signaling any long-term bullish or bearish shift.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: GBPUSD Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support