ASX: WESFARMERS LIMITED (WES) Elliott Wave Technical Analysis – TradingLounge

Overview

Welcome to today's Elliott Wave analysis of Wesfarmers Limited (ASX: WES). Our technical outlook evaluates the stock's ongoing trend based on Elliott Wave principles.

Currently, ASX: WES remains in a corrective phase, showing no immediate signs of bullish momentum. The stock is in a larger downtrend, forming a significant corrective wave.

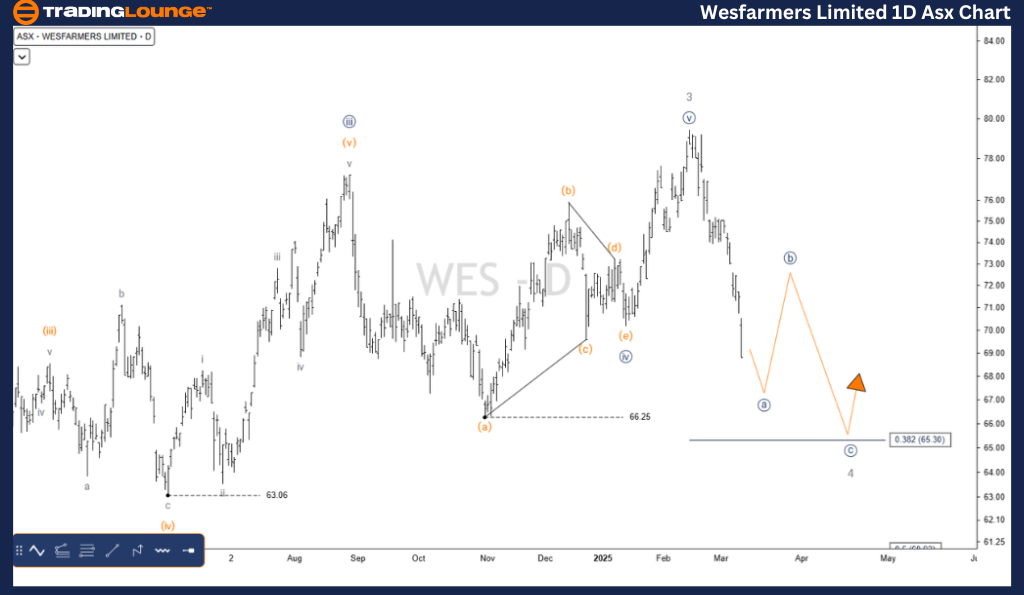

ASX: WESFARMERS LIMITED (WES) Elliott Wave Technical Analysis – 1D Chart (Semilog Scale)

WESFARMERS LIMITED Stock 1D Chart Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave 4 - Grey of Wave (3) - Orange

WES Stock Technical Details:

Wave 3 - Grey has completed, and Wave 4 - Grey is currently unfolding with further downside expected.

The next support target is around 65.30, aligning with the corrective structure.

Given the price movement's sharpness, Wave 4 - Grey is forming a Zigzag pattern labeled ((a))((b))((c)) - Navy.

Wave ((c)) - Navy is still progressing downward, suggesting further declines before a potential reversal.

Invalidation Level: If prices exceed 79.43, our current Elliott Wave count would be invalidated.

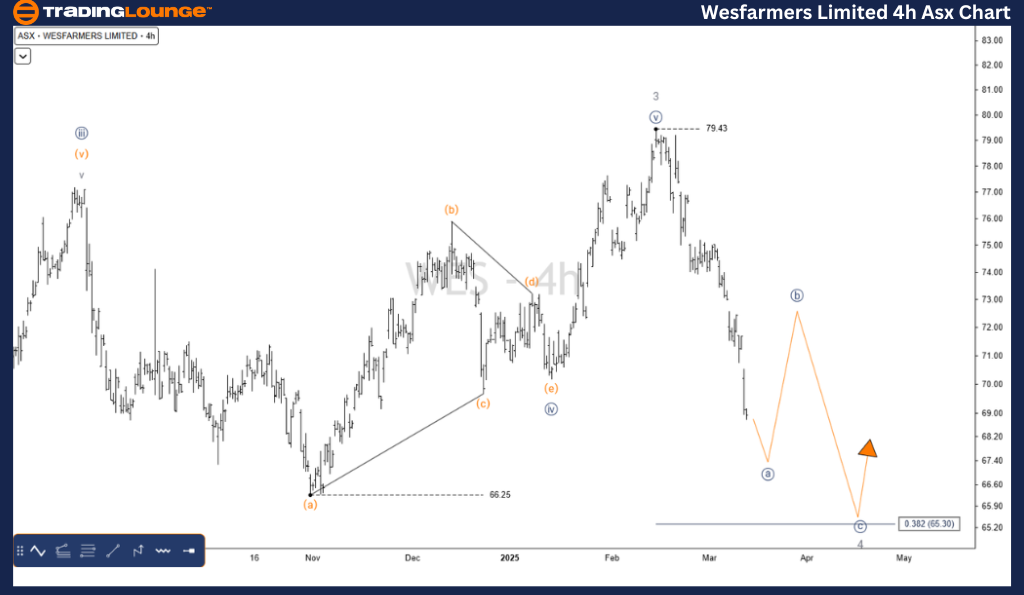

ASX: WESFARMERS LIMITED (WES) Elliott Wave Analysis – 4-Hour Chart (TradingLounge)

Wesfarmers Stock 4-Hour Chart Analysis

Function: Major Trend (Minute Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave ((a)) - Navy of Wave 4 - Grey

Wesfarmers Technical Details:

Wave ((a)) - Navy is nearing completion, with a short-term bounce expected in Wave ((b)) - Navy before the downtrend resumes.

The next resistance level to monitor is around 73.00 - 75.00, where sellers may regain control.

Invalidation Level: If prices exceed 79.43, the wave count would be invalid.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous:FISHER & PAYKEL HEALTHCARE CORPORATION Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave forecast for ASX: WESFARMERS LIMITED (WES) highlights critical price levels and trend movements, offering traders a structured approach to market analysis.

We identify key support and resistance levels based on the wave count.

The ongoing Wave 4 correction remains in progress, with further downside before any possible reversal.

Traders should monitor Wave ((b)) - Navy’s potential bounce, followed by renewed bearish pressure.

By integrating Elliott Wave analysis with price action strategies, this forecast provides a technical roadmap for traders, helping them make more informed decisions.