EURUSD Elliott Wave Analysis - Trading Lounge Daily Chart

Euro/ U.S. Dollar (EURUSD) Daily Chart Analysis

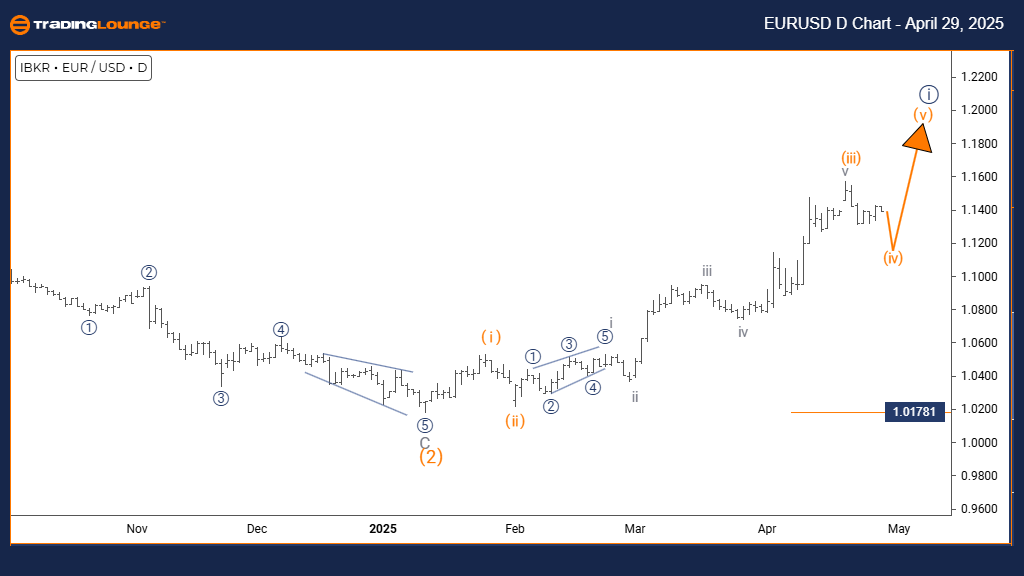

EURUSD Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Orange wave 4

POSITION: Navy blue wave 1

DIRECTION NEXT HIGHER DEGREES: Orange wave 5

DETAILS: Orange wave 3 appears complete; orange wave 4 correction unfolding.

Invalidation level: 1.01781

The EURUSD daily Elliott Wave analysis identifies a corrective wave 4 forming after the completion of orange wave 3, all within a larger bullish wave 1 (navy blue). This signals a near-term downward move in a broader uptrend.

Wave 4 corrections typically retrace 23%–38% of the prior wave 3 rally, suggesting a measured pullback with choppy price action and weakening momentum. This aligns with common corrective traits seen during counter-trend phases.

Following this pullback, the next bullish move — orange wave 5 — is expected to complete the current impulsive sequence. Traders should watch for support near 1.01781, as a break below this invalidation level would challenge the current wave count.

Technical traders are advised to monitor reversal setups and indicators like RSI or MACD divergence during this phase, as they may hint at the completion of wave 4 and the onset of wave 5.

This correction offers a strategic entry zone for the next rally. Watching Fibonacci levels and support zones will help identify optimal positioning before the next impulsive push higher.

Euro/ U.S. Dollar (EURUSD) Elliott Wave Analysis - TradingLounge 4-Hour Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Orange wave 4

POSITION: Navy blue wave 1

DIRECTION NEXT HIGHER DEGREES: Orange wave 5

DETAILS: Orange wave 3 completed; orange wave 4 correction in progress. Invalidation level: 1.01781

On the 4-hour chart, EURUSD displays a classic Elliott Wave correction as orange wave 4 unfolds within a larger bullish navy blue wave 1. The current phase signals a temporary decline before the next bullish leg.

Wave 4 corrections are generally shallow, with price overlapping and momentum fading — aligning with the typical corrective nature. This pause in the trend reflects consolidation before orange wave 5 begins.

The expected next move is orange wave 5 to the upside, which would finalize the impulsive structure. The key invalidation level remains 1.01781 — a critical threshold for wave count validation.

Traders should look for bullish reversal patterns and oversold momentum readings to anticipate the wave 5 advance. Tools like Fibonacci retracements and price action setups will aid in identifying low-risk long opportunities.

This short-term correction provides a valuable setup window. Attention to intraday support levels and market sentiment will help in capturing the final upward push in the current cycle.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: GBPAUD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support