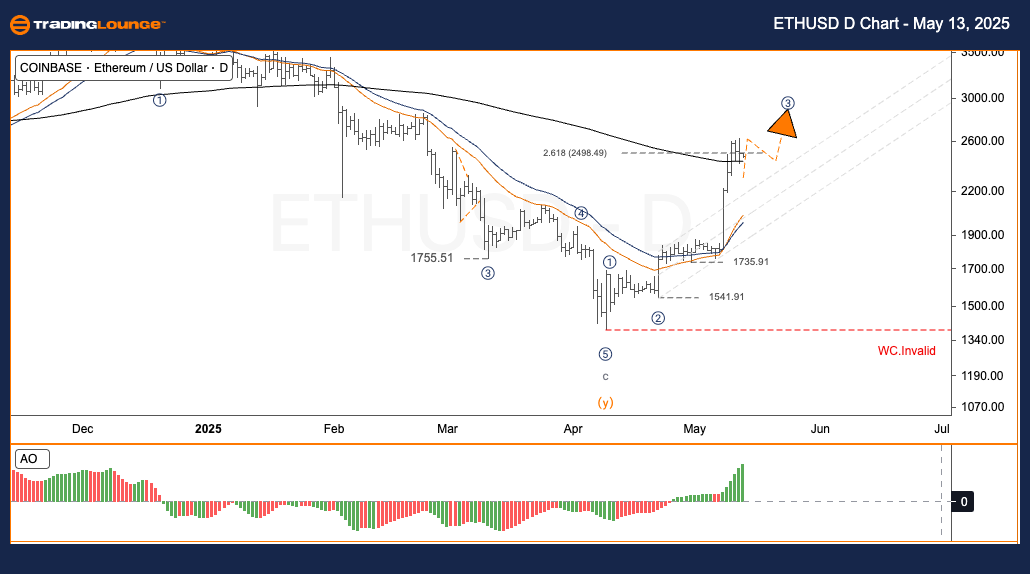

ETHUSD Elliott Wave Analysis | TradingLounge Daily Chart

Ethereum to USD (ETHUSD) Daily Chart Analysis

ETHUSD Elliott Wave Technical Outlook

Function: Trend Continuation

Mode: Motive Phase

Wave Structure: Impulse

Current Position: Wave 3

Next Higher Degree Trend Direction: Uptrend

Invalidation Level for Wave Count: N/A

Ethereum (ETHUSD) Daily Trading Strategy – Elliott Wave Forecast

Ethereum continues progressing through Wave (3), with potential for consolidation before Wave (5) initiates. Targets remain above $3,000.

After bottoming near $1,541 in Wave (2) with a classic ABC corrective structure, Ethereum surged beyond $2,600, confirming a strong impulsive move into Wave (3). Price action now indicates that the Wave (3) advance is maturing, setting the stage for a sideways consolidation. This will likely precede the emergence of Wave (5), pushing prices higher in alignment with the broader trend.

Trading Strategy for ETHUSD

✅ Swing Trading Strategy (Short-Term):

- Monitor ETH price behavior closely as it approaches the $2,290 to $2,300 zone.

- Look for bullish reversal setups such as bullish engulfing candles or long lower wicks signaling buyer interest.

- Use these technical cues as potential entries for a long position in anticipation of Wave (5).

🟥 Risk Management Guidelines:

- Set stop-loss orders just below $2,250 to manage downside risk.

- Place take-profit targets above $3,000 to align with the completion of Wave (5).

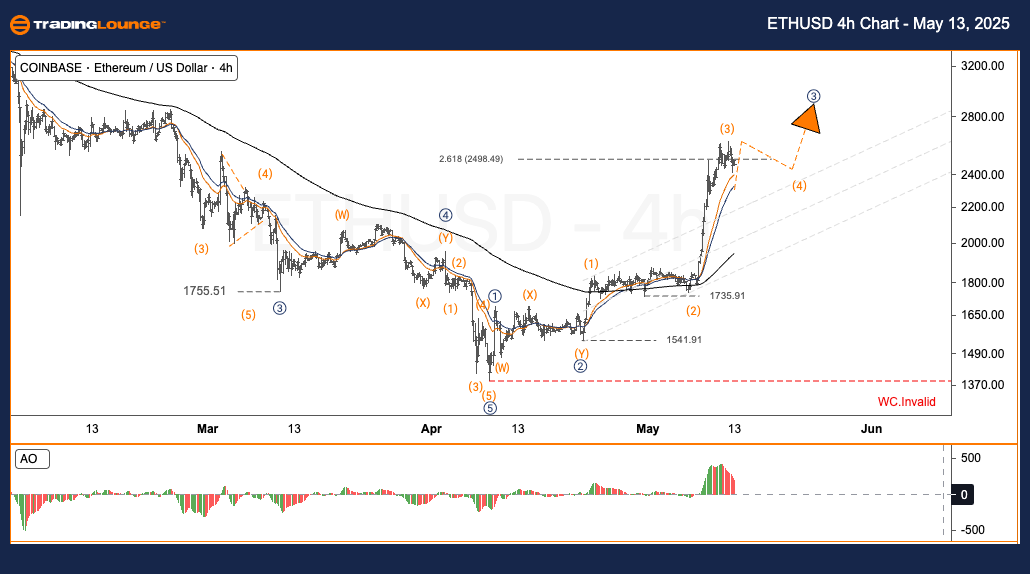

ETHUSD Elliott Wave Analysis | TradingLounge 4-Hour Chart

Ethereum to USD (ETHUSD) 4-Hour Chart Analysis

ETHUSD Elliott Wave Technical Outlook

Function: Trend Continuation

Mode: Motive Phase

Wave Structure: Impulse

Current Position: Wave 3

Next Higher Degree Trend Direction: Uptrend

Invalidation Level for Wave Count: N/A

Ethereum (ETHUSD) 4-Hour Trading Strategy – Wave Analysis Update

Ethereum continues its upward Wave (3) rally, signaling a likely pause before Wave (5) drives the next bullish leg. Price targets remain above $3,000.

Following the completion of a corrective ABC Wave (2) at the $1,541 low, ETHUSD rallied past $2,600, initiating a strong Wave (3) surge. This current wave phase is nearing exhaustion, with indicators pointing to a likely consolidation period. The setup favors a bullish continuation pattern that will precede Wave (5).

Short-Term Trading Strategy for ETH

✅ Strategy (Swing Traders):

- Observe Ethereum’s movement near $2,290–$2,300.

- Identify bullish setups such as engulfing candles or wick rejections at support for possible long entries.

- Prepare for a resumption of the upward move in Wave (5).

🟥 Manage Risk Effectively:

- Place a protective stop-loss under $2,250.

- Target gains above $3,000 in line with the Wave (5) outlook.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: THETAUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support