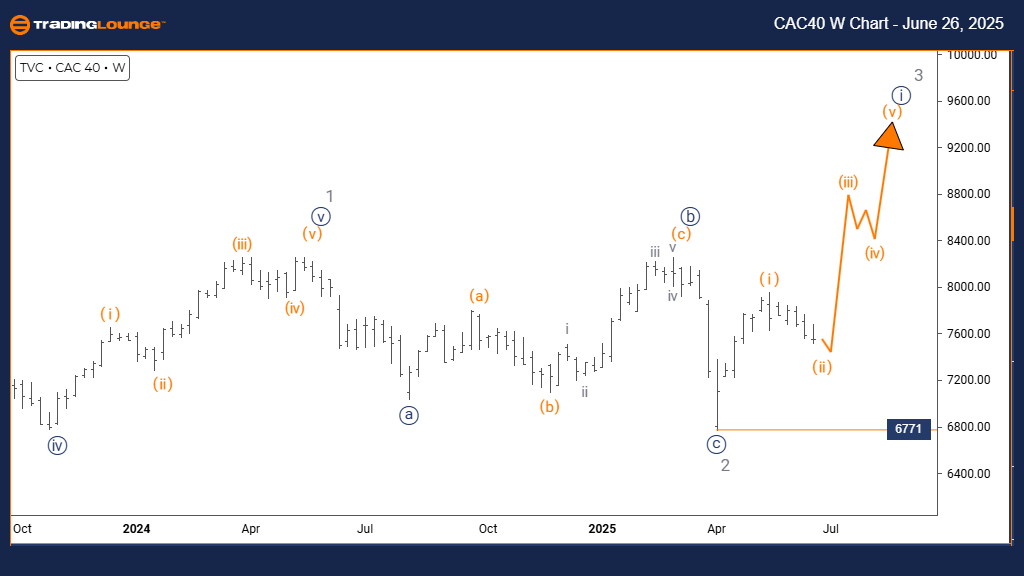

CAC 40 (France) Elliott Wave Analysis – Trading Lounge Day Chart

CAC 40 (France) Wave Technical Review

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Orange Wave 2

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3

DETAILS: Orange Wave 1 has likely completed; Orange Wave 2 is in progress

Wave Cancel/Invalidation Level: 6771

The Elliott Wave analysis of the CAC 40 daily chart reveals a counter-trend movement defined by a corrective structure. Presently, Orange Wave 2 is developing within the broader scope of Navy Blue Wave 1. This phase typically reflects a retracement that precedes a continuation of the overall bullish trend.

The shift from Orange Wave 1 to Orange Wave 2 marks a standard corrective phase, usually retracing part of the prior upward impulse. As Orange Wave 2 nears completion, the expectation shifts toward Orange Wave 3, signaling a potential resumption of the upward market trend.

At this stage, CAC 40 remains in Orange Wave 2, often representing range-bound conditions or moderate pullbacks. Its location within Navy Blue Wave 1 reinforces the corrective nature of the movement.

Traders should monitor for confirmation of Orange Wave 2’s end, as a breakout into Orange Wave 3 could suggest renewed bullish momentum. The critical invalidation level stands at 6771—any movement below this would call for a reassessment of the current wave count.

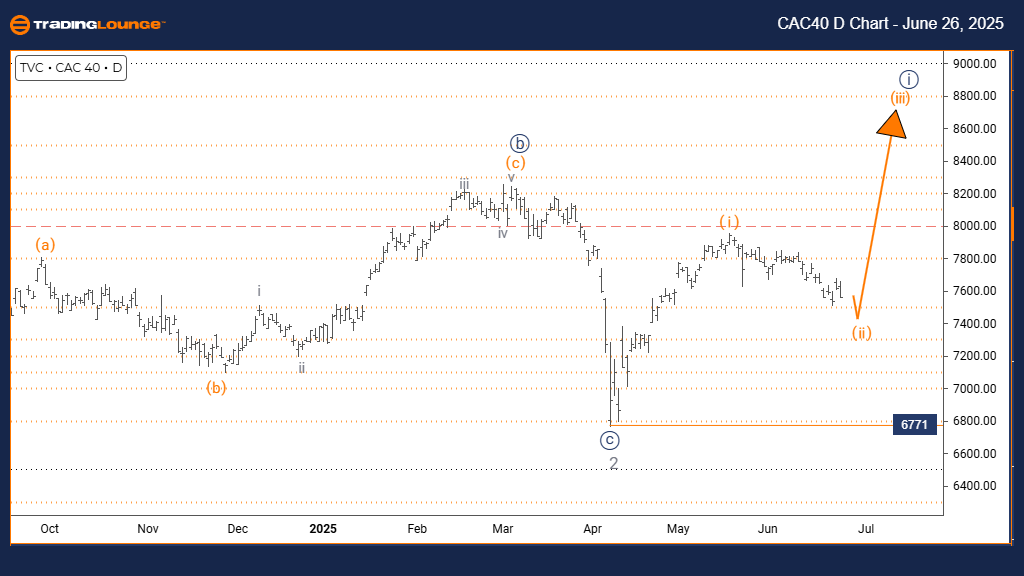

CAC 40 (France) Elliott Wave Analysis – Trading Lounge Weekly Chart

CAC 40 (France) Wave Technical Review

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Gray Wave 2 likely completed; Navy Blue Wave 1 of 3 is progressing

Wave Cancel/Invalidation Level: 6771

The weekly Elliott Wave review of CAC 40 outlines a bullish trend with impulsive price action. The active wave—Navy Blue Wave 1—forms part of a larger Gray Wave 3, indicating the initiation of a potentially strong upward market phase.

Following the apparent completion of Gray Wave 2, the development of Navy Blue Wave 1 highlights the beginning of a powerful third-wave movement. Once this impulse finalizes, Navy Blue Wave 2 is expected to introduce a brief corrective adjustment.

The wave invalidation threshold remains fixed at 6771. A break below this support would challenge the current wave interpretation, while a hold above it would sustain the bullish setup.

As Navy Blue Wave 1 unfolds post-Gray Wave 2, CAC 40 may benefit from strong upside momentum, largely driven by technical setups and institutional market activity continuing through Gray Wave 3.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: NIFTY 50 Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support