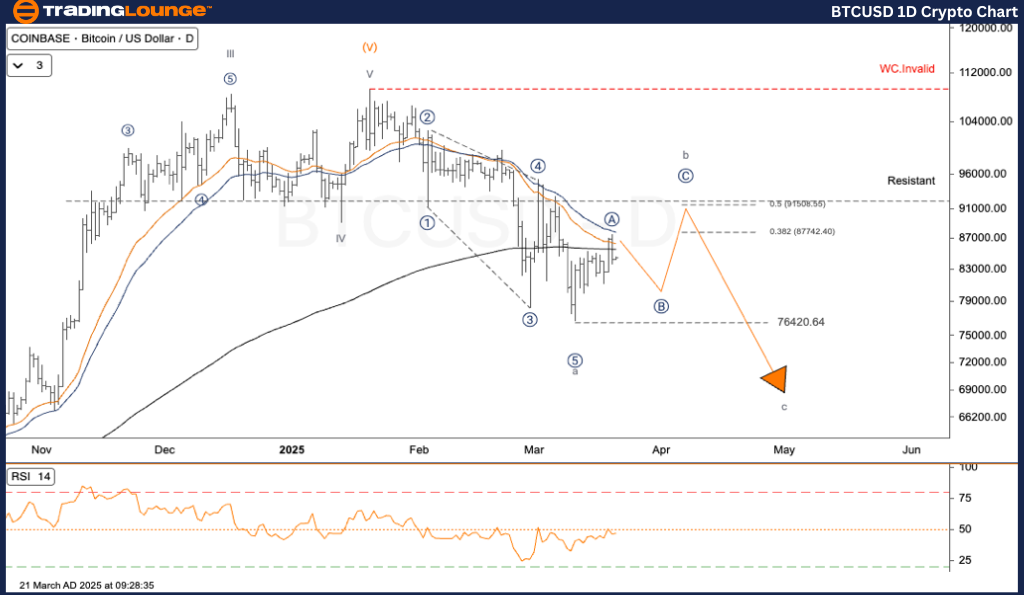

Bitcoin / U.S. Dollar (BTCUSD) Elliott Wave Analysis – TradingLounge Daily Chart

BTCUSD Elliott Wave Technical Overview

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave b

Next Higher Degree Direction: Wave ((II))

Wave Cancellation Level: Not specified

Details:

Bitcoin (BTC/USD) is navigating a corrective Elliott Wave formation. The completion of Wave A sets the stage for a short-term price increase in Wave B. This rebound is expected before a probable continuation lower into Wave C.

Bitcoin / U.S. Dollar (BTCUSD) Trading Strategy

BTCUSD has rebounded mildly after finalizing Wave (a). Elliott Wave principles suggest the market is entering Wave (b), which historically leads into another downward leg. Traders should focus on the $90,792 resistance level, which could act as a significant pivot point. The bearish trend completed Wave ((5)) near $76,703. Current movement indicates sub-wave a of (b) has likely ended, with wave b of (b) unfolding.

If BTCUSD remains under this resistance, a decline toward wave c of (b) is likely, followed by a possible continuation into wave (c).

Trading Strategies

✅ For Short-Term Traders (Swing Trade)

If BTCUSD retests the $90,792 level and encounters resistance, traders may consider short positions aligned with the anticipated move in wave (c).

A price move above $111,954 invalidates the current wave scenario and signals the need for a revised analysis.

Bitcoin / U.S. Dollar (BTCUSD) Elliott Wave Analysis – TradingLounge H4 Chart |

BTCUSD Elliott Wave Technical Overview

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave b

Next Higher Degree Direction: Wave ((II))

Wave Cancellation Level: Not specified

Details:

Bitcoin (BTC/USD) remains within a corrective Elliott Wave zigzag. Following the conclusion of Wave A, the market appears to be in the early stages of Wave B — a temporary rally — ahead of a projected decline into Wave C.

Bitcoin / U.S. Dollar (BTCUSD) Trading Strategy

BTC is recovering slightly from wave (a), and wave (b) is now in progress as per the Elliott Wave framework. Watch the $90,792 resistance carefully, as it may dictate short-term market direction. The downtrend terminated with wave ((5)) at $76,703. Currently, price action implies wave b of (b) is forming, following the end of sub-wave a.

Failure to overcome this resistance may lead to a sharp drop in wave c of (b), and possibly wave (c) afterwards.

Trading Strategies

✅ For Short-Term Traders (Swing Trade)

A rejection near $90,792 resistance could offer a shorting setup in sync with the next bearish leg in wave (c).

If BTCUSD breaks above $111,954, the bearish Elliott Wave pattern becomes invalid, requiring updated analysis.

Technical Analyst: Kittiampon Somboonsod

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: AAVEUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support