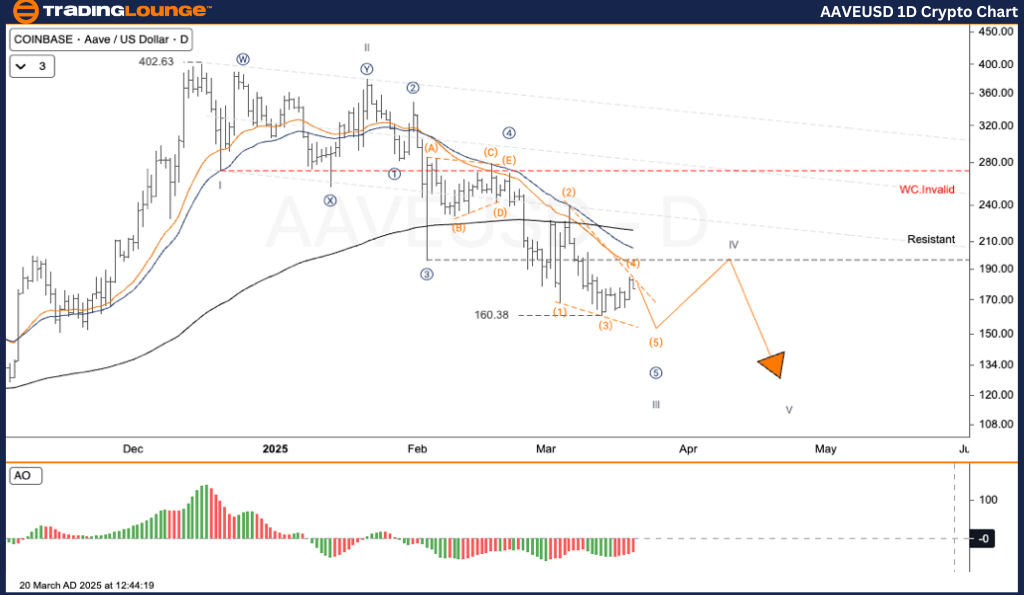

AAVE/USD (AAVEUSD) Elliott Wave Analysis – TradingLounge Daily Chart

AAVEUSD Elliott Wave Technical Analysis

Function: Trend Following

Mode: Motive

Structure: Impulse

Position: Wave III

Next Higher Degree Direction: Downtrend Continuation

Wave Cancellation Level: Not Specified

Analysis Details:

AAVE is experiencing a downward correction after peaking at $399. The ongoing wave structure indicates a progressive decline, adhering to the classic (1)-(2)-(3)-(4)-(5) impulse pattern.

AAVE/USD Trading Strategy

AAVE/USD remains in a strong downtrend, with the current wave IV acting as a temporary recovery before the final wave V decline. Unless the price breaks resistance, it is expected to test levels below $140.

- Invalidation Level: A price breakout above $280 would require structural reassessment.

Trading Strategies:

For Short-Term Traders (Swing Trading):

✅ Enter sell positions when the price approaches the $180 – $200 range and exhibits reversal signals.

Risk Management:

If the price exceeds $280, the Elliott Wave structure is invalid and needs reevaluation.

AAVE/USD (AAVEUSD) Elliott Wave Analysis – TradingLounge H4 Chart

AAVEUSD Elliott Wave Technical Analysis

Function: Trend Following

Mode: Motive

Structure: Impulse

Position: Wave III

Next Higher Degree Direction: Downtrend Continuation

Wave Cancellation Level: Not Specified

Analysis Details:

AAVE continues its downward movement after reaching a $399 high. The Elliott Wave pattern confirms a well-defined five-wave impulse sequence (1)-(2)-(3)-(4)-(5), supporting the downtrend.

AAVE/USD Trading Strategy

AAVE/USD remains in a bearish trend, with wave IV acting as a short-term pullback before the final wave V downturn. If the price remains under key resistance levels, it will likely test support below $140.

- Invalidation Level: A breakout above $280 would signal the need for wave structure reassessment.

Trading Strategies:

For Short-Term Traders (Swing Trading):

✅ Consider selling when the price nears the $180 – $200 zone and exhibits a clear reversal.

Risk Management:

A move above $280 suggests the need for structural reanalysis.

Technical Analyst: Kittiampon Somboonsod

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: BTCUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support