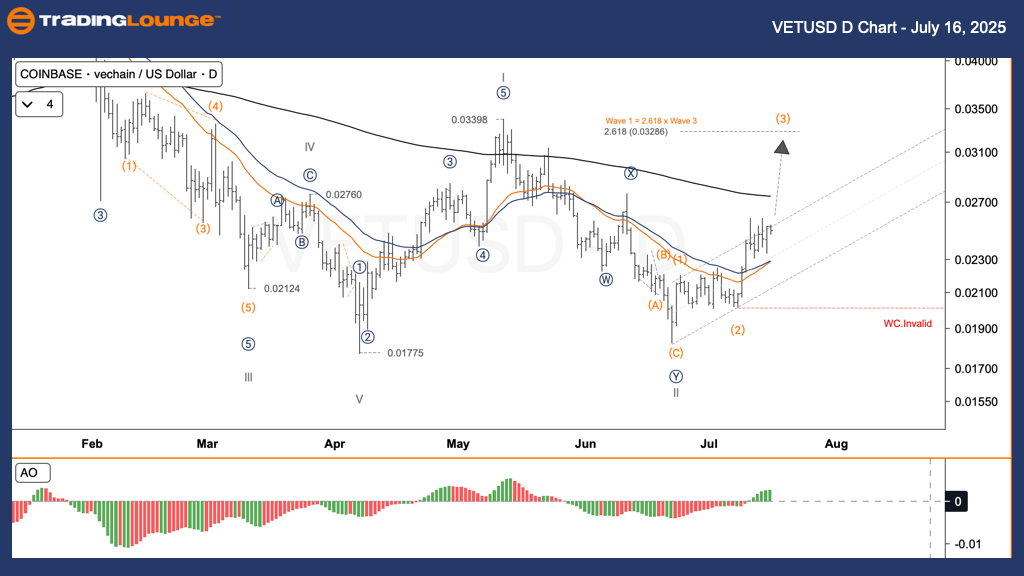

Vechain (VETUSD) – Elliott Wave Analysis Technical Analysis – TradingLounge Daily Chart

VETUSD Elliott Wave Forecast

Function: Follow-Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Invalidation Level: $0.02000 (Wave Count Invalidation)

Overview:

Vechain (VETUSD) is currently in sub-wave (3) of the broader wave III sequence, having concluded corrective wave II. The price target for sub-wave (3) aligns near the 2.618 Fibonacci extension of wave (1), which sits close to $0.03286 USD. To preserve the bullish Elliott Wave structure, VETUSD must trade above the critical support of $0.02000 USD. A breakdown below this level would invalidate the existing wave interpretation.

Trading Strategy:

✅ Swing Trade Strategy (Short-Term Outlook):

If wave (4) consolidation develops, it can offer favorable conditions for scaling into long positions.

🟥 Invalidation Alert (Wave Cancel Level):

Support to Watch: $0.02000 USD

A decisive close below this level nullifies the current bullish scenario.

Vechain (VETUSD) – Elliott Wave Analysis – 4-Hour Chart Technical Analysis – TradingLounge

Function: Follow-Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Invalidation Level: $0.02000 (Wave Count Invalidation)

Overview:

On the 4-hour chart, VETUSD extends within sub-wave (3) of major wave III, following the confirmed completion of wave II. The near-term bullish target remains at approximately $0.03286 USD, coinciding with the 2.618 Fibonacci extension of wave (1). As long as the price sustains above $0.02000 USD, the bullish count stays intact.

Trading Strategy:

✅ Swing Trade Potential:

Look for minor pullbacks such as wave (4) to establish or add to long positions during trend continuation.

🟥 Wave Count Invalidation:

Key Support: $0.02000 USD

A drop below this support level cancels the current wave structure.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: BTCUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support