ASX: NEWMONT CORPORATION (NEM) Elliott Wave Technical Analysis - TradingLounge

Greetings,

Today's Elliott Wave analysis focuses on Newmont Corporation (NEM) listed on the Australian Stock Exchange (ASX). The stock is currently in the final phase of a corrective wave, which could create a potential bullish trading opportunity for those monitoring ASX:NEM.

ASX: NEWMONT CORPORATION (NEM) Elliott Wave Technical Analysis

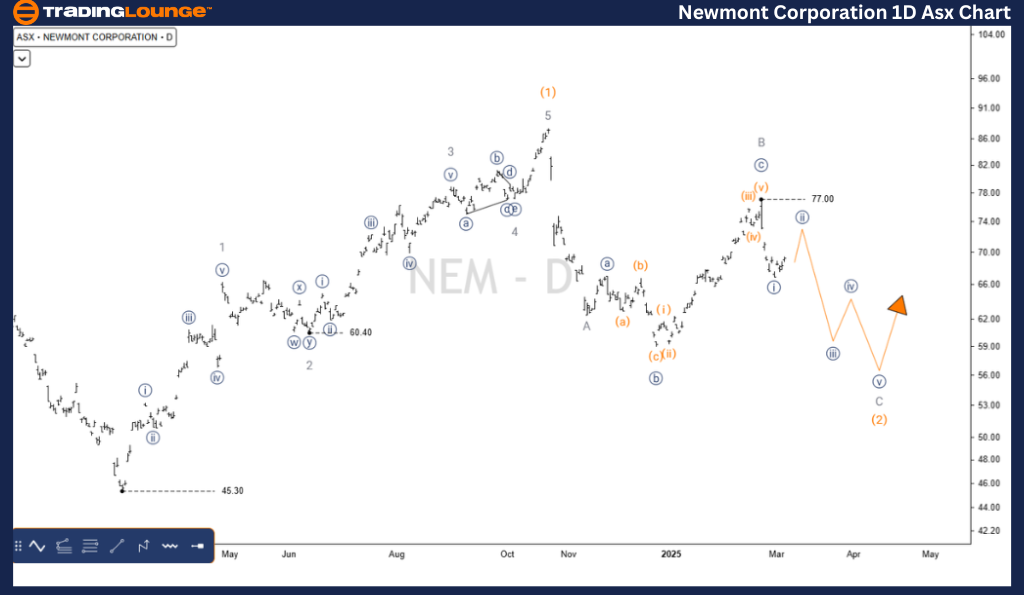

1D Chart (Semilog Scale) Analysis

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave C (Grey) of Wave (2) - Orange

Details:

- The Elliott Wave count has been refined to improve accuracy.

- Wave (2) - Orange continues its Zigzag formation (A-B-C, Grey), potentially extending longer than expected.

- Wave B - Grey has recently concluded, with Wave C - Grey now trending downward, potentially reaching lower support levels.

- Key Invalidation Point: 77.00

ASX: NEWMONT CORPORATION (NEM) Elliott Wave Technical Analysis - TradingLounge

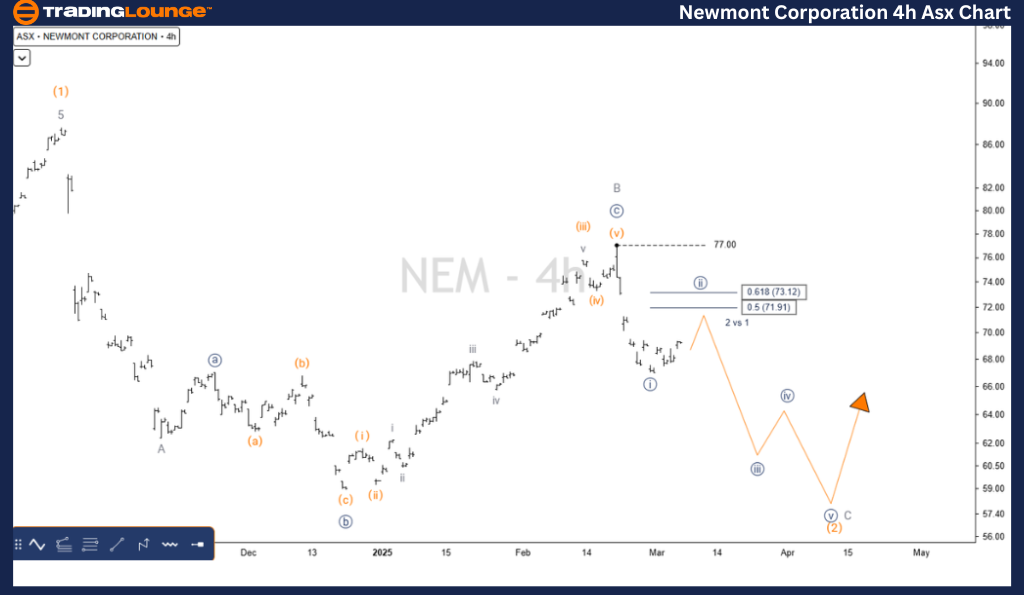

4-Hour Chart Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave ((ii)) (Navy) of Wave C - Grey of Wave (2) - Orange

Details:

- Since 77.00, Wave C - Grey has been forming a Five-Wave pattern on the downside.

- Wave ((i)) - Navy appears to be completed.

- Wave ((ii)) - Navy is now retracing higher, targeting the 0.5 - 0.618 Fibonacci levels.

- Once this retracement is completed, Wave ((iii)) - Navy is expected to resume its downward move.

- Key Invalidation Point: 70.00

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: MACQUARIE GROUP LIMITED MQG Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: NEWMONT CORPORATION (NEM) provides key insights into current market trends and potential trading opportunities. By identifying critical price levels and validation/invalidation points, traders can enhance their confidence in the wave structure projections. This analysis delivers a data-driven and professional outlook on price movements, ensuring an objective perspective on ASX:NEM trading strategies.