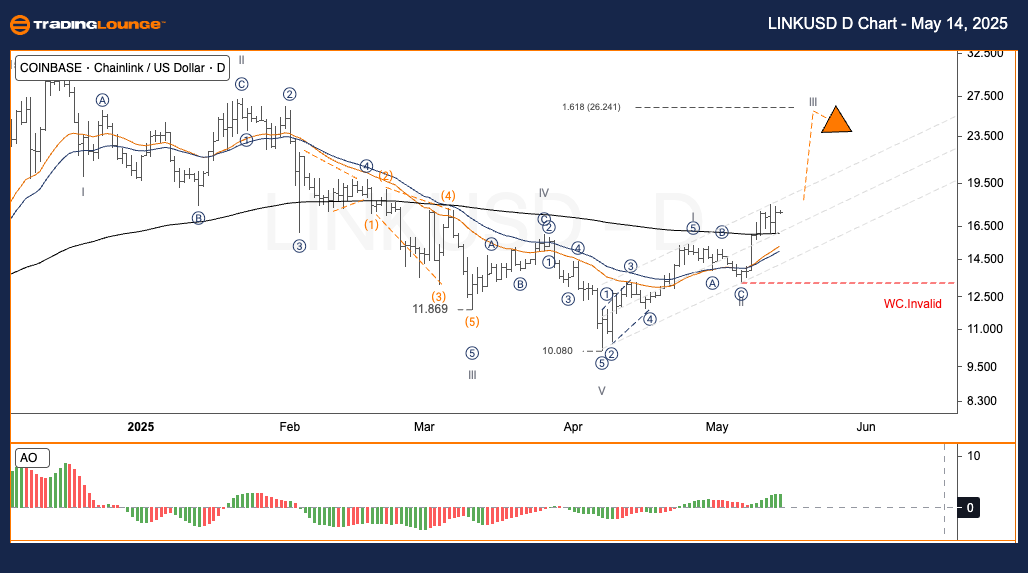

LINKUSD Elliott Wave Analysis – TradingLounge Daily Chart

Chainlink / U.S. Dollar (LINKUSD) Daily Chart Analysis

LINKUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Direction Next Higher Degrees:

Wave Cancel Invalid Level: $13.00

Chainlink (LINKUSD) Daily Chart Strategy – Elliott Wave Outlook

After completing wave II with a defined ABC corrective structure and maintaining key support levels, Chainlink (LINK) displays upward momentum. This price rebound signals the potential initiation of wave III, typically the most powerful move in the Elliott Wave cycle. Based on a Fibonacci extension of wave I, wave III could target the $26.24 level, aligning with a 1.618 extension. Holding above the midpoint of the price channel enhances the likelihood of reaching or exceeding this target.

The crucial invalidation threshold remains at $13.00. A drop below this price level invalidates the current Elliott Wave count and requires re-evaluation.

Trading Strategy – Daily Chart

Approach:

✅ Swing Traders:

Monitor the $15–$16 range for potential entry points, which could represent wave 2 of the developing wave III structure.

Risk Management:

🟥 A move below $13.00 nullifies the current wave setup and suggests a need for recalculating the count.

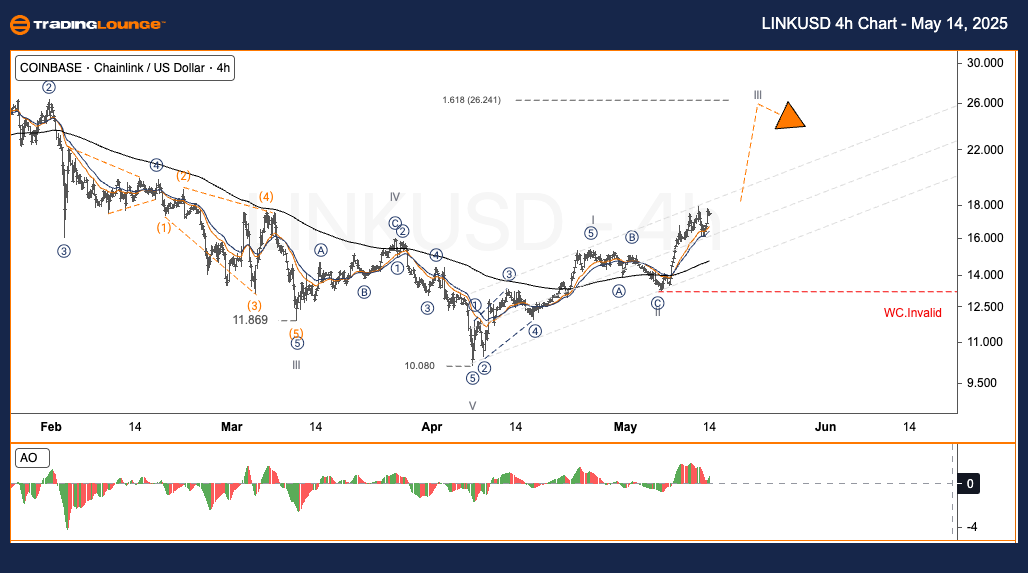

LINKUSD Elliott Wave Analysis – TradingLounge H4 Chart

Chainlink / U.S. Dollar (LINKUSD) 4-Hour Chart Analysis

LINKUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Direction Next Higher Degrees:

Wave Cancel Invalid Level: $13.00

Chainlink (LINKUSD) H4 Chart Strategy – Technical Elliott Wave Forecast

LINK completed its wave II correction and has stayed above crucial support levels. This resilience suggests the potential beginning of wave III, typically the most dynamic leg in a five-wave sequence. Should wave III reach a 1.618 extension of wave I, the price target stands at $26.24. Maintaining levels above the mid-channel increases the odds of achieving this projection.

The invalidation line for the current wave structure remains firm at $13.00. A breach below this level would invalidate the Elliott count.

Trading Strategy – H4 Chart

Approach:

✅ Swing Traders:

A pullback toward the $15–$16 zone may present a strategic entry aligned with wave 2 of III.

Risk Management:

🟥 A fall beneath $13.00 marks the wave structure invalid, requiring a new wave count.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: ETHUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support