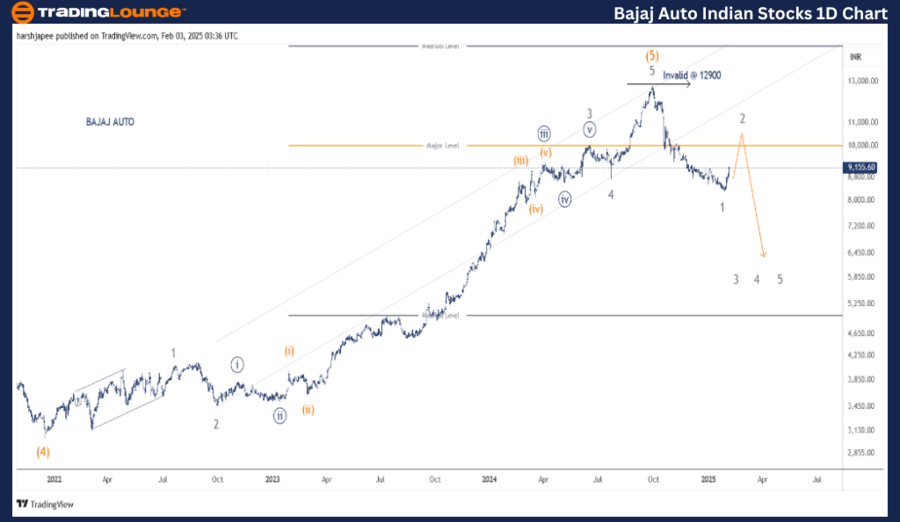

BAJAJ AUTO Elliott Wave Technical Analysis - (1D Chart)

BAJAJAUTO Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree, Grey)

Mode: Corrective

Structure: Impulse within a larger corrective structure

Position: Minor Wave 2 (Grey)

Details: Minor Wave 2 appears to be unfolding near the 10,000 mark.

Invalidation Point: 12,900

BAJAJ AUTO Daily Chart: Elliott Wave Analysis and Key Levels

The BAJAJ AUTO daily chart indicates a significant top around the 12,900 mark. The stock has declined impulsively, breaking below 8,400, marking the completion of Wave 1. It is currently undergoing a corrective phase towards the 10,000 level before a potential bearish resumption.

In December 2021, the stock dropped to 3,030, completing Intermediate Wave (4) Orange. The subsequent rally was impulsive, subdividing into five waves at the Minor degree, reaching the 12,900 mark.

Now, the price action suggests a larger-degree correction from the 12,900 highs. The sub-waves indicate that Minor Wave 1 completed near 8,400, while Minor Wave 2 is developing towards 10,000. If this scenario holds, Wave 3 may resume lower soon.

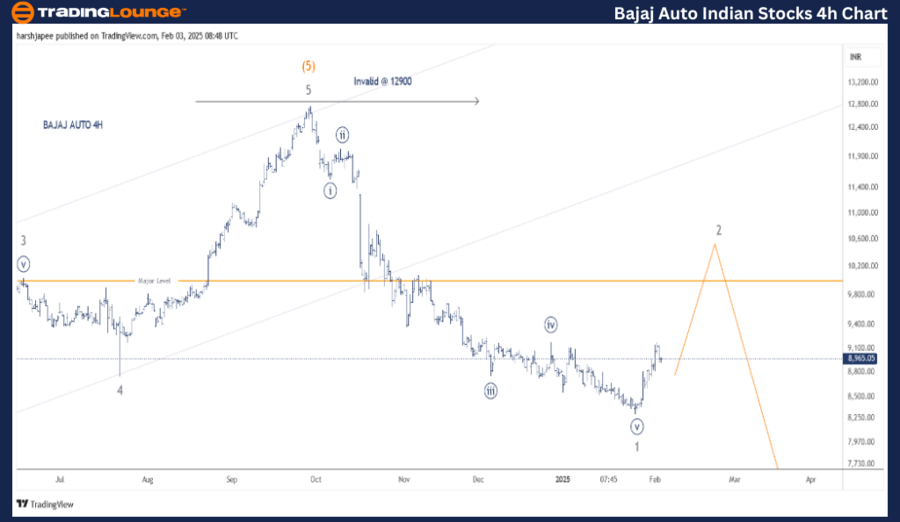

BAJAJ AUTO – BAJAJAUTO (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree, Grey)

Mode: Corrective

Structure: Impulse within a larger corrective structure

Position: Minor Wave 2 (Grey)

Details: Minor Wave 1 was an impulse subdividing into five waves at Minute Degree, terminating near 8,345. Minor Wave 2 is now progressing towards 10,000.

Invalidation Point: 12,900

BAJAJ AUTO 4H Chart: Elliott Wave Analysis and Key Levels

The 4-hour chart highlights price action following Minor Wave 3 of the broader trend, which ended near 10,070. Subsequently, Minor Wave 4 found support around 8,775 in July 2024, before an impulsive Wave 5 pushed the stock to 12,900, marking a potential top.

The price has since dropped in an impulsive Wave 1, completing just below 8,400. The current movement suggests a corrective Wave 2, retracing towards 10,000 before Wave 3 resumes the downward trend.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: GRASIM INDUSTRIES Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

BAJAJ AUTO is currently forming Minor Wave 2, likely advancing towards 10,000, before resuming its downward trend. The invalidation level remains at 12,900. If this structure holds, Wave 3 may soon push the stock lower.