ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis TradingLounge

Greetings,

This updated Elliott Wave analysis highlights the latest outlook on CAR GROUP LIMITED (ASX: CAR). Our review indicates that CAR stock may have completed corrective Wave (4) in orange, forming a Zigzag pattern. This could signal the start of a new bullish phase. Below is a concise projection with important trend targets and key invalidation levels.

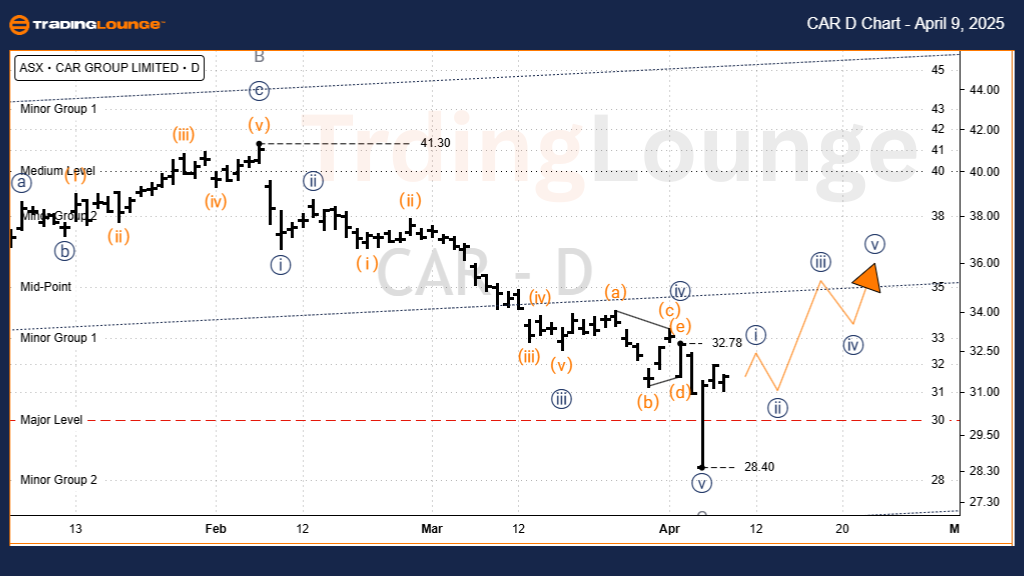

ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave (5) – Orange

Details:

Wave (4) – orange likely started after the swing high near 42.71 AUD and bottomed at 28.40 AUD, forming a classic A-B-C Zigzag correction (grey labels). Sub-wave C – grey’s wave I displayed five distinct sub-waves, suggesting its conclusion. This raises the probability that Wave (5) – orange is now in progress. Additionally, a confirmed breakout above 32.78 AUD enhances the bullish sentiment.

Invalidation Point: 28.40 AUD (Dropping below this price level invalidates the current wave setup.)

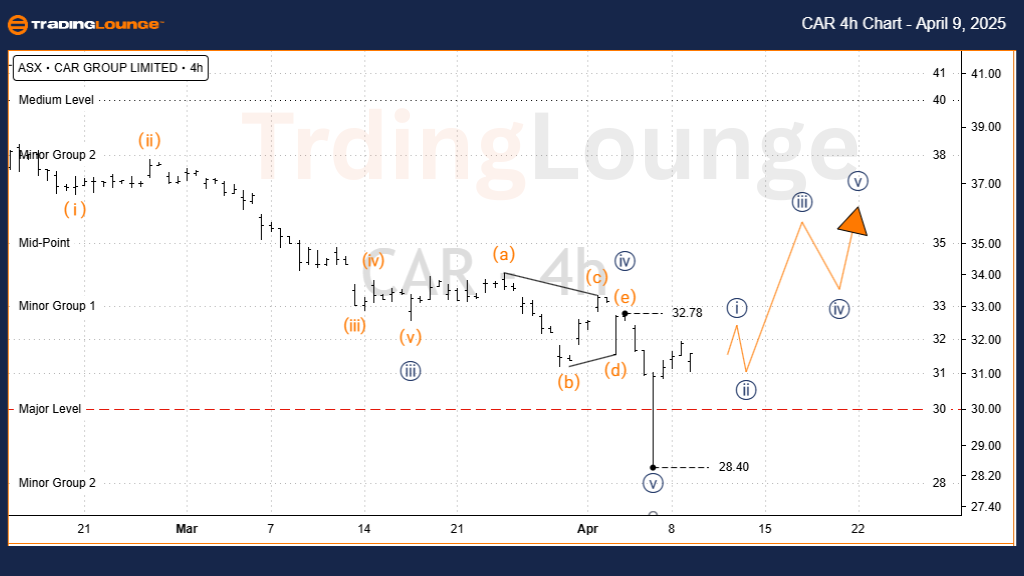

ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis 4-Hour Chart Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave ((i)) – Navy of Wave (5) – Orange

Details:

Since reaching the 28.40 AUD low, Wave (5) – orange is seemingly progressing higher. Wave ((i)) – navy is nearing finalization. A retracement within Wave ((ii)) – navy is expected, potentially offering a favorable entry point for long trades, aiming toward Wave ((iii)) – navy. Sustained momentum above 32.78 AUD continues to support the bullish forecast.

Invalidation Point: 28.40 AUD (A price decline below this point would invalidate the bullish scenario.)

Conclusion:

This Elliott Wave outlook delivers mid-term and short-term trend analysis for ASX: CAR GROUP LIMITED (CAR stock). With key price projections and invalidation thresholds, this analysis is designed to help traders assess CAR's potential movement with clarity and precision. The objective is to offer structured, insightful market intelligence for strategic trading decisions.