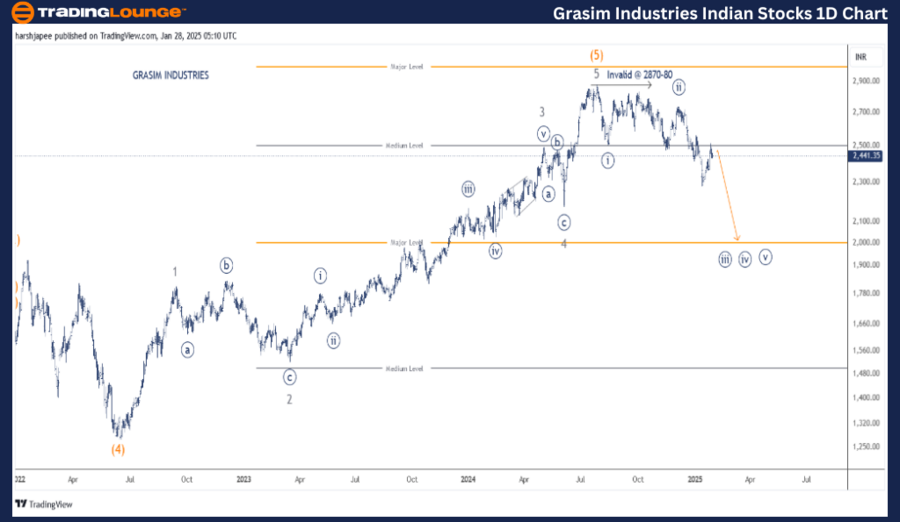

GRASIM INDUSTRIES – GRASIM Elliott Wave Analysis (1D Chart)

GRASIM 1D Chart Analysis

Grasim Industries Elliott Wave Technical Analysis

Function: Counter Trend Lower (Minor Degree Grey)

Mode: Corrective

Structure: Potential Zigzag or Impulse within Larger Degree Correction

Position: Minute Wave ((iii)) Navy

Details: A larger degree correction might be underway against the 2880 resistance level.

- An interim low has been established near 2300 as the price pulls back.

- Resistance is expected at the 2500–2600 range, providing a potential entry point for bearish momentum.

Invalidation Point: 2880

GRASIM Daily Chart Technical Analysis and Potential Elliott Wave Counts

The daily chart of GRASIM suggests a significant top formed around 2880 in July 2024, completing Intermediate Wave (5) Orange. Following this, the stock appears to be moving lower in an impulse wave of Minute degree.

- Wave ((i)) and Wave ((ii)) are identified near 2510 and 2740, respectively.

- Currently, the stock seems to be in Minute Wave ((iii)), potentially an extension wave.

For bearish dominance:

- Prices should remain below the 2740 resistance level.

- Alternate Scenario: A corrective phase might have ended around 2275, allowing bulls to regain control.

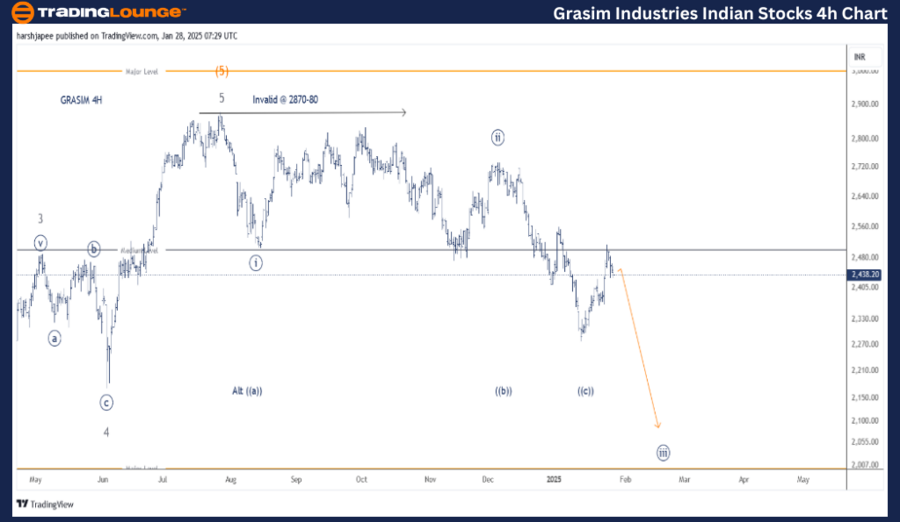

GRASIM INDUSTRIES – GRASIM Elliott Wave Analysis (4H Chart)

Function: Counter Trend Lower (Minor Degree Grey)

Mode: Corrective

Structure: Potential Zigzag or Impulse within Larger Degree Correction

Position: Minute Wave ((iii)) Navy

Details: A larger degree correction could be forming against the 2880 resistance level.

- An interim low was formed around 2300, with a price pullback underway.

- Resistance near the 2500–2600 range remains a critical zone for bearish reentry.

- Minute Wave ((iii)) is potentially progressing lower.

Invalidation Point: 2880

GRASIM 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4H chart of GRASIM highlights subwaves within Minor Wave 3 Grey, which ended at 2487 in May 2024. Minor Wave 4 unfolded as a sharp zigzag, concluding around 2180 in June 2024. Wave 5 then surged to 2880, completing Intermediate Wave (5) Orange.

The subsequent price action:

- A move towards 2275 formed in three waves, which could either develop as an impulse or an ((a))-((b))-((c)) correction.

- Bears may push prices lower toward 2175, coinciding with Wave 4 of one lesser degree.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: AXIS BANK LTD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

GRASIM is moving lower in Minute Wave ((iii)), targeting levels below 2175. Alternatively, a corrective decline may have concluded around 2275, opening opportunities for bullish momentum.