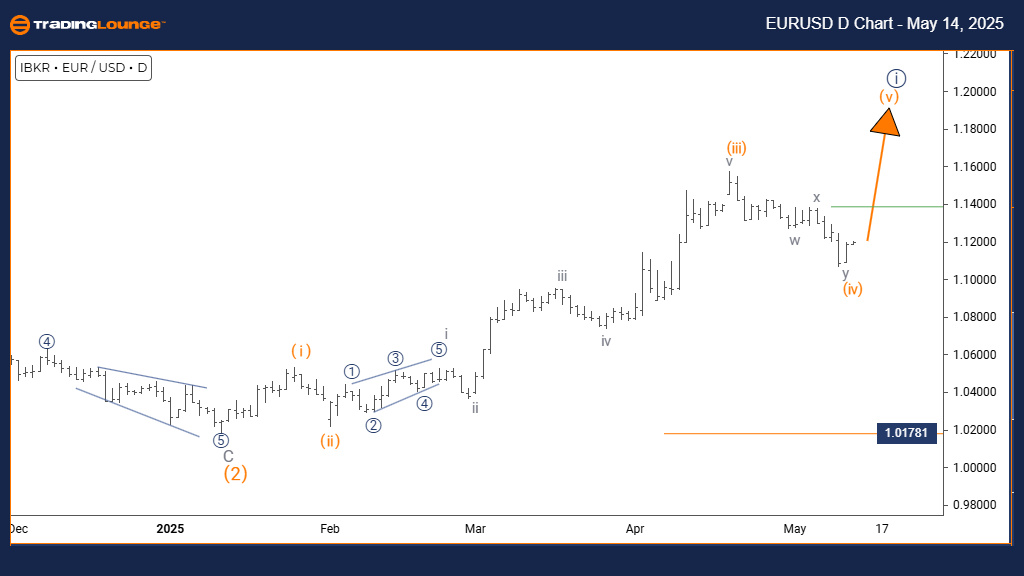

EURUSD Elliott Wave Analysis – Trading Lounge Day Chart

Euro/ U.S. Dollar (EURUSD) – Day Chart Analysis

EURUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Completion of orange wave 4 indicates the start of orange wave 5.

Wave Cancel Invalid Level: 1.01781

The EURUSD daily chart reflects a bullish scenario, supported by an impulsive Elliott Wave structure. Current analysis shows that orange wave 5 is unfolding within navy blue wave 1. This suggests that the previous corrective phase—orange wave 4—has concluded, leading to the final upward movement of this impulse wave sequence. This phase typically precedes a corrective wave or trend reversal.

Technical confirmation points to the end of wave 4 and the beginning of wave 5. The set invalidation level at 1.01781 acts as a key reference—any move below this threshold would invalidate the current bullish Elliott Wave count and could prompt a reassessment. The ongoing pattern supports continued bullish momentum, though traders should monitor closely for any signals of weakening buying pressure as wave 5 progresses.

Looking forward, the chart suggests the upcoming phase is navy blue wave 2, expected to be corrective in nature once orange wave 5 is complete. This Elliott Wave projection helps traders identify the pair’s standing within the broader bullish cycle and anticipate potential reversal points. The upside potential appears limited, signaling a cautious approach as the market nears the end of the five-wave structure.

Market participants should maintain focus on orange wave 5’s completion and stay alert to the 1.01781 invalidation point, which could necessitate an update to the current market outlook.

Euro/ U.S. Dollar (EURUSD) – Tradinglounge 4-Hour Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 5 (started)

DETAILS: Orange wave 4 looks complete; orange wave 5 is in progress.

Wave Cancel Invalid Level: 1.01781

On the 4-hour timeframe, the EURUSD pair maintains its bullish outlook, driven by an impulsive Elliott Wave pattern. The current wave structure highlights orange wave 5 actively forming within the framework of navy blue wave 1, after the conclusion of orange wave 4. This movement represents the final stage in the bullish cycle and often precedes a shift toward a corrective trend.

Wave 4 has been confirmed as completed, and orange wave 5 is underway. A crucial invalidation level remains at 1.01781; any decline below this would invalidate the bullish scenario and call for a reevaluation of the wave structure. Upward momentum persists, yet market participants should watch for exhaustion signals as the fifth wave matures.

This Elliott Wave setup provides a structured path for managing long trades or preparing for exit points. As the five-wave cycle nears completion, only a limited upside is projected before the market may transition into a corrective pattern. Traders are encouraged to observe resistance areas, identify divergence or reversal signals, and adjust their positions according to the 1.01781 invalidation level.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: AUDUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support