ASX: BLOCK, INC – XYZ (SQ2) Elliott Wave Technical Analysis

Greetings,

Our latest Elliott Wave analysis for ASX: BLOCK, INC – XYZ (SQ2) highlights a potential bullish setup. This Australian stock is showing signs of advancing in wave (3) - orange, provided the price stays above the key invalidation level for 5–7 days.

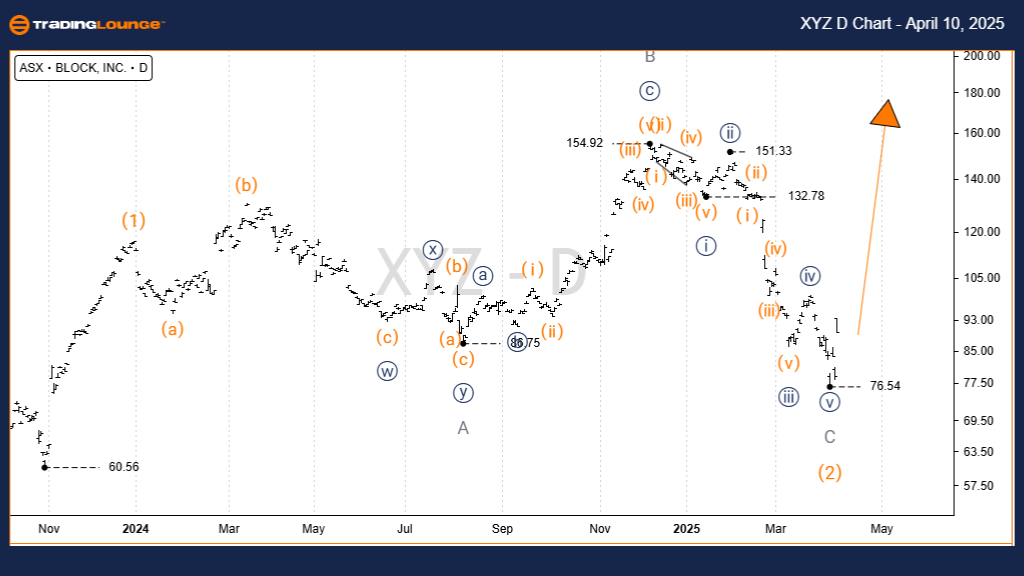

ASX: BLOCK, INC – XYZ (SQ2) Stock - TradingLounge - 1D Chart (Semilog Scale)

ASX: BLOCK, INC – XYZ (SQ2) Elliott Wave Forecast TradingLounge -1D Chart (Semilog Scale) Analysis

Function: Major Trend (Intermediate Degree – Orange)

Mode: Motive

Structure: Impulse

Position: Wave (3) – Orange

Technical Insight:

Wave (2) – orange may have completed, and wave (3) – orange is unfolding to the upside. Sustaining above the 76.54 invalidation level for the next several sessions would confirm bullish continuation and strengthen the wave count.

Key Level – Invalidation Point: 76.54

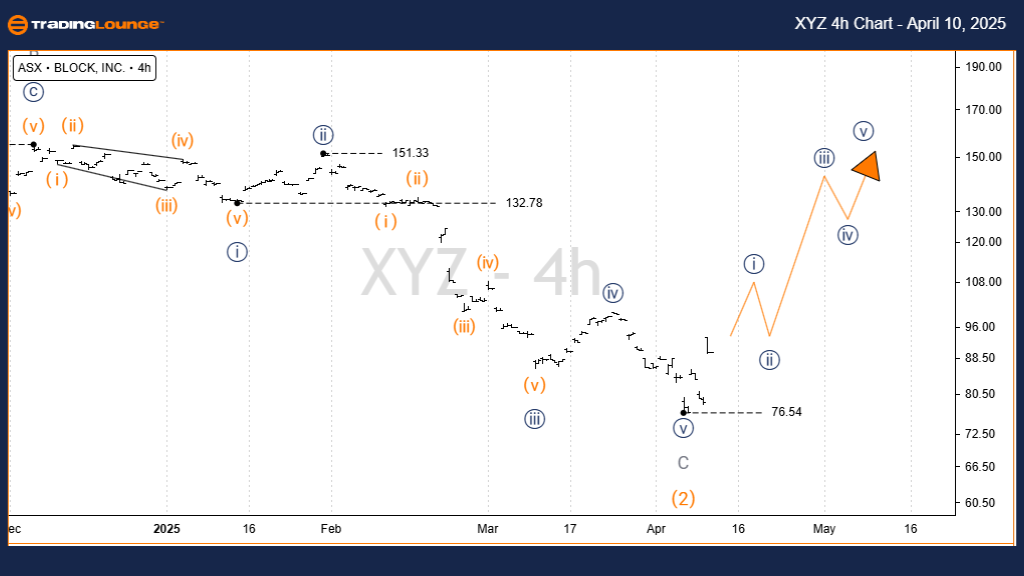

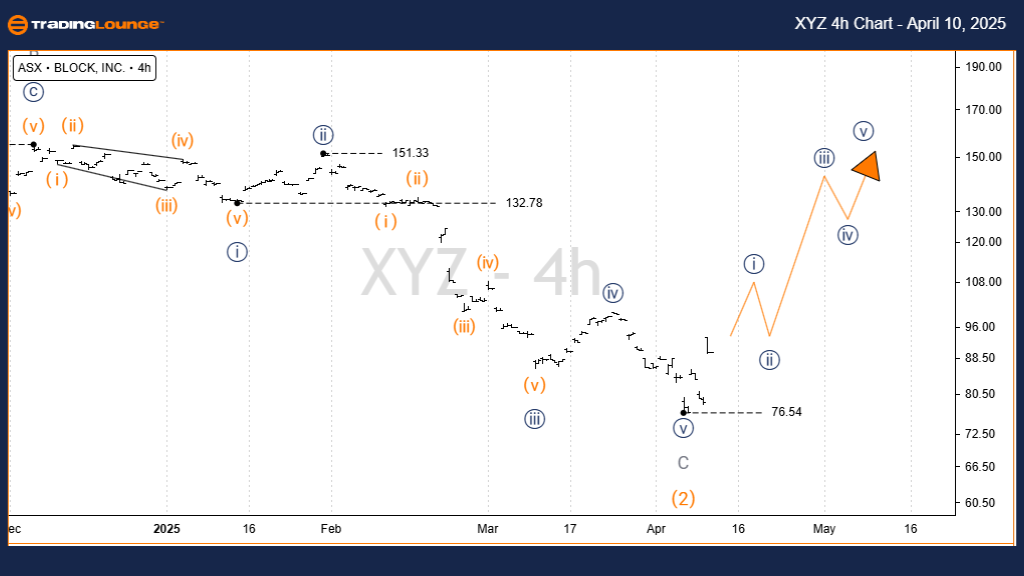

ASX: BLOCK, INC – XYZ (SQ2) Elliott Wave Analysis TradingLounge 4-Hour Chart

ASX: BLOCK, INC – XYZ (SQ2) Intraday Elliott Wave Analysis 4-Hour Chart

Function: Major Trend (Minute Degree – Orange)

Mode: Motive

Structure: Impulse

Position: Wave ((I)) – Navy of Wave (3) – Orange

Technical Insight:

From the low at 76.54, wave (3) – orange appears to be extending through the smaller wave sequence ((i)) to ((v)) navy. Current short-term momentum is positive, supported by prices holding above 76.54.

Key Level – Invalidation Point: 76.54

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave forecast for ASX: BLOCK, INC – XYZ (SQ2) offers a multi-timeframe analysis with intermediate and intraday wave counts. Identifying trend structures and critical support levels enables traders to stay aligned with the market direction. For accurate and actionable stock analysis, rely on TradingLounge’s expert wave counts and professional guidance.