Cocoa Elliott wave analysis - bullish trend persists.

In the dynamic world of commodities, the cocoa market is currently displaying a resilient bullish trend, according to our in-depth Elliott Wave technical analysis as of February 24, 2024. Employing the Elliott Wave theory, we delve into the intricate patterns and structures governing cocoa's price movements, focusing on the ongoing impulse wave that has persisted since the pivotal breakout at 2198. This breakout marked the end of a 23-week triangle range, setting the stage for a compelling bullish trajectory.

Cocoa Elliott Wave technical analysis

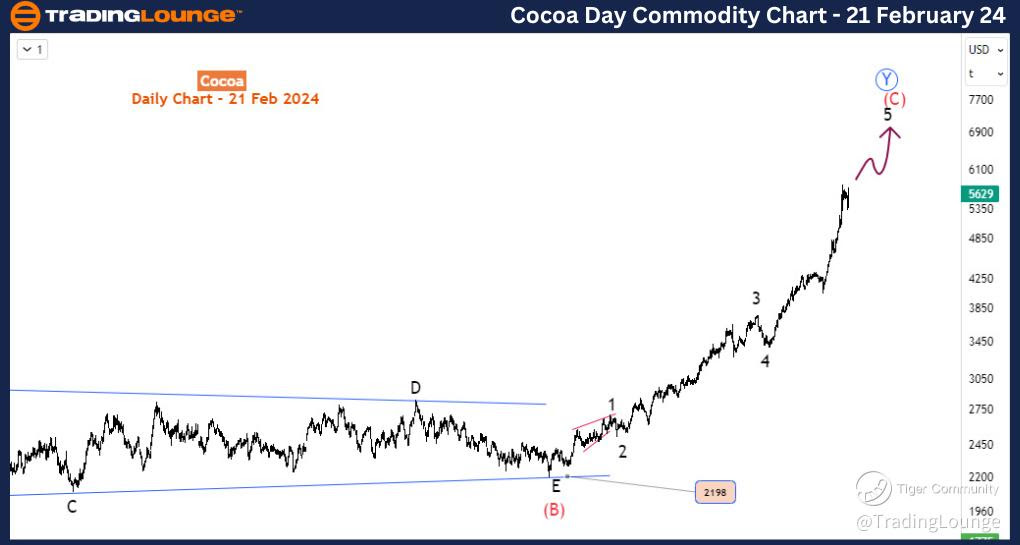

Daily Time Frame Analysis:

On the daily time frame, our analysis pinpoints a robust structure within the ongoing impulse wave, denoted as the black wave. This wave is anticipated to reach its culmination in the expansive red wave (C), unfolding within the larger context of the blue wave Y. The breakout at 2198 serves as the origin point for this impressive wave sequence. With this framework in mind, we foresee a sustained upward movement, projecting a rally that could potentially propel cocoa prices toward the 7000 level.

It is crucial to note that our observation indicates that the current impulse wave is approaching its final phase, identified as black wave 5. This implies that despite the upward momentum, traders should remain vigilant for potential shifts in market sentiment as the wave nears completion.

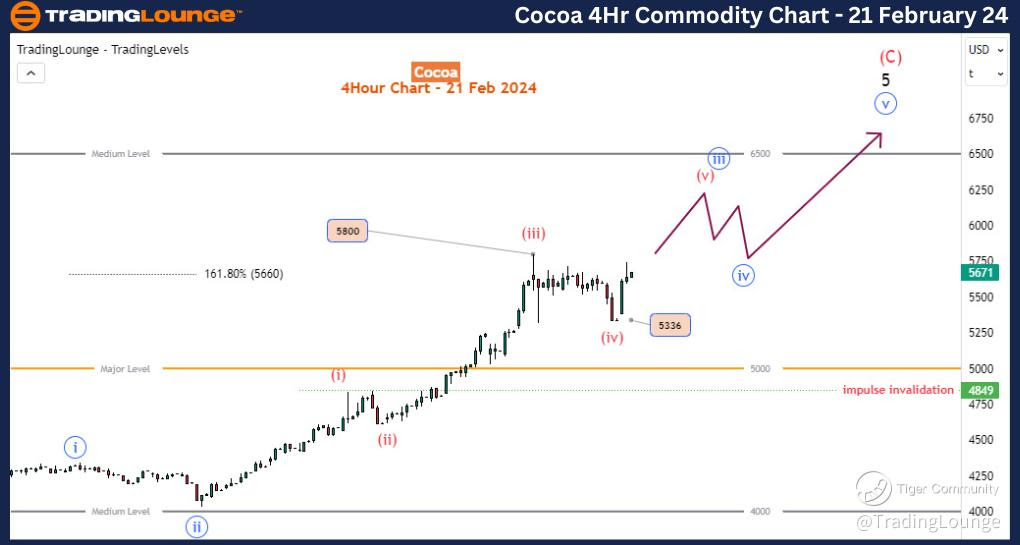

4-Hour Time Frame Analysis:

Zooming in on the 4-hour time frame, we closely examine the internal sub-waves constituting the ongoing wave 5, with a specific focus on the progression within the blue sub-wave iii of 5. Our analysis indicates that the market is currently traversing the internal waves of the blue wave iii. Notably, the completion of red sub-wave iv within blue iii occurred around the 5336 mark, poised to surpass the preceding peak of red sub-wave (iii) at 5800.

This impending breakout sets the stage for a fresh bullish momentum, steering the price action towards the 6500 threshold to complete the blue wave iii. Further upward extension is envisioned to finalize black wave 5. This analysis positions traders to anticipate potential entry points and capitalize on the unfolding bullish opportunities.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Gold (XAUUSD)

Conclusion:

In conclusion, our Elliott Wave analysis strongly suggests that the current upward momentum in cocoa prices remains intact. The impending breakout on the 4-hour chart signals the potential for further gains for cocoa buyers. As the market navigates the final phases of the black wave 5, traders should exercise caution and remain attuned to potential shifts in market dynamics. The projected rally toward the 7000 level aligns with a bullish trajectory, presenting lucrative opportunities for traders to capitalize on the prevailing market sentiment.

For investors and traders alike, staying informed about these Elliott Wave patterns provides a strategic advantage in navigating the cocoa commodity market. As always, it is essential to combine technical analysis with a comprehensive understanding of market dynamics to make well-informed and profitable decisions.