ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis

Greetings, today's Elliott Wave analysis focuses on CAR GROUP LIMITED (ASX:CAR).

We believe ASX:CAR has likely completed a corrective wave, identified as wave (4) orange, forming a Zigzag pattern. This signals the potential start of a bullish phase. Below is our technical breakdown, including key levels to confirm or invalidate the outlook.

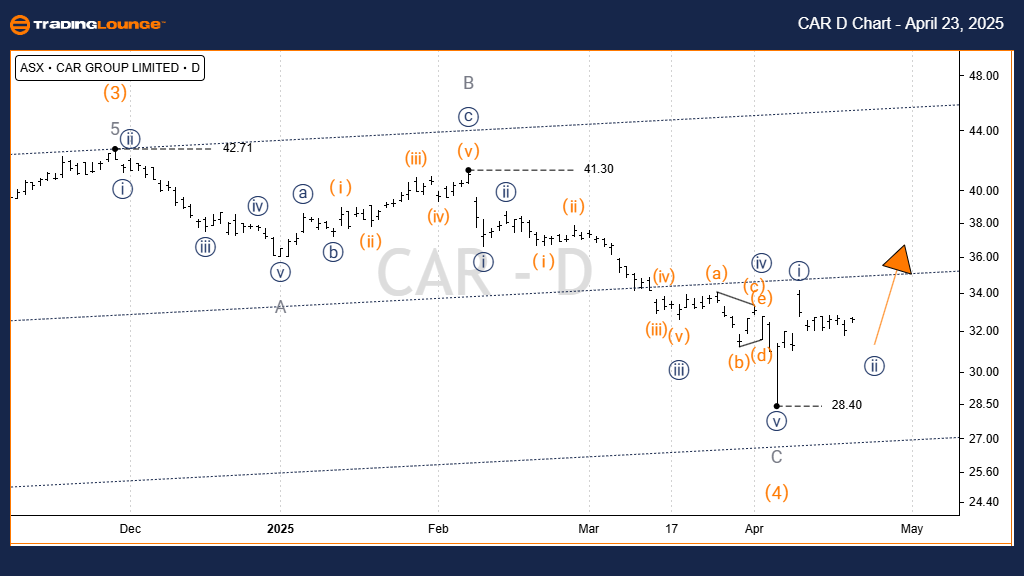

ASX: CAR GROUP LIMITED CAR Elliott Wave Analysis – TradingLounge 1d Chart

CAR GROUP LIMITED 1d Chart (Semilog Scale) Analysis

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave ii)) navy of Wave (5) orange

Details:

Wave (4) orange appears to have ended near 28.40, completing an A-B-C Zigzag correction in grey. The C wave unfolded in a clear five-wave sequence, supporting this conclusion. Following this, wave (5) orange is unfolding upward. Wave i)) navy is already complete, and the market is currently forming wave ii)) navy, which is experiencing a minor pullback. Once wave ii)) finalizes, wave iii)) navy is expected to drive prices higher in a bullish continuation.

Invalidation Point: 28.40 – A drop below this level would invalidate the bullish wave structure.

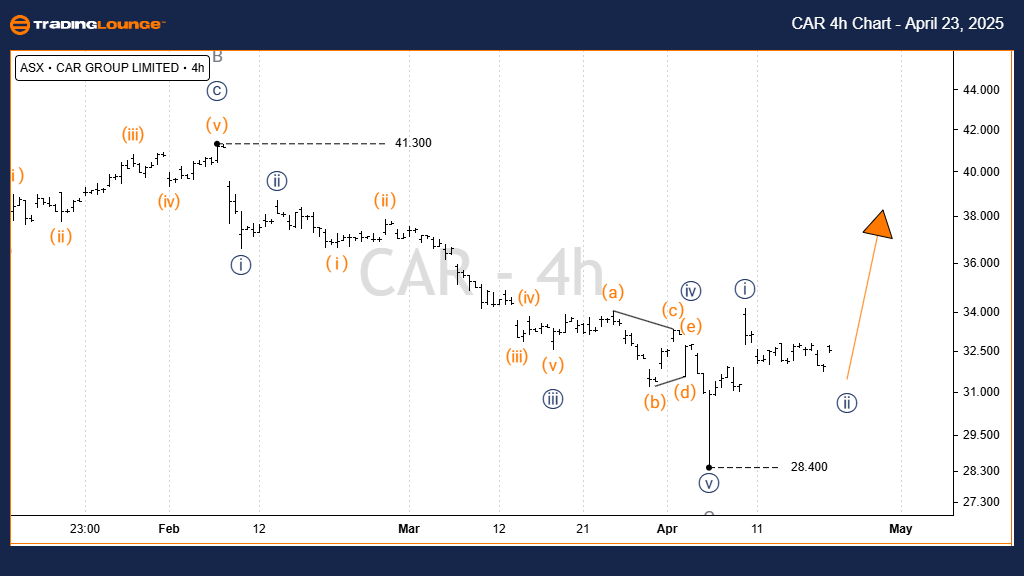

ASX: CAR GROUP LIMITED CAR Elliott Wave Analysis – TradingLounge 4H Chart

CAR GROUP LIMITED 4-Hour Chart Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((ii)) navy of Wave (5) orange

Details:

After rebounding from the 28.40 low, wave i)) navy completed successfully. We’re now in the midst of wave ii)) navy, which still shows downside potential. Once this pullback completes, we anticipate wave iii)) navy to resume the uptrend—potentially targeting a retest of the 41.30 level.

Invalidation Point: 28.40 – A break below this level nullifies the current bullish count.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: COMPUTERSHARE LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave forecast for CAR GROUP LIMITED (ASX:CAR) offers clear directional bias and strategic trade planning. With defined invalidation points and wave structure clarity, traders gain a reliable framework for interpreting current price action and projecting future moves. Stay tuned for updates as this trend develops.