Welcome to Our Latest Elliott Wave Analysis for Visa Inc. (V)

This analysis offers an in-depth examination of Visa's price movements through the lens of Elliott Wave Theory. Our goal is to help traders identify potential opportunities by analyzing current trends and market structures. We will cover insights from both the daily and 4-hour charts to provide a comprehensive view of Visa's market behavior.

V Elliott Wave Analysis Trading Lounge Daily Chart

Visa Inc. (V) Daily Chart Analysis

Visa Stock Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave 1

DIRECTION: Upside in wave 1

DETAILS: We are looking for a bottom in wave (4) to be in place after what appears to be a clear three-wave move. This move reached the equality of wave C versus wave A, which is a common target for wave C.

V Elliott Wave Technical Analysis – Daily Chart

The daily chart suggests that a bottom in wave (4) might be in place, following a clear three-wave corrective move. This move reached the equality of wave C versus wave A, which is a common target for wave C. With wave (4) potentially complete, we anticipate the start of wave 1's upside movement.

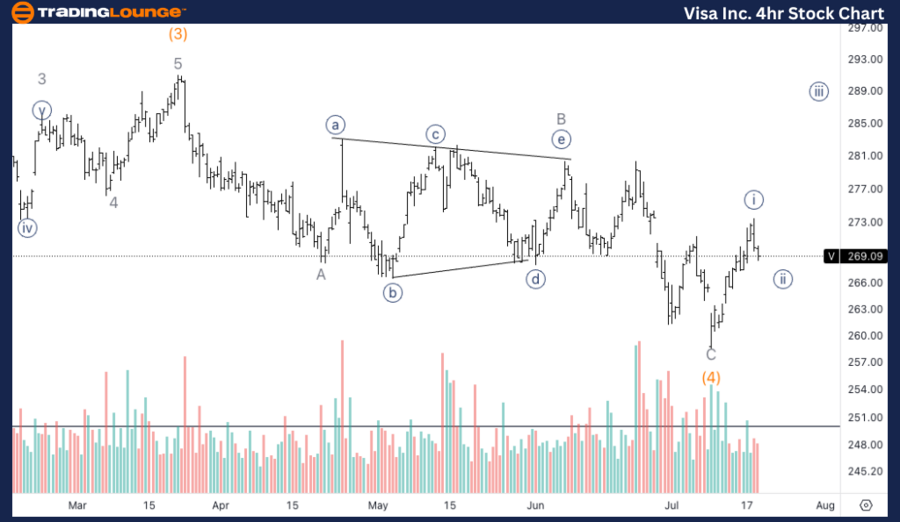

V Elliott Wave Analysis Trading Lounge 4Hr Chart

Visa Inc. (V) 4Hr Chart Analysis

V Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave {i} of 1

DIRECTION: Upside in wave {iii}

DETAILS: We are looking for a clear five-wave move into Minor wave 1 to break the $280 level and provide additional upside confirmation.

V Elliott Wave Analysis – 4Hr Chart

The 4-hour chart indicates that we are looking for a clear five-wave move into Minor wave 1. Breaking above the $280 level will provide additional upside confirmation and signal the continuation of wave {iii} of 1. Traders should monitor the price action closely for this breakout to validate the bullish scenario.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Advanced Micro Devices Inc. (AMD) Ellott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support