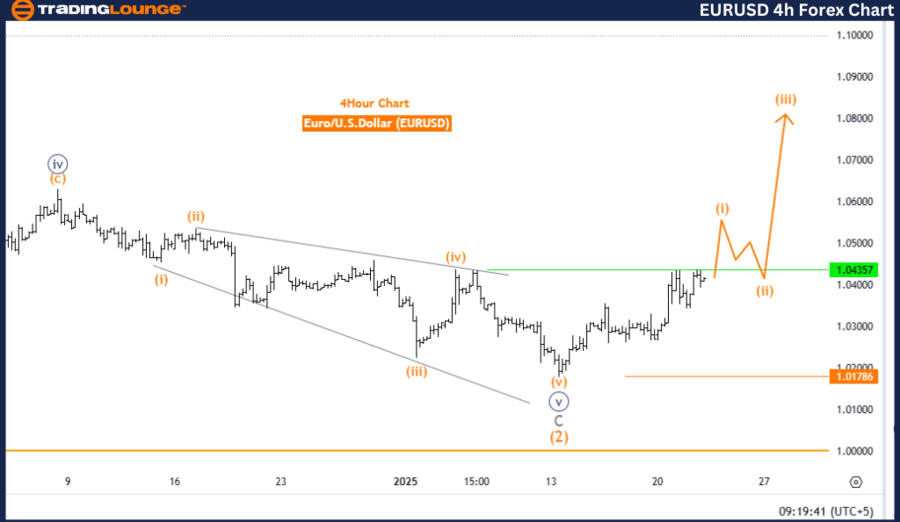

Euro/ U.S. Dollar (EURUSD) – Daily Chart Analysis

EURUSD Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 1

Position: Gray Wave 1

Direction (Next Lower Degrees): Navy Blue Wave 2

Details: Navy Blue Wave 1 within Gray Wave 1 indicates a new bullish trend in progress.

Wave Invalidation Level: 1.01786

This analysis delves into the EURUSD currency pair's daily chart through Elliott Wave Theory, highlighting an ongoing bullish trend within an impulsive phase. The focus is on the development of Navy Blue Wave 1, forming part of the larger Gray Wave 1, which signals the beginning of an upward movement in the market.

The active Navy Blue Wave 1, within the broader Gray Wave 1, demonstrates strong bullish momentum, suggesting the market is in the early stages of an extended uptrend. Next, the emergence of Navy Blue Wave 2 is expected, introducing a corrective phase within the prevailing bullish trend.

A critical wave invalidation level is set at 1.01786, which acts as a crucial reference point. If the price drops below this threshold, the current wave structure would be considered invalid, necessitating a reevaluation of the bullish outlook.

Key Takeaways:

- The analysis indicates a bullish trajectory for EURUSD, with Navy Blue Wave 1 strengthening within the broader Gray Wave 1 trend.

- The development of Navy Blue Wave 2 offers traders opportunities to assess corrections and plan strategic trade entries.

- This structured approach aids traders in aligning their strategies with the projected bullish movement, enhancing decision-making.

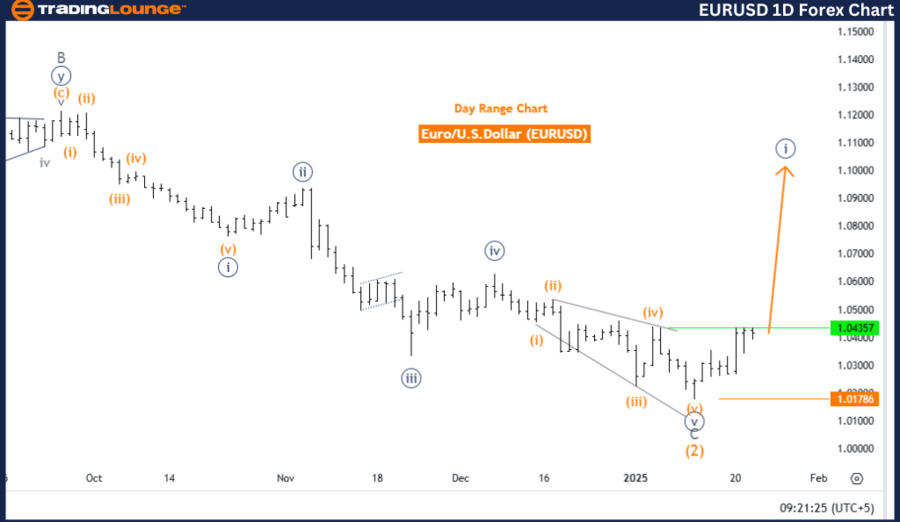

Euro/ U.S. Dollar (EURUSD) – 4-Hour Chart Analysis

EURUSD Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 1

Position: Navy Blue Wave 1

Direction (Next Lower Degrees): Orange Wave 2

Details: Orange Wave 1 within Navy Blue Wave 1 signals a new bullish trend in motion.

Wave Invalidation Level: 1.01786

This analysis assesses the EURUSD currency pair on the 4-hour chart based on Elliott Wave Theory, confirming a bullish trend with an impulsive wave structure. The focus is on the ongoing Orange Wave 1, which forms part of the larger Navy Blue Wave 1, indicating a fresh upward movement.

The presence of Orange Wave 1 within Navy Blue Wave 1 underlines a strong directional push. As per Elliott Wave principles, the expected formation of Orange Wave 2 should introduce a corrective phase, consolidating gains and offering potential entry opportunities for traders.

The critical wave invalidation level remains at 1.01786, serving as a key threshold. Any price decline below this level would necessitate a review and potential revision of the bullish scenario.

Key Takeaways:

- The analysis suggests a favorable outlook for EURUSD, emphasizing the strength of Orange Wave 1 within the broader Navy Blue Wave 1 structure.

- The expected emergence of Orange Wave 2 allows traders to monitor market corrections and strategize accordingly.

- Elliott Wave insights assist traders in understanding market movements and optimizing their trading strategies.

- This structured analysis equips traders with actionable insights to align with evolving market conditions.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: AUDJPY Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support