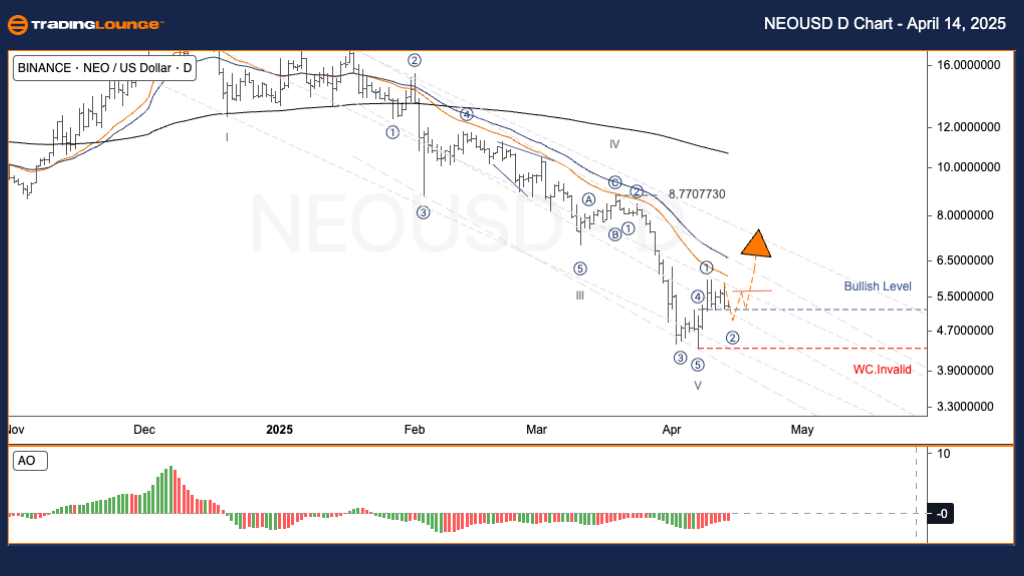

NEO/USD Elliott Wave Analysis – TradingLounge Daily Chart

NEO/USD Daily Chart Analysis

NEO/USD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave ((C))

Direction Next Higher Degrees: Wave Y

Wave Cancel Invalid Level: $4.36

NEO/USD Trading Strategy Overview:

After falling sharply from the $22 range down to the $4.50 zone, NEO/USD appears to have completed a significant Elliott Wave corrective pattern, potentially setting up for a bullish impulsive move—Wave 3. This shift marks a key turning point in the NEO technical analysis landscape.

📌 Key Resistance – Bullish Breakout Confirmation: $5.75

A decisive move above this level would confirm Wave 3 initiation in the Elliott Wave sequence, offering a bullish trade setup.

📌 Key Support – Wave Count Invalidation: $4.36

A close below this level would invalidate the current Elliott Wave structure and suggest an alternative corrective formation is unfolding.

📌 Wave 3 Upside Targets:

Projected resistance lies at $7.50 and $8.77, corresponding to the prior Wave IV high, offering strong potential for bullish continuation.

Trading Strategy for NEO/USD:

✅ Swing Trading Approach:

If price consolidates above $5.00 and holds within the established support zone, swing traders may position for a bullish breakout, aligning with the beginning of Wave 3.

⚠️ Risk Management Guidance:

A break below $4.36 requires reassessment of the wave count and suggests that the correction may not yet be over.

NEO/USD Elliott Wave Analysis – TradingLounge 4H Chart

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave ((C))

Direction Next Higher Degrees: Wave Y

Wave Cancel Invalid Level: $4.36

The 4-hour NEO/USD Elliott Wave chart confirms the daily outlook, signaling the probable completion of the corrective Zigzag pattern. All previously noted key technical levels—$5.75 resistance and $4.36 invalidation—remain valid, reinforcing the near-term trading setup and bullish Elliott Wave outlook for NEO.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

Previous: AUDUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support