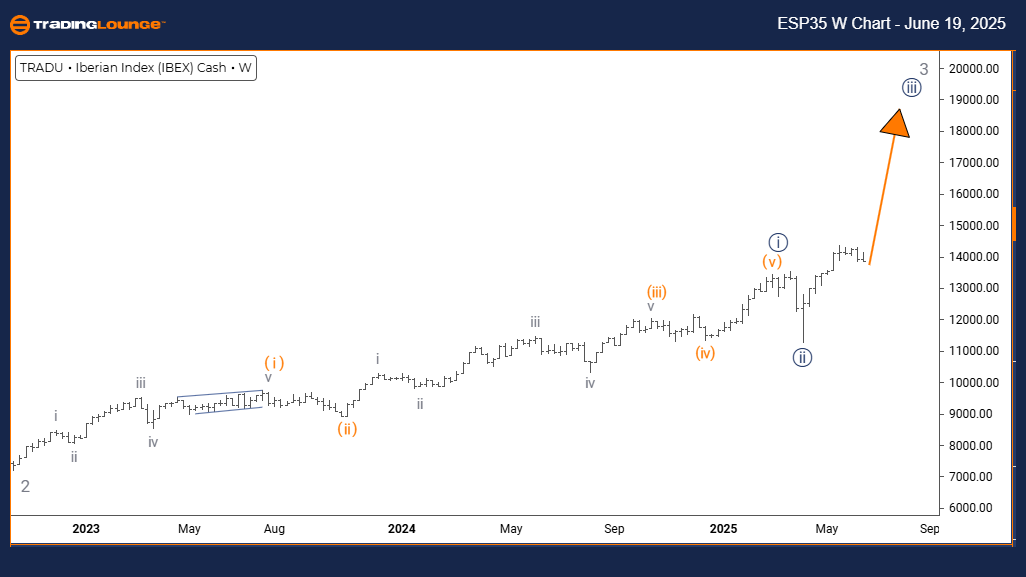

IBEX 35 (Spain) Elliott Wave Analysis – Trading Lounge Day Chart

IBEX 35 (Spain) Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 1

POSITION: Navy Blue Wave 3

DIRECTION NEXT LOWER DEGREES: Orange Wave 2

DETAILS: Navy Blue Wave 2 looks complete. Orange Wave 1 of 3 is unfolding.

The daily Elliott Wave chart for IBEX 35 indicates a strong bullish trend. The current market behavior is impulsive, confirming buyer strength. The ongoing wave structure marks Orange Wave 1 within a broader Navy Blue Wave 3, signaling the initial phase of a sustained upward trend.

As Navy Blue Wave 2 finishes its corrective cycle, Orange Wave 1 of Navy Blue Wave 3 has activated, initiating a fresh bullish leg. The expected next move in the lower degree is Orange Wave 2, which typically follows Wave 1 and may present a short corrective dip before resuming the primary trend.

Overall, the technical setup for IBEX 35 supports further gains. The transition from Navy Blue Wave 2 to Orange Wave 1 suggests renewed buying pressure and higher price potential. The impulsive formation aligns with a bullish outlook, highlighting increased investor interest and short-term upside prospects.

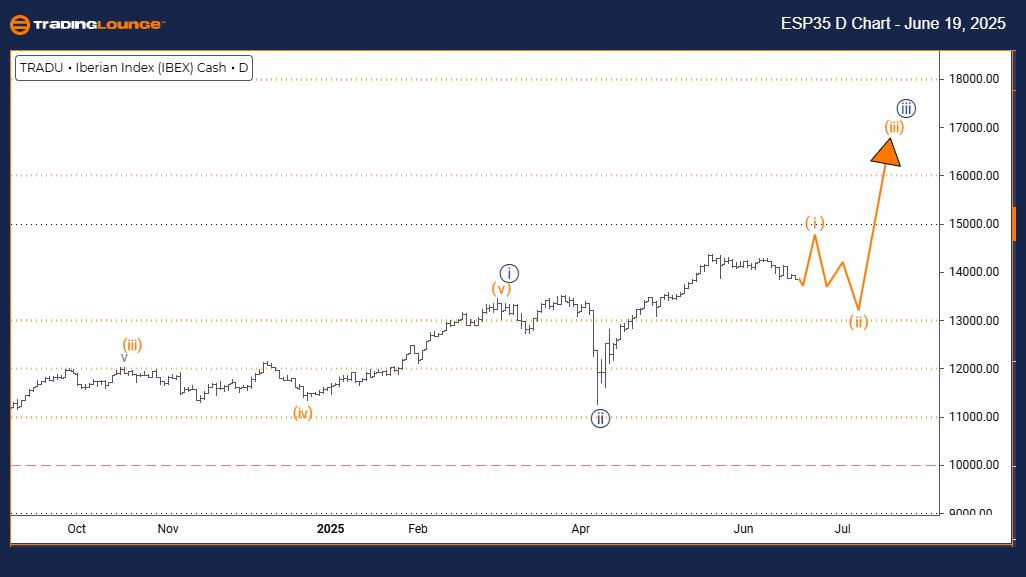

IBEX 35 (Spain) Elliott Wave Analysis – Trading Lounge Weekly Chart

IBEX 35 (Spain) Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 3

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Orange Wave 2

DETAILS: Navy Blue Wave 2 appears complete. Navy Blue Wave 3 is active.

The weekly Elliott Wave forecast for IBEX 35 confirms a strong bullish momentum. The index is progressing within an impulsive Navy Blue Wave 3, part of the broader Gray Wave 3 formation. Third waves typically represent the most dynamic phase of an Elliott Wave sequence.

Following the completion of Navy Blue Wave 2, the market has entered Navy Blue Wave 3, pointing to the start of a sustained advance. This leg often features sharp price gains and minimal retracements. After this phase, Orange Wave 2 is expected to develop at the lower degree.

The broader technical landscape continues to favor IBEX 35 upside potential. With Navy Blue Wave 3 in play, the chart reflects a period of strong institutional support and positive investor sentiment. As it progresses inside Gray Wave 3, the bullish trend is likely to persist over the medium term.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: SWISS MARKET Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support