ASX: Macquarie Group Limited (MQG) Elliott Wave Technical Analysis

Overview

Today's Elliott Wave analysis delivers an updated outlook on Macquarie Group Limited (ASX: MQG).

Our latest assessment suggests that MQG stock is nearing the final phase of Wave Four, unfolding as a flat pattern. This presents a potential bullish opportunity in Wave Five. Key price levels are highlighted to help traders assess trend validation or potential reversals.

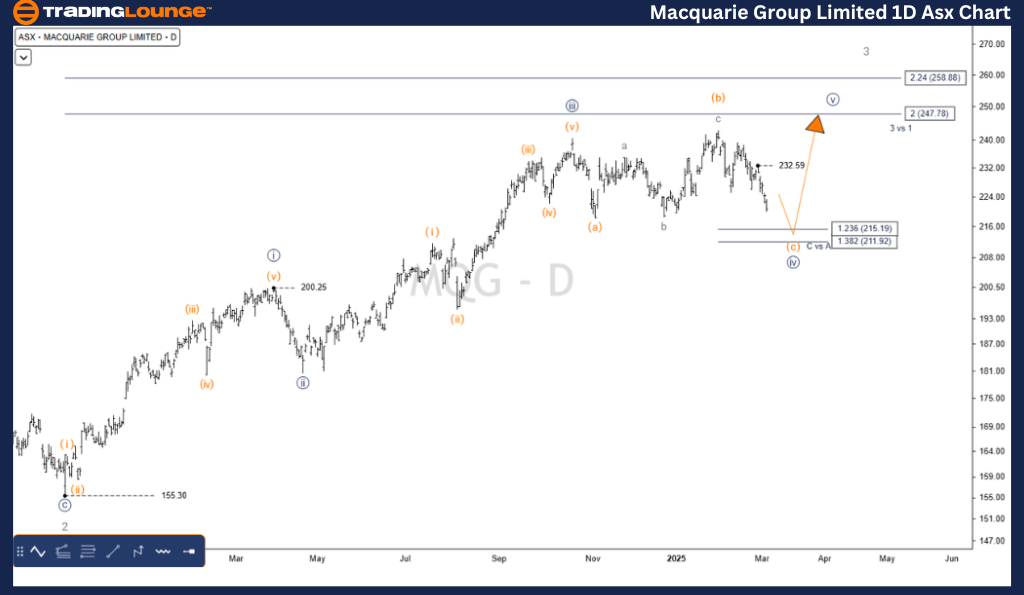

ASX: MQG 1D Chart (Semilog Scale) – Elliott Wave Analysis

Function: Major Trend (Minute Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave v-grey of Wave (c)-orange of Wave ((iv))-navy

Analysis:

- Wave ((iii))-navy recently concluded with a five-wave structure.

- Wave ((iv))-navy is unfolding as a Flat (a)-(b)-(c) formation (orange).

- Wave (c)-orange remains in progress, targeting 211.92 or slightly lower.

- A break above 232.59 would serve as the first signal that Wave ((v))-navy is initiating an upward move.

Key Levels:

- Invalidation Point: The end of Wave (b)-orange.

- Confirmation Point: 232.590.

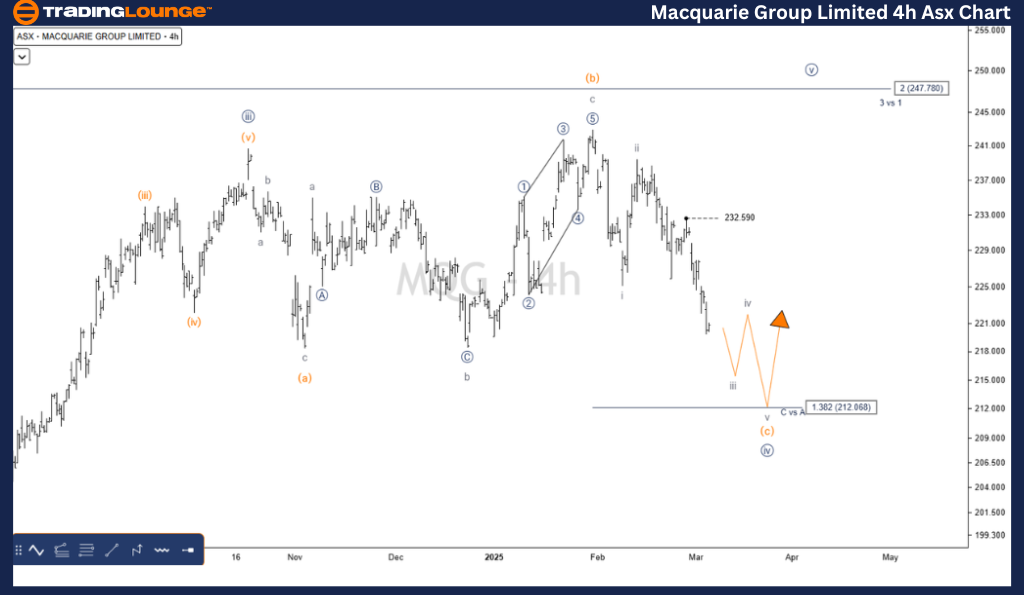

ASX: MQG 4H Chart – Elliott Wave Analysis

Function: Major Trend (Minute Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave v-grey of Wave (c)-orange of Wave ((iv))-navy

Analysis:

- No significant changes observed on the 4-hour timeframe.

- Wave (c)-orange maintains its five-wave formation, labeled i-grey to v-grey, continuing its downward movement.

Key Levels:

- Invalidation Point: The end of Wave (b)-orange.

- Confirmation Point: 232.590.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ASX LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: Macquarie Group Limited (MQG) provides a clear technical outlook on the current market structure. By pinpointing crucial price levels, traders can enhance their decision-making strategies.

The analysis remains objective and data-driven, ensuring a professional assessment of ASX-listed stocks.