Elliott Wave Analysis: Chevron Inc. (CVX) - Current Trend Insights

This analysis examines Chevron Inc. (CVX) using the Elliott Wave Theory on both the daily and 1-hour charts. Below is a detailed breakdown of the stock’s current position and potential movements based on this methodology.

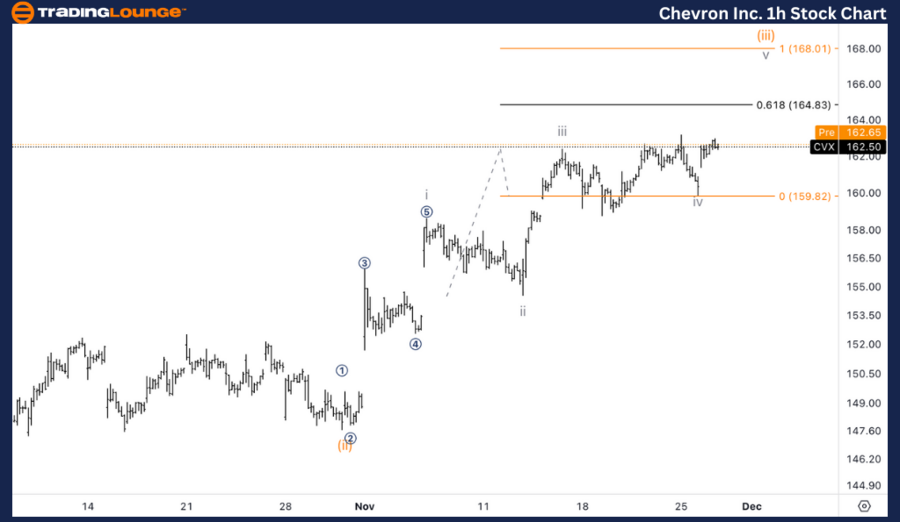

CVX Elliott Wave Analysis: Trading Lounge Daily Chart

Chevron Inc. (CVX) Daily Chart

CVX Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minute {iii}

Direction: Upside within {iii}

Details: The analysis suggests further upside potential into wave {iii}. Currently, we appear to lack the subdivisions of waves (iii) and (iv) within {iii}, which points to a continuation of the upward trend. The wave structure indicates a target near $200, marking the expected completion of wave {iii}.

CVX Elliott Wave Technical Analysis – Daily Chart

Chevron Inc. (CVX) continues to progress within minute wave {iii} of a larger impulsive structure. Missing subdivisions for waves (iii) and (iv) within wave {iii} indicate potential for additional extensions higher. The upward trajectory is forecasted to reach $200, which aligns with the probable completion of wave {iii}.

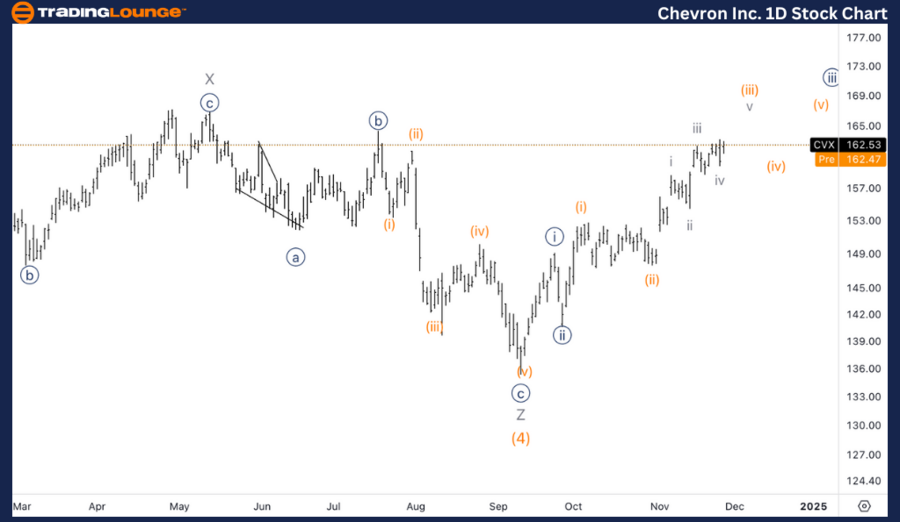

CVX Elliott Wave Analysis: TradingLounge 1-Hour Chart

Chevron Inc. (CVX) 1-Hour Chart

CVX Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (iii) of {iii}

Direction: Upside in wave v of (iii)

Details:

Chevron appears to be advancing into wave v of (iii). Since wave iii is shorter than wave i, wave v is expected to be constrained, with a maximum target near $168 based on equality with earlier wave structures.

CVX Elliott Wave Technical Analysis – 1-Hour Chart

On the 1-hour chart, Chevron is moving within wave v of (iii). Given that wave iii is shorter than wave i, wave v must also remain shorter than wave iii. This projection limits the target for wave v to $168, signaling a measured upward progression as wave {iii} nears its completion.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Fortinet Inc. (FTNT) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support